By John Meyer, consultant in financial affairs – Eurasia Business News, September 23, 2023

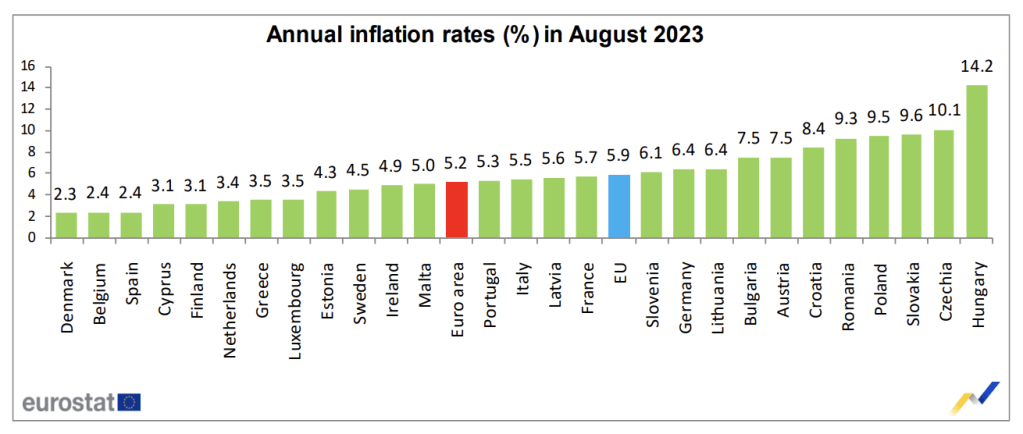

The euro area annual inflation rate was 5.2% in August 2023, stable after 5.3% in July. A year earlier, the rate was 9.1%. European Union annual inflation was 5.9% in August 2023, down from 6.1% in July. A year earlier, the rate was 10.1%. These figures are published by Eurostat, the statistical office of the European Union.

The lowest annual rates were registered in Denmark (2.3%), Spain and Belgium (both 2.4%). The highest annual rates were recorded in Hungary (14.2%), Czechia (10.1%) and Slovakia (9.6%). Compared with July, annual inflation fell in fifteen Member States, remained stable in one and rose in eleven.

Annual inflation in France accelerated in August, hitting 5.7%, after 5.1% in July.

In August, the highest contribution to the annual euro area inflation rate came from services (+2.41 percentage points, pp), followed by food, alcohol & tobacco (+1.98 pp), non-energy industrial goods (+1.19 pp) and energy (-0.34 pp).

The 5.2% rate is still well above the 2% inflation target set by the European Central Bank.

The annual inflation rate in the United States for August 2023 was +3.7%. It was +6.7% in the United Kingdom and +4% in Canada (It was +3.7% in July 2023 for Canada).

What impact is inflation having on the eurozone economy?

Reduced purchasing power: The high inflation rate in the Eurozone is eroding the purchasing power of consumers. As prices rise, consumers can buy fewer goods and services with the same amount of money, reducing their purchasing power. Such a process leads to deflation.

Less investment: High inflation can lead to uncertainty and reduced confidence in the economy, which can discourage investment.

Reduced competitiveness: High inflation can lead to higher costs for businesses, reducing their competitiveness in the global market.

Increased interest rates: Central banks may raise interest rates to combat inflation, which can increase borrowing costs for businesses and consumers.

Increased wage demands: As prices rise, workers may demand higher wages to maintain their purchasing power, which can lead to higher labor costs for businesses.

Inflation and democracy

The social pact of European democracies is disintegrating before our eyes. More and more citizens are questioning the legal authority and legitimacy of governments, their policies and financial capitalism. The middle class in France as in Germany is less and less willing to work more to earn less. Weak GDP growth in the Eurozone is maintaining the unemployment rate. The high public debt of the Eurozone States is now leading, with interest rates of nearly 5%, to debt trap situations. This leads to a mechanical impoverishment of national economies and their stakeholders, businesses and citizens.

Read also : How to invest in gold

The European real estate market will be the next victim of rising interest rates and the fall in purchasing power of the middle classes.

A first short-term measure to be taken by States is to significantly reduce the share of taxes on energy and fuels, which would lower the spending of the working and middle classes on transport and heating. A second measure to be taken quickly is to alleviate administrative and fiscal constraints on agricultural businesses, in order to increase production and lower food prices. A third measure to take is to ease constraints on the profitability of industrial companies. The industry must return to Europe. European states must pursue proactive industrial policies and free themselves from the dogma of free competition advocated by the Brussels Commission. The United States, China and Russia have no qualms about massively subsidizing their national industries.

Finally, major economic and fiscal reforms are needed in the Eurozone, whose 19 member states have the same currency but 19 different economies, 19 different budgets and 19 different tax systems. Harmonization of taxation is essential, as much as the reindustrialization of Europe.

Thank you for being one of our readers.

Our community already has nearly 120,000 members!

Sign up to receive our latest articles, it’s free!

Follow us on Telegram, Facebook and Twitter

© Copyright 2023 – Eurasia Business News