By John Meyer, consultant in financial affairs – Eurasia Business News, October 4, 2023

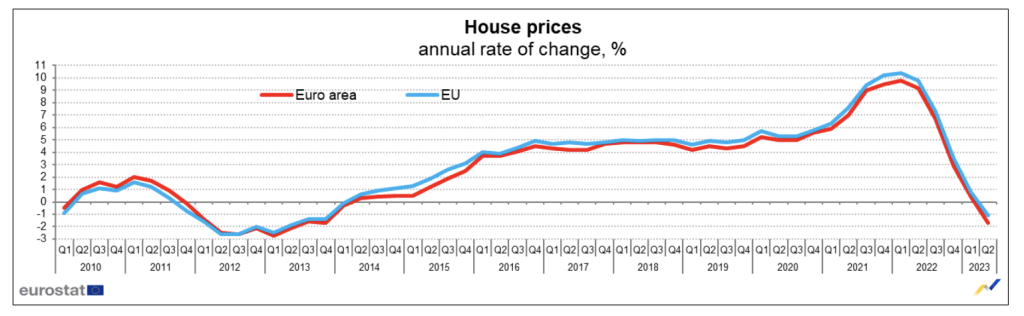

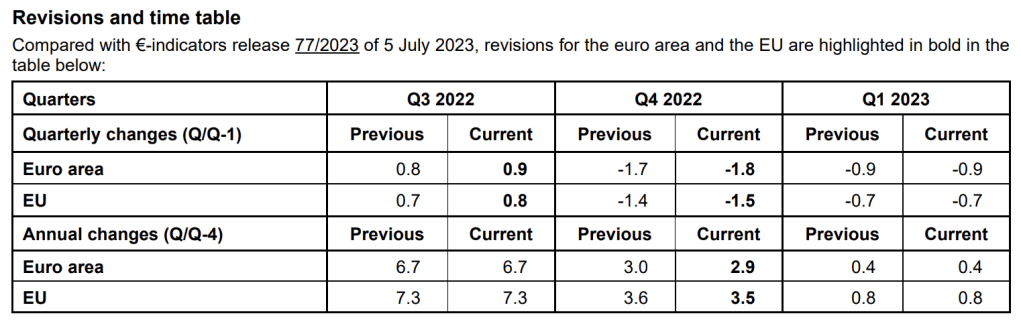

In the second quarter of 2023, house prices, as measured by the House Price Index, fell by 1.7% in the euro area and by 1.1% in the EU compared with the same quarter of the previous year, reported Eurostat Agency.

In the first quarter of 2023, house prices rose by 0.4% and 0.8% in the euro area and EU, respectively. This is the first annual decrease since the first quarter of 2014.These figures come from Eurostat, the statistical office of the European Union.

Compared with the first quarter of 2023, house prices rose by 0.1% in the euro area and by 0.3% in the EU in the second quarter of 2023.

This suggests that the housing market in the Euro area and the EU is experiencing some volatility, with prices falling in the second quarter of 2023 but increasing in the first quarter of the same year.

The current data marks the first annual decrease in house prices since the first quarter of 2014.

European housing prices have sharply risen over the past ten years. They were up by 6.8 % in the euro area and by 7.3 % in the European Union in the second quarter of 2021, compared with the same quarter in 2020, reported Eurostat.

Rents and house prices in the EU have continued their steady increase in the second quarter of 2021, going up by 1.3 % and 7.3 % respectively, compared to the second quarter of 2020.

In the first quarter of 2022, house prices, as measured by the European House Price Index, rose by 9.8% in the euro area and by 10.5% in the European Union (27 countries) compared with the first quarter in 2021. This was the highest annual increase for the euro area since 2005 when house prices started to be collected, and since the fourth quarter of 2006 for the European Union, reported Eurostat, the European statistics agency, in early July. Compared with the previous quarter, prices also increased in all Member States. The lowest increases were registered in Malta (+0.4%), Cyprus (+0.5%) and Germany (+0.8%). The highest increases were recorded in Estonia (+7.1%), Hungary (+6.7%) and Bulgaria (+5.2%).

House price developments in the EU Member States

Among the Member States for which data are available, nine showed an annual decrease in house prices in the second quarter of 2023, and seventeen showed an annual increase. The largest falls were registered in Germany (-9.9%), Denmark (-7.6%) and Sweden (-6.8%), while the highest increases were recorded in Croatia (+13.7%), Bulgaria (+10.7%) and Lithuania (+9.4%).

Compared with the previous quarter, prices decreased in eleven Member States and increased in fifteen Member States. The largest falls were registered in Slovakia (-3.9%), Luxembourg (-2.7%), and Hungary (-1.7%), while the highest increases were recorded in Latvia (+5.1%), Bulgaria (+4.3%) and Estonia (+3.8%).

The next release with data (third quarter of 2023) is scheduled for 10 January 2024.

Interest rates and house prices

Interest rates on loans have a significant impact on the housing market. Lower rates rationally led to an increase in housing demand by lowering the cost of borrowing to finance the purchase of a house or to build on. Rising interest rates set by the European central bank to controle and reduce inflation eventually reshape European housing markets, and tighter monetary policy increases mortgage rates, which in turn reduce demand for real estate and slow growth in real estate prices. With 5% interest rates on home mortgage, European middle class can’t afford anymore buying a house or an apartment.

Read also : Gold : Build Your Wealth and Freedom

Getting further into increasingly heavy mortgages cannot be a sustainable solution for the economy. This is a housing price bubble. Population has not grown to such level to provoke such a growth in prices. The direct cause is quantitative easing policies by central banks since 2010, which injected vast amounts of credit money into assets like real estate and stocks.

Thank you for being one of our readers.

Our community already has nearly 120,000 members!

Notify me when a new article is published:

Follow us on Telegram, Facebook and Twitter

© Copyright 2023 – Eurasia Business News

Check out this interesting article on mortgages:

LikeLike