By Paul Jouvenet, essayist and consultant in international affairs. Eurasia Business News, July 26, 2024. Article n°1108.

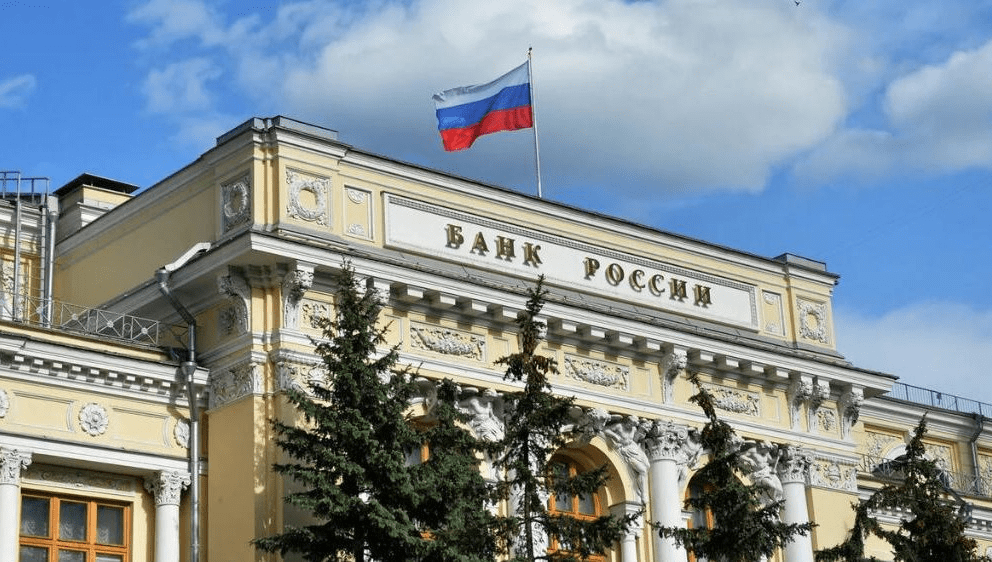

At a meeting on July 26, the Board of Directors of the Bank of Russia raised the key rate by 200 bps at once – now it is 18% per annum. The Central Bank had raised the rate to 16% in December 2023 and has kept it at this level since then. A step of 200 bps was expected by the majority of Russian analysts.

Inflation has accelerated and is significantly higher than the Bank of Russia’s April forecast, according to a press release following the decision: the growth of domestic demand continues to significantly outstrip the ability to expand the supply of goods and services. In order for inflation to begin to decline again, additional tightening of monetary policy is required, and to return it to the target of 4%, significantly tighter monetary conditions than previously assumed are required, the Central Bank noted.

As at the previous meeting, the central bank left a tough signal – the Bank of Russia will assess the feasibility of further raising the key rate at the next meetings.

The Bank of Russia has significantly revised its April medium-term forecast. The Central Bank sharply raised its inflation forecast for 2024 to 6.5-7% from the previous 4.3-4.8%. In 2025, inflation would return to 4-4.5% and then would stay close to the 4% target.

The forecast for the average key rate for 2024 has been raised to 16.9-17.4% from 15-16%.

The Russia’s GDP, according to the regulator’s updated estimates, will grow by 3.5% in 2024 against 2.5-3.5% in April. The loan portfolio of banks will increase by 10-15% by the end of the year (in April, the Central Bank predicted 8-13%) – both corporate and retail.

One week ago the International Monetary Fund (IMF) had lowered its forecast for Russia’s gross domestic product (GDP) growth for 2025, according to a July review of the prospects for the development of the world economy. The forecast decreased by 0.3 percentage points, expected to reach 1.5% in 2025. At the same time, the GDP growth forecast for 2024 remained unchanged at the level of 3.2%.

Over the medium term, the balance of risks for inflation remains shifted towards pro-inflationary ones, said the Bank of Russia. The risks are mainly associated with changes in the terms of foreign trade (including under the influence of geopolitical tensions), the persistence of high inflation expectations of individuals and businesses, and the deviation of the Russian economy upwards from the trajectory of balanced growth.

From July 16 to July 22, consumer price growth remained at 0.11%, as a week earlier, Rosstat reported the day before. Annual inflation by July 22 slowed to 9.07% from 9.19% in the previous weekly period. According to FOM surveys for the Bank of Russia, households’ inflation expectations rose to 12.4% from 11.9% in July, returning to the level of January 2024.

The peak of annual inflation will be in July, and from August-September, the Bank of Russia expects to see a gradual decrease in the rate of price growth, Deputy Chairman of the Central Bank Alexei Zabotkin said in July in an interview with the Russia 24 TV channel. He associated the peak predicted in July with a significant increase in utility tariffs. “It is a one-time, but it makes a big contribution to the annual inflation rate, because last July there was no increase in utility tariffs. We expect to see a gradual decrease in annual inflation from August to September,” Zabotkin explained.

In our opinion, a step of 200 bps at once is needed to lower inflation so that in September and October “you don’t have to repeat the exercise.”

Read also : Gold : Build Your Wealth and Freedom

The growth of the Russian bank mortgage portfolio in June on the eve of the termination of preferential mortgages for new buildings accelerated to 3.1% from 1.7% in May, the Central Bank indicated in a report on the dynamics of the development of the banking sector. The growth rate of the consumer loan portfolio also remained quite high – 2%. In just the first half of the year, the figure has already increased by almost 10%. According to preliminary data from Frank RG, in June, banks provided citizens with loans for a total of 1.7 trillion rubles, which is 14.47% higher than in June 2023.

Corporate lending shows a slowdown in positive dynamics to 1.2% after 1.7% in May, the regulator noted.

Alexander Isakov, Chief Economist for Russia at Bloomberg Economics, expected a rate hike in the range of 200 to 300 bps – it is easier for the Board of Directors of the Central Bank to make this decision, given that the money market has already priced in an increase to a peak of 19-20%.

The growth in inflation expectations of Russian companies and consumers in June shows a drop in confidence in the Russian central bank’s ability to return inflation to the target of 4%, John Meyer believes. In his opinion, the longer the period of “normalization” of high expectations lasts, the more difficult it will be for the Russian central bank to reduce inflation.

Our community already has nearly 135,000 readers!

Subscribe to our Telegram channel

Notify me when a new article is published:

Follow us on Telegram, Facebook and Twitter

© Copyright 2024 – Eurasia Business News. Article No. 1108.