By Swann Collins, investor, writer and consultant in international affairs – Eurasia Business News. August 9, 2024. Article no 1160.

The possibility of its complete termination will depend on political decisions, local experts say, after the attack of Ukrainian armed forces against the Russian Kursk region.

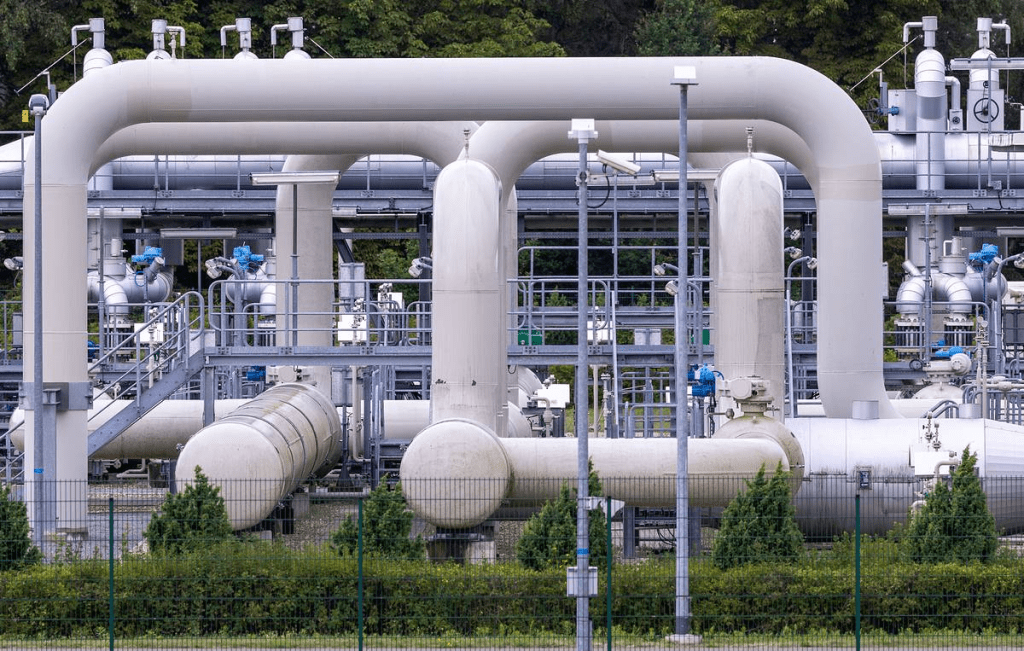

“On August 8, Gazprom reduced gas transit through the Ukrainian gas transmission system (GTS) by 5% compared to the previous day and by 12% by August 6, follows from the company’s data.” The fall occurred amid hostilities in the Sudzhansky district of the Kursk region, where the Sudzha gas metering station (GIS) is located – the only one today through which fuel is pumped to Ukraine.

Gazprom spokesman Sergei Kupriyanov told journalists that on August 8, the company supplies Russian gas for transit through the Ukrainian GTS in the amount “confirmed by the Ukrainian side” – 37.3 million cubic meters.

From Gazprom’s statistics, it follows that this is the minimum daily volume of transit since the beginning of the year – pumping was at this level on January 1. Current deliveries to the European Union (EU) and Moldova in transit through Ukraine are 12% less than the average daily volume in July – early August this year. The decrease in pumping began on August 7, then transit amounted to 39.4 million cubic meters against 42.4 billion cubic meters a day earlier. The reasons for the decrease in pumping in Gazprom are not explained.

The Sudzha GIS is located a few kilometers northwest of the city of the same name. Gas is supplied through it to the Ukrainian-controlled Sumy region for further pumping to Europe. Before February 2022, transit was carried out through two stations, but in May 2022, Kiev refused to accept applications for pumping fuel through the Sokhranovka gas station in the Rostov region, from where gas comes to the territory of the Lugansk People’s Republic. The Ukrainian side explained this by the “loss of control” over the GTS facilities, considering the situation as force majeure.

The transit of Russian gas through Ukraine should end in December 2024, according to the contract signed in 2019.

In January-July 2024, Gazprom exported 8.98 billion cubic meters of gas to Europe in transit through Ukraine, which is 10% more than in the same period last year. The average daily volume of supplies in the first half of the year amounted to about 42 million cubic meters per day, which is close to the maximum possible level of pumping through the Sudzha gas station (42.4 million cubic meters). In July, 1.3 billion cubic meters, or 42.3 million cubic meters per day, were delivered to Europe through the Ukrainian GTS.

Transit through Ukraine is one of the two remaining routes for Russian gas supplies to Europe through pipelines. The second is one of the two lines of the Turkish Stream gas pipeline, through the other line of the pipeline gas goes to the Turkish market. Through the GTS of Ukraine, pumping is carried out to the countries of Central and Western Europe (now mainly to Austria, Hungary and Slovakia), as well as to Moldova. The Turkish Stream supplies gas to the countries of the Balkan Peninsula (Bulgaria, Serbia, Bosnia and Herzegovina, etc.) and Hungary.

On August 6, units of the Armed Forces of Ukraine (AFU) invaded the territory of the Kursk region, and then advanced to the district center of Sudzha. Hostilities are taking place on the territory of the Korenevsky and Sudzhansky districts. According to the General Staff of the Russian armed forces, a group of up to 1000 ukrainian military personnel was involved in the offensive. The Russian President Vladimir Putin called the attack a “large-scale provocation.”

The sortie of the Armed Forces of Ukraine and the outbreak of hostilities in the Kursk region provoked an increase in spot gas prices in the EU. On August 8, the cost of September futures at the most liquid European TTF hub in the Netherlands crossed the $450 per 1000 cubic meter mark for the first time since December 2023 and reached $455.5.

The Ministry of Energy of Moldova initiated the procedure for introducing a high alert regime in the gas market “in connection with the information received from the Ukrainian operator [GTS] about the situation at the Sudzha gas station.”

Since the beginning of the special military operation on February 24, 2022, Gazprom has never stopped gas supplies to Europe, as this is fraught with financial and reputational losses for the company.

Transit through Ukraine accounts for about half of Gazprom’s exports to Europe. According to experts, Gazprom’s annual revenue from gas exports in transit through the Ukrainian GTS is about $5.3-6 billion (based on an average price of $350-400 per 1000 cubic meters), that is, about $3.7-4.2 billion after the company paid the export duty.

In the current situation, Gazprom can declare force majeure and suspend transit, citing the impossibility of accounting for the volume of gas pumped through the Sudzha gas station. But in fact, the suspension of transit does not depend on the position of the company, but on the political decision of the country’s top leadership. It will depend on the timing of Russia’s restoration of control over the territory of the Kursk region.

Alexander Miller, consultant in energy markets for Eurasia Business News, notes that the reason for declaring force majeure may be the official recognition by the Russian authorities of the seizure of the GIS by the Ukrainian military or the introduction of a special state in the region. On August 7, the acting governor of the Kursk region, Alexei Smirnov, decided to introduce a state of emergency in the region. The situation of force majeure will reduce the chances of Gazprom’s European buyers to succeed in litigation in court, in case of litigation.

Hungary, in the event of the suspension of Ukrainian transit, will be able to receive Russian gas through an alternative route – through the Turkish Stream. At the same time, Austria and Slovakia will be forced to start withdrawing from their UGSFs, and then conclude supply contracts with neighboring countries and buy gas at a higher price. Other European countries that receive Russian gas today through the territory of Ukraine (including Italy) will have to compensate for the shortfall by importing LNG, from Russian arctic or from the U.S.

In the event of a suspension of transit through Ukraine, the spot price of gas in the EU, may rise to $550-600 per 1000 cubic meters.

Our community already has nearly 135,000 readers!

Subscribe to our Telegram channel

Notify me when a new article is published:

Follow us on Telegram, Facebook and Twitter

© Copyright 2024 – Eurasia Business News. Article No. 1160.