By Swann Collins, investor, writer and consultant in international affairs – Eurasia Business News. September 26, 2024. Article 1241.

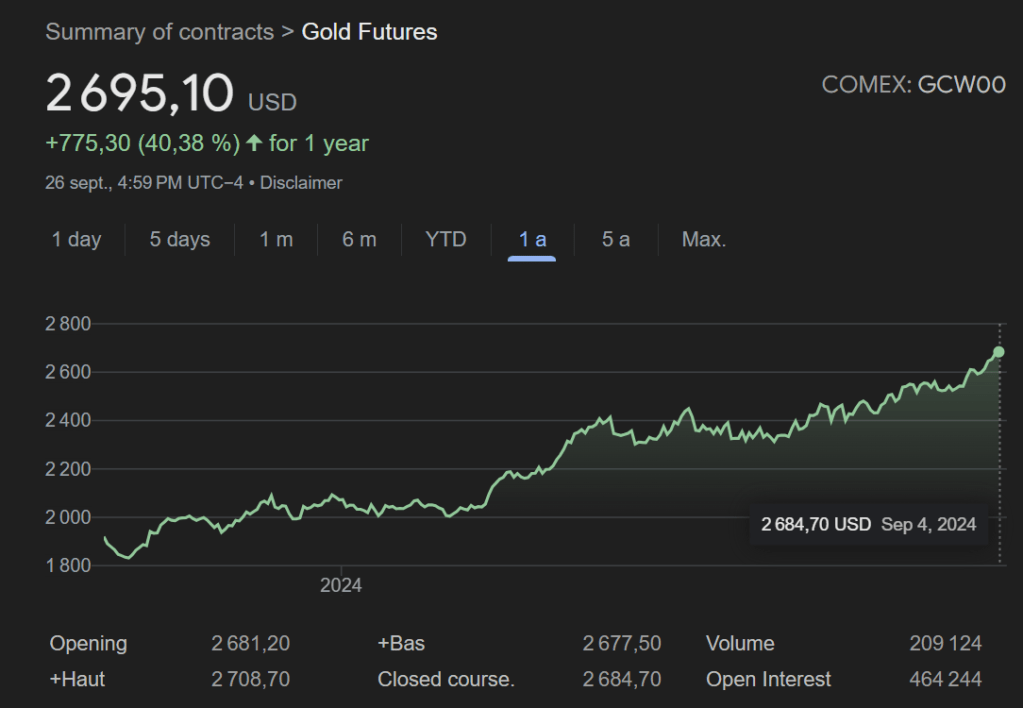

Gold prices run above $2,690 marks its continuous push to record highs so far this year. This is a +5.48% growth over the past month, and a +40% growth over the past year.

Last month gold price crossed $2,500 per Troy ounce.

Interest rate cuts by the US Federal Reserve last week reduced the opportunity cost of holding non-yielding gold.

Expectations for further U.S. interest rate cuts have driven up demand for non-yielding assets like gold. Traders are pricing in a 62% probability of a 50 bps rate cut by the Fed in November, as indicated by the CME FedWatch tool. Fed Chair Jerome Powell’s upcoming remarks are expected to shed light on the extent of future rate adjustments, which will further guide gold’s direction.

Heightened global uncertainty, such as the ongoing Israel-Gaza conflict, has also increased demand for gold as a safe-haven asset against inflation and geopolitical turmoil.

Read also : Gold : Build Your Wealth and Freedom

The significant increase in gold futures prices over the past year can be attributed to several key factors:

- Geopolitical Tensions: Heightened geopolitical uncertainties in Europe, Asia and Middle East in 2023-2024 have driven investors towards gold as a safe-haven asset, able to resist crisis.

- Central Bank Activity: Central banks, particularly from BRICS+ nations, have increased their gold purchases, reducing reliance on U.S. Treasuries and dollars and avoiding Western sanctions linked to the use of dollars and euros.

- Interest Rates and Dollar Weakness: Anticipation of Federal Reserve rate cuts and a weakening U.S. dollar have made gold more attractive, as lower rates enhance the appeal of non-interest-bearing assets like gold.

- Inflation Concerns: Persistent inflation has also contributed to increased demand for gold as a hedge

- Gold backed currency plan of the BRICS, which extended to 10 member States last January, and now holds 30% of global GDP.

Gold is a hard asset that keeps value in times of inflation. One gold coin will always feed your family for a week.

Gold is a long-term store of value and this storage capacity is standardized internationally. Each troy ounce of gold has the same value. The yellow metal is an asset with intrinsic value in itself, capable of maintaining its purchasing power throughout the centuries and around the world.

Donald Trump’s likely return to power in the United States next November is expected to further worsen relations between the United States and China and lead to an increase in geopolitical risks and demand for the precious metal. According to Paul Jouvenet, an essayist and consultant in international affairs, the difficult situation in the global economy against the backdrop of continuing inflationary pressure will support gold prices in the range of $2,400 – 2,700 per troy ounce by December 2024.

Our community already has nearly 135,000 readers!

Subscribe to our Telegram channel

Notify me when a new article is published:

Follow us on Telegram, Facebook and Twitter

© Copyright 2024 – Eurasia Business News. Article No. 1241.