By Swann Collins, investor, writer and consultant in international affairs – Eurasia Business News. October 7, 2024. Article no 1255.

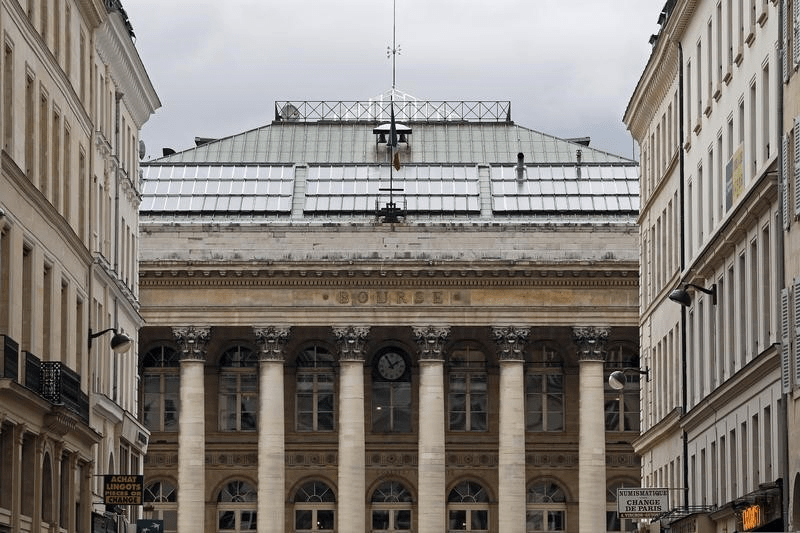

The Paris Stock Exchange ended 0.46% higher in a quiet low-volume session, still benefiting from optimism sparked by a strong U.S. jobs report and ahead of the release of other key indicators, but capped by geopolitical risk in the Middle East.

The flagship index of the Paris Stock Exchange, the CAC 40, gained 34.66 points, to 7,576.02 points. On Friday, it had gained 0.85%.

John Meyer, market analyst based in Paris, described the day’s session as “very quiet” with low volumes, with equity markets “still digesting last week’s US employment figures”.

The unemployment rate fell slightly in September in the United States, to 4.1% from 4.2% the previous month, with job creation rising sharply and well above market expectations, according to data released on Friday by the US Labor Department.

“This figure relieves pressure on the Fed (for) a further 0.5 percentage point cut,” now “less likely.” “We are heading towards 0.25 percentage points,” says John Meyer.

Investors are now awaiting the publication in the United States on Thursday of the consumer price index (CPI) for September, then the producer price index (PPI) on Friday, the next “major macroeconomic event of the week”, the analyst said.

Markets also remain attentive to the situation in the Middle East and the risks of conflagration in the region, exactly one year after the attack by the Palestinian Islamist movement Hamas in Israel that triggered the war in the Gaza Strip.

Questions about Israel’s possible retaliation after Iran’s strikes on its territory last week are particularly occupying the minds of investors, who fear a surge in oil prices and its potentially inflationary effects.

Read also : Gold : Build Your Wealth and Freedom

Brent, the world’s benchmark for oil, has also exceeded the symbolic threshold of $80 a barrel for the first time since the end of August.

Share buyback at Amundi and Rubis

The French asset manager Amundi (+2.46% to 68.60 euros at the close) launched on Monday a share buyback program that should “amount to a maximum of 1 million” shares, for “0.5% of the share capital”, or “80 million euros”, in the next eighteen months, it announced in a press release on Monday.

These shares will “not be destroyed” but “redistributed” to certain executives as part of a performance program, a spokesman for the group told AFP.

The industrial liquid products storage company Rubis (+3.46% to 25.72 euros at the close) also announced on Monday share buybacks for “a maximum number of 1,000,000” shares with a “maximum price of “50 euros” per share, in order to control the “dilution” of capital caused by the issuance of securities for the benefit of its employees.

Luxury in the green

Luxury stocks benefited from “cheap buying” after being battered, said John Meyer.

The giant LVMH gained 2.70% to 679.80 euros, Kering +4.57% to 247.35 euros and Hermès 1.12% to 2,162 euros. Elsewhere on the market, Christian Dior gained 2.67% to 635.50 euros.

The analyst also recalls the “strong dependence of luxury on the Chinese market”.

The Chinese authorities are expected to announce new measures to revive the economy, penalised by the real estate crisis and sluggish consumption, on Tuesday, just ten days after a first salvo that sent the stock markets soaring.

The measures are to be announced at a press conference scheduled for 10:00 am (0200 GMT) of the China’s National Development and Reform Commission.

Our community already has nearly 135,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2024 – Eurasia Business News. Article no. 1253.