By John Meyer, consultant in financial affairs – Eurasia Business News, November 6, 2024. Article n°1291.

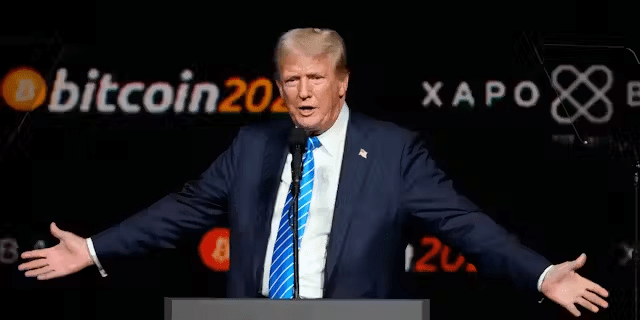

Following Donald Trump’s victory in the 2024 presidential election, Bitcoin has experienced a significant surge, reaching new all-time highs.

Bitcoin Price Surge

Record Highs: Bitcoin’s price surged nearly 8%, climbing above $75,000 for the first time, marking a new record. The cryptocurrency peaked at approximately $75,345 before stabilizing around $73,500 as of recent trading. This increase reflects a broader trend in the cryptocurrency market, with other major cryptocurrencies like Ethereum also seeing substantial gains.

Investor Sentiment

Positive Outlook for Cryptocurrencies: Investors are optimistic that Trump’s administration will foster a more favorable regulatory environment for cryptocurrencies. Trump has shifted from being a skeptic to a supporter of digital currencies, pledging to make the U.S. “the crypto capital of the planet” and proposing the creation of a strategic reserve of Bitcoin.

Speculation on Future Growth: Market analysts suggest that Bitcoin could potentially reach $100,000, fueled by this newfound optimism and reduced regulatory scrutiny under Trump’s leadership. The sentiment among crypto traders is that Trump’s victory represents a significant narrative shift that could drive further investment into the sector.

Regulatory Changes

Potential Deregulation: Trump’s campaign promises include removing Gary Gensler, the current chair of the Securities and Exchange Commission (SEC), who has been viewed as an adversary to the crypto industry due to his stringent regulatory approach. This change is expected to provide clarity and potentially more favorable conditions for cryptocurrency businesses operating in the U.S.

Support from the Crypto Industry: The crypto sector has rallied behind Trump, anticipating that his policies will lead to reduced regulatory burdens and increased institutional participation in digital assets. This support was evident during his campaign, where he actively engaged with crypto enthusiasts and accepted donations in cryptocurrencies.

Broader Market Implications

Increased Market Capitalization: The total market capitalization of cryptocurrencies surged to approximately $2.5 trillion, reflecting heightened investor interest and speculation following the election results. This rally is not limited to Bitcoin; other tokens like Dogecoin and Solana also saw significant price increases.

Read also : Gold is gaining weight in investors’ portfolios

Historical Trends: Historically, Bitcoin has performed well in election years, often experiencing substantial gains following elections. This trend appears to be continuing as investors react positively to Trump’s victory and its implications for monetary policy and fiscal spending.

Read also : Gold : Build Your Wealth and Freedom

In summary, Trump’s victory has catalyzed a significant surge in Bitcoin prices, driven by investor optimism regarding potential regulatory changes and a supportive stance towards cryptocurrencies. As the market adjusts to these developments, there is widespread speculation about Bitcoin’s future growth trajectory and its role as a hedge against inflation amid anticipated fiscal changes under Trump’s administration.

Our community already has nearly 140,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2024 – Eurasia Business News. Article no. 1291