By Swann Collins, investor, writer and consultant in international affairs – Eurasia Business News. November 26, 2024. Article no 1319.

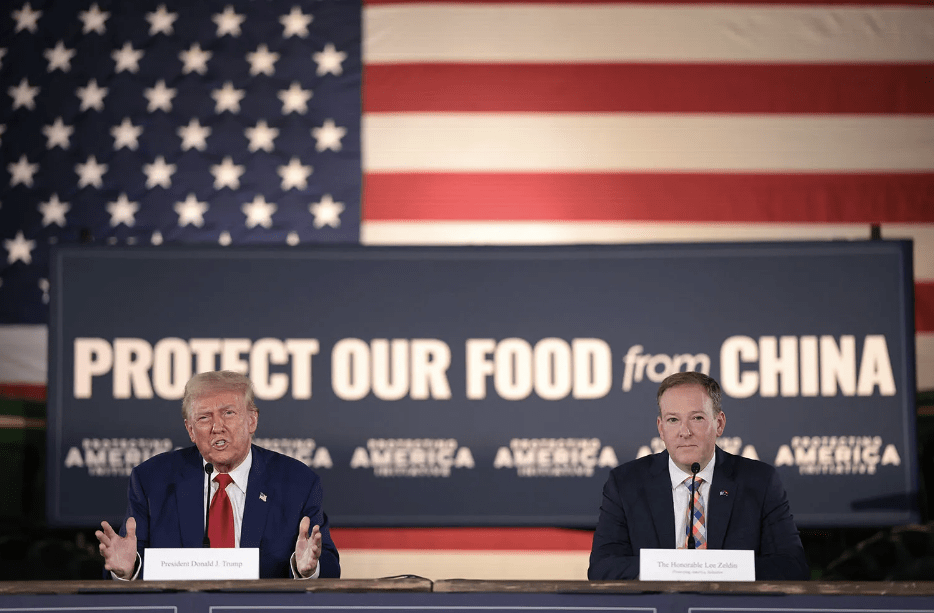

Former U.S. President Donald Trump (left) speaks about the threat of China to U.S. agriculture at the Smith Farm in Smithton, Pennsylvania, on Sept. 23.

The shift in U.S. trade dynamics, particularly the impact of tariffs on China since 2018, has been significant, leading to Mexico surpassing China as the largest exporter of goods to the United States in 2023. This transformation is attributed to a combination of geopolitical tensions, trade policies of Donald Trump, and economic strategies.

Key Changes in U.S. Trade

Mexico’s Rise: In 2023, Mexico exported approximately $475.6 billion worth of goods to the U.S., marking a nearly 5% increase from the previous year. In contrast, imports from China fell by about 20% to $427.2 billion, resulting in Mexico overtaking China for the first time since 2002.

Impact of Tariffs: The Trump administration initiated tariffs on Chinese imports in 2018, arguing that these measures were necessary due to unfair trade practices by Beijing. These tariffs have persisted under the Biden administration, contributing to a significant decline in Chinese imports and prompting U.S. companies to seek alternative sources closer to home.

Friend-Shoring and Near-Shoring: The Biden administration has encouraged U.S. companies to adopt “friend-shoring,” sourcing materials from allied countries, and “near-shoring,” relocating production closer to the U.S. This strategy has favored Mexico, which benefits from its proximity and existing trade agreements like the USMCA (United States-Mexico-Canada Agreement signed in 2018 and entered into force in 2020).

Economic Implications

Trade Deficit Reduction: The overall U.S. trade deficit narrowed by 10% in 2023, reflecting a broader shift in import sources and a decrease in reliance on Chinese goods.

Chinese Investments in Mexico: Despite the drop in direct exports from China, Chinese companies are increasingly establishing manufacturing operations in Mexico to take advantage of tariff-free access to the U.S. market under USMCA. This trend raises concerns about potential circumvention of tariffs on Chinese products.

Future Outlook: As geopolitical tensions continue and with the upcoming 2024 U.S. elections, scrutiny over Chinese investments in Mexico may increase. This could lead to further adjustments in trade policies and regulations aimed at ensuring compliance with U.S. interests.

The U.S. president elect Donald Trump is expected to impose nearly 40% tariffs on Chinese imports starting in early 2025.

This move, part of his “America First” trade policy, aims to reshape global trade dynamics and could significantly impact China’s economy, potentially reducing its growth by up to 1-1.5 percentage point according to economists surveyed.

Read also : Gold : Build Your Wealth and Freedom

These expected tariffs are notably higher than those implemented during his previous term, which ranged from 7.5% to 25%.

The transition of Mexico to the forefront of U.S. imports signals a significant change in global trade patterns influenced by tariffs and shifting economic strategies. As companies adapt to these new realities, the landscape of international trade will likely continue evolving, with implications for both U.S.-Mexico relations and broader global supply chains.

Our community already has nearly 145,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2024 – Eurasia Business News. Article no. 1319.