By Swann Collins, investor, writer and consultant in international affairs – Eurasia Business News. February 21, 2025. Article no 1424.

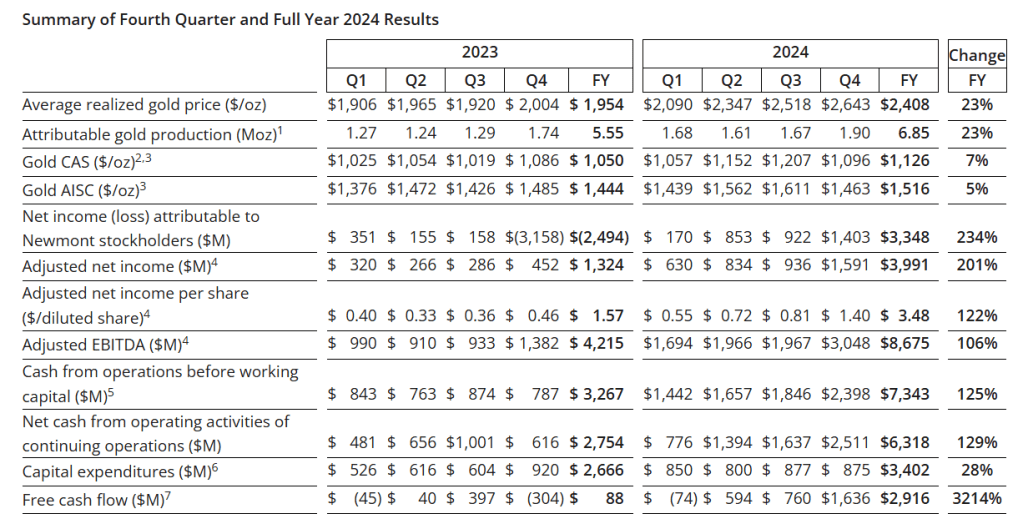

Newmont Corporation (NYSE: NEM, TSX: NGT) reported its fourth quarter and full year 2024 results on Thursday, February 20. The company’s adjusted net income for Q4 2024 was $1.6 billion, or $1.40 per diluted share, compared to $0.81 per diluted share in the prior quarter. This exceeded analysts’ expectations, which were forecasting $1.03 per share.

2024 Financial Highlights:

Net Income: Newmont reported a net income of $3.4 billion over 2024, a significant increase from a $2.5 billion net loss in 2023.

Adjusted Net Income: The adjusted net income reached $3.99 billion in 2024, compared to $1.32 billion in 2023. Adjusted net income per diluted share almost tripled to $3.48 from $1.57 in 2023.

Adjusted EBITDA: Adjusted EBITDA for 2024 more than doubled to $8.7 billion from $4.2 billion in 2023.

Cash Flow: The company generated $6.3 billion in operating cash flow and $2.9 billion in free cash flow for the year6. Free cash flow in the fourth quarter was a record $1.6 billion.

Factors Contributing to the Results:

Increased Gold Prices: The average realized gold price increased to $2,643 per ounce in Q4 2024, up from $2,518 per ounce in Q3 2024 and $2,004 per ounce in Q4 2023.

Strategic Decisions: Newmont focused on integrating the Newcrest portfolio, divesting non-core assets, and transitioning to a stable operating and investment platform. The company anticipates proceeds of up to $4.3 billion from divestitures, with $2.5 billion expected in the first half of 2025.

Improved Operational Performance: Streamlining Newmont into a collection of Tier 1 gold assets led to a strong foundation of operational and financial performance.

2025 Expectations

Production: Newmont anticipates attributable production of 5.9 million gold ounces.

Costs: The company expects gold AISC (All-In Sustaining Costs) of $1,630 per ounce for the total portfolio.

Capital Spending: Newmont plans sustaining capital spend of $1.8 billion and development capital spend of $1.3 billion.

Tax Rate: Assuming average prices of $2,500 per ounce for gold in 2025, Newmont estimates its consolidated adjusted effective tax rate related to continuing operations for 2025 will be 34%

Gold is a hard asset that keeps value in times of inflation. One gold coin will always feed your family for a week. In 2023, central banks added 1,037 tonnes of gold – the second highest annual purchase in history – following a record high of 1,082 tonnes in 2022.

Central banks added 1,045t to global gold reserves in 2024. The National Bank of Poland led the charge (90t) but demand was seen from a broad range of emerging market banks.

Total gold demand (including OTC investment) rose 1% y/y in Q4 to reach a new quarterly high and contribute to a record annual total of 4,974t.

Read also : Gold : Build Your Wealth and Freedom

Gold is a long-term store of value and this storage capacity is standardized internationally. Each troy ounce of gold has the same value. The yellow metal is an asset with intrinsic value in itself, capable of maintaining its purchasing power throughout the centuries and around the world.

Donald Trump’s return to power in the United States is expected to further worsen relations between the United States and China and would lead to an increase in geopolitical risks and demand for the precious metal.

Our community already has nearly 145,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1424.