By John Meyer, consultant in financial affairs – Eurasia Business News, March 4, 2025. Article No 1436.

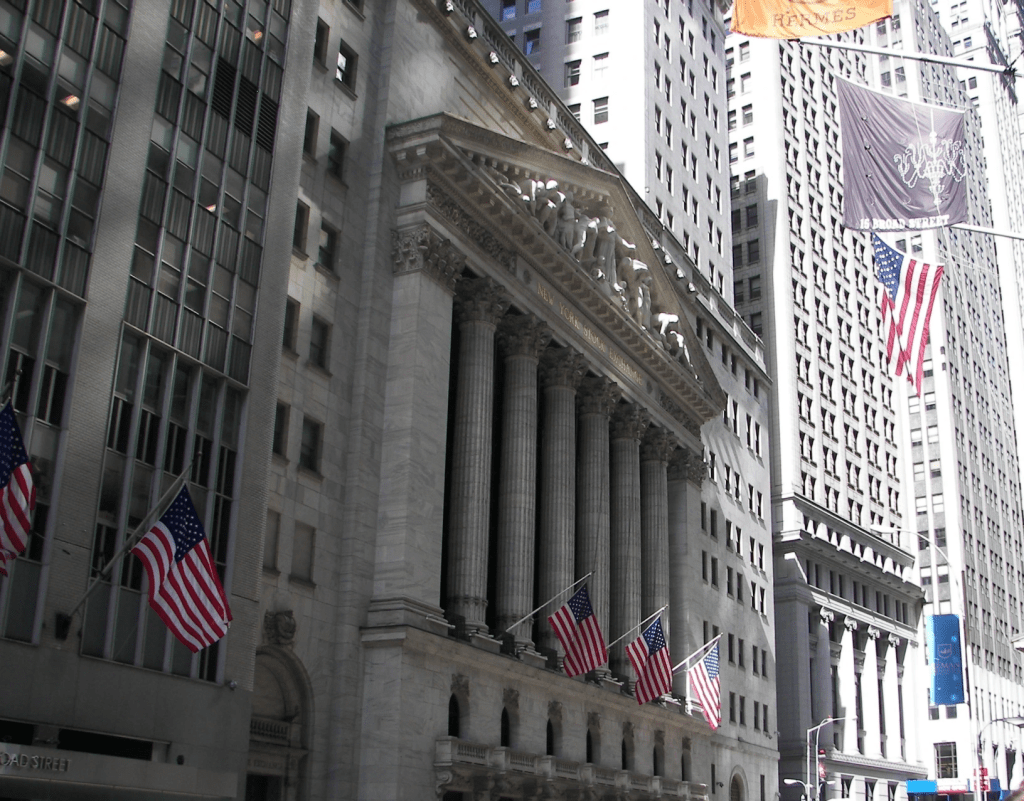

Dow Jones Stock Exchange, Manhattan, New York City- Photo credit : Swann Collins.

The Dow Jones Industrial Average and the Nasdaq Composite have experienced significant declines following U.S. President Donald Trump’s imposition of tariffs on the U.S.’s largest trading partners, including Canada, Mexico, and China.

Market Performance

Dow Jones Industrial Average: On Monday, the Dow plummeted by 650 points, or about 1.5%, to close at 43,191. On Tuesday, it fell by nearly 800 points before recovering somewhat, ending the day down by around 1.8%

Nasdaq Composite: The Nasdaq saw a decline of 2.64% on Monday. On Tuesday, it initially dropped by over 1.5% but later showed some recovery, ending the day down by about 1.1% to 1.6%.

The Dow industrials and S&P 500 fell, with the Nasdaq Composite paring losses and turning slightly positive. The Nasdaq had earlier in the day flirted with correction territory, down more than 10% from a recent closing peak. Tariffs on Chinese goods were increased from 10% to 20%.

Treasury yields were little changed. The 10-year yield had settled Monday at 4.178%, the lowest this year.

Economic and Trade Implications

Tariff Details: Trump implemented a 25% tariff on most goods from Canada and Mexico, and increased tariffs on Chinese imports to 20%.

Trade War Concerns: The tariffs have sparked fears of a trade war, with Canada and China announcing retaliatory measures. This has led to increased uncertainty and volatility in global markets.

Economic Impact: The tariffs are expected to raise prices for U.S. consumers on goods such as gasoline, avocados, clothes and electronics, potentially affecting economic growth and inflation in 2025.

Sectoral Impact

Automotive Sector: Shares of major U.S. automakers like Ford and General Motors have fallen significantly due to their reliance on supply chains in Mexico and Canada.

Read also : Gold : Build Your Wealth and Freedom

Retail Sector: Retailers like Target and Best Buy have seen declines, citing concerns over higher prices due to tariffs.

Global Market Reaction

European Markets: European stock markets closed provisionally lower on Tuesday with Germany’s Dax down by 3.5%, the U.K.’s FTSE 100 lower by 1.3%, and France’s CAC 40 down 1.9%.

Asian Markets: Asian markets have seen more modest declines, with the Nikkei 225 and Hang Seng indices dropping by around 1.2% and 0.28%, respectively.

Our community already has nearly 150,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1436.