By Swann Collins, investor, writer and consultant in international affairs – Eurasia Business News. March 18, 2025. Article no 1454.

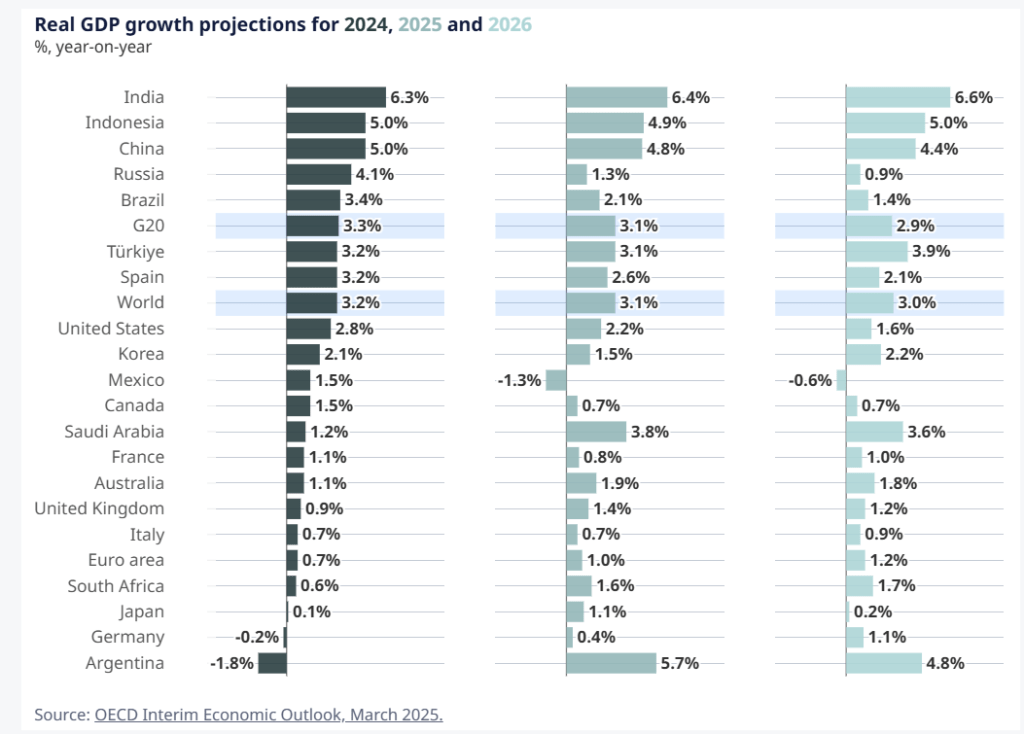

The OECD’s latest projection for Argentina’s economic growth in 2025 is 5.7%.

This represents a strong improvement from previous forecasts and indicates a positive outlook for the Argentine economy after a period of contraction.

However, annual inflation is forecast to persist at 28.4% in 2025 in the Argentinian economy, reports the OECD in its latest Economic Outlook, Interim Report March 2025.

IMF and World Bank forecast approximately 5% GDP growth for Argentina in 2025.

Read also : Gold : Build Your Wealth and Freedom

The latest Market Expectations Survey released by Argentina’s Central Bank reports that Argentina’s economy shows strong signs of recovery as experts project a 23.3% inflation rate and 4.8% GDP growth for 2025.

Read also : When Argentina was a Wealthy Nation

Key Factors Contributing to Growth

- Economic reforms and fiscal adjustments implemented by President Javier Milei’s government since December 2023.

- Significant reduction in inflation rates, from 117.8% in 2024 to a projected 23.3% in 2025.

- Growth in key sectors such as energy, mining, agriculture, and other natural resource-related industries.

- Increased real wages due to disinflation, leading to improved consumption.

- Tax amnesty plan launched in August 2024, generating over $22 billion in new financial flows.

Challenges and Considerations

The projected growth comes after an estimated 2.8% contraction in 2024.

Ongoing efforts to stabilize the currency, with experts predicting a nominal exchange rate of 1,175 pesos per dollar by December 2025.

Argentina’s government needs to maintain fiscal responsibility and continue economic reforms to ensure sustained recovery and attract foreign directi investments.

Read also : TAX MANAGEMENT STRATEGIES FOR DIGITAL NOMADS

Incentive Regime for Large Investments (RIGI): Introduced in July 2024, this regime offers significant tax and regulatory incentives for investments over $200 million across various sectors, including energy, mining, and technology in Argentina. The goal is to attract both local and foreign investment in Argentina by providing a stable regulatory environment for up to 30 years.

In early January, Argentina successfully made a significant debt repayment of US$4.341 billion to international bondholders, marking a crucial step in President Javier Milei’s efforts to restore investor confidence.

Our community already has nearly 150,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1454.