By Anthony Marcus for Eurasia Business News, March 21, 2025. Article no.1456.

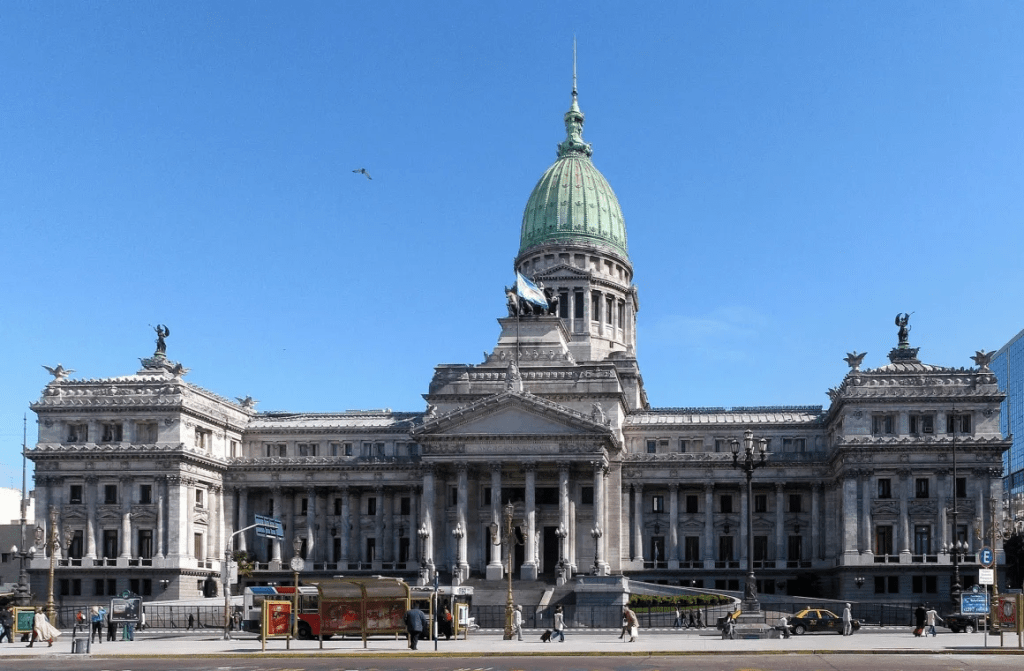

Argentina’s lower house of Congress has granted President Javier Milei’s administration approval for a new loan agreement with the International Monetary Fund (IMF). The vote, which took place on March 19, resulted in 129 votes in favor, 108 against, and six abstentions, allowing Milei to negotiate a new deal without needing Senate approval. This agreement is crucial for Argentina as it seeks to bolster its central bank’s foreign currency reserves and manage impending debt payments.

Purpose of the Loan

The new IMF loan aims to bolster the Central Bank’s foreign currency reserves and manage impending debt payments. Argentina is currently the IMF’s largest debtor, having borrowed $44 billion in 2018 under former President Mauricio Macri.

The loan is part of a 10-year Extended Fund Facility program, which includes a four-and-a-half-year grace period for repayments.

Legislative Process

Javier Milei used an emergency executive decree to expedite the process, which only requires approval from one chamber of Congress. This approach was criticized by opposition parties but allowed the government to bypass traditional legislative procedures.

Political Support

Despite being in a minority, Milei’s La Libertad Avanza party secured support from conservative and centrist factions, including the PRO party and Unión Cívica Radical (UCR), to pass the decree.

Public Reaction

The approval was met with protests outside Congress, reflecting public concern about austerity measures and the impact of IMF involvement on ordinary citizens, particularly retirees.

Economic Implications

Economic Stabilization:

The government argues that the new loan will help stabilize Argentina’s economy by reducing debt and allowing for the removal of capital controls that have hindered business operations since 2019.

Inflation and Poverty:

Milei claims that the loan will help “exterminate” inflation, which has been a major challenge for Argentina. However, his austerity measures have led to rising poverty levels, sparking public discontent.

Read also : Gold : Build Your Wealth and Freedom

In February 2025, Argentina’s inflation rate increased slightly to 2.4% month-on-month (MoM), up from 2.2% in January. This rise was driven by significant increases in housing costs, electricity, gas, and other fuels, as well as higher prices for food and non-alcoholic beverages, particularly meat and meat products.

Read also : When Argentina was a Wealthy Nation

In February 2025, Argentina’s annual inflation rate was 66.9%. This represents a decline from the previous month’s rate of 84.5% and marks a significant reduction from the triple-digit inflation rates experienced in earlier years. The decrease in annual inflation reflects efforts by the government to stabilize the economy, although monthly inflation rates have remained around 2% to 3% in recent months;

Conclusion

The approval of the IMF loan agreement marks a significant step for Milei’s administration in addressing Argentina’s economic challenges. However, it also underscores ongoing tensions between the government’s economic policies and public sentiment, particularly regarding austerity measures and IMF involvement.

The OECD’s latest projection for Argentina’s economic growth in 2025 is 5.7%.

In early January, Argentina successfully made a significant debt repayment of US$4.341 billion to international bondholders, marking a crucial step in President Javier Milei’s efforts to restore investor confidence.

Our community already has nearly 150,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1456.