By Swann Collins, investor, writer and consultant in international affairs – Eurasia Business News. March 29, 2025. Article no 1463.

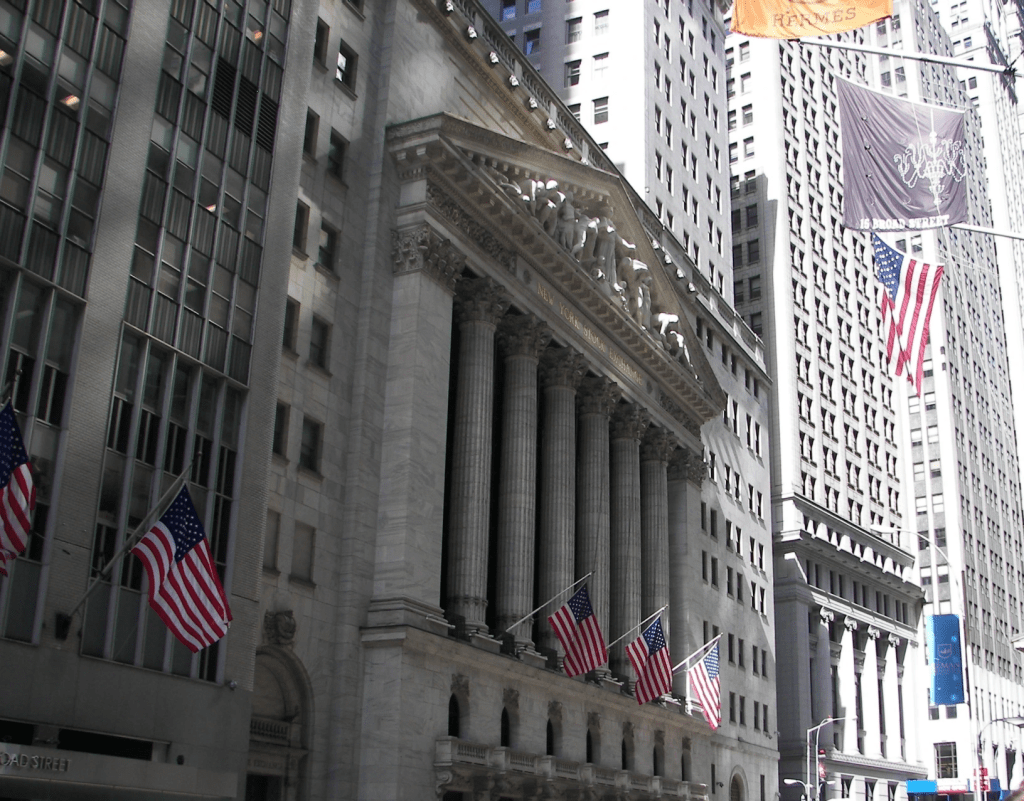

Dow Jones Stock Exchange, Manhattan, New York City- Photo credit : Swann Collins.

On Friday March 28, the U.S. stock market experienced a significant downturn, driven by rising inflation concerns and consumer fears.

The worrisome signs included U.S. inflation picking up, as tracked by the Fed’s preferred measure. Consumer sentiment also worsened, which investors fear could slow spending, with the University of Michigan’s survey showing a drop in the headline index to the lowest level since 2022.

Key Factors Contributing to the Selloff

Inflation Fears: The core Personal Consumption Expenditures (PCE) index, a key inflation measure, rose more than expected, increasing by 0.4% month-over-month and 2.8% year-over-year. This data suggests that inflation remains above the Federal Reserve’s target of 2%, raising concerns about future economic stability.

Tariff Announcements: President Trump’s imposition of a 25% tariff on imported vehicles and auto parts, along with plans for additional tariffs, heightened trade tensions. These tariffs are expected to increase consumer costs and potentially fuel inflation further.

Consumer Confidence: Consumer confidence dropped to its lowest level since November 2022, reflecting concerns about inflation and the job market. This decline in sentiment led to reduced spending and further market instability.

Market Performance

Dow Jones Industrial Average: Dropped by more than 700 points, or approximately 1.7%, closing at around 41,583.90.

On March 4, the Dow Jones had already plummeted by 650 points, or about 1.5%, to close at 43,191, because of trade tariffs.

Nasdaq Composite: Fell by 2.7%, with technology stocks leading the decline.

S&P 500: Decreased by about 2%, reflecting a broader market downturn.

Impact on Other Assets

Gold: Benefited from the market volatility, reaching new highs as investors sought safe-haven assets. Gold futures surged past $3,000, hitting $ 3,085 per troy ounce, driven by increased demand for secure investments amid economic uncertainty.

Read also : Gold : Build Your Wealth and Freedom

Overall, the combination of inflationary pressures, trade tensions, and declining consumer confidence led to a significant selloff in the stock market, while boosting demand for safe-haven assets like gold.

Read also : Five Good Reasons to Own Gold Now

Our community already has nearly 150,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1463.