By John Meyer, consultant in financial affairs – Eurasia Business News, April 7, 2025. Article No 1477.

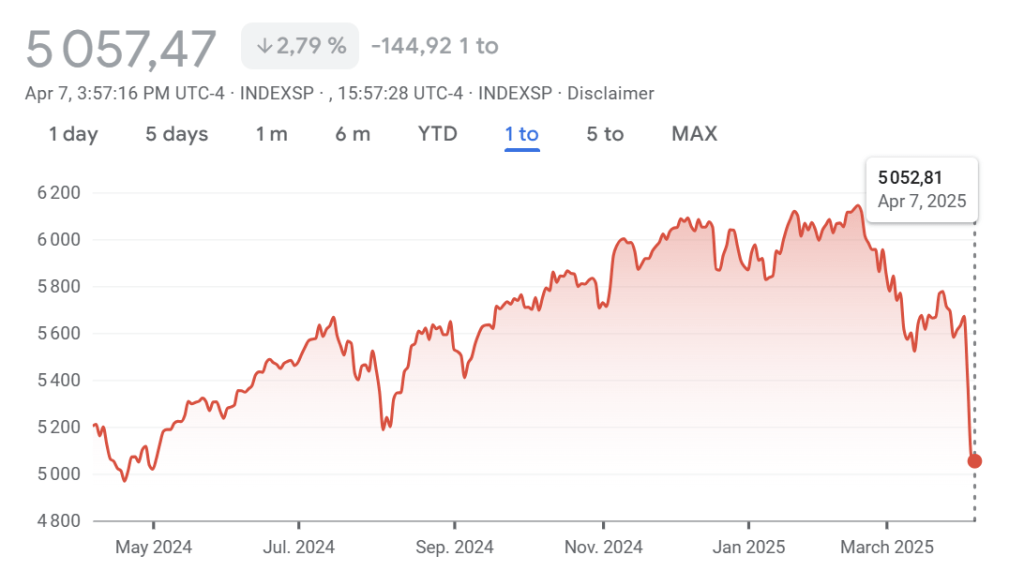

Markets have experienced significant volatility today as President Donald Trump maintains his stance on tariffs, despite growing concerns from Wall Street and global economic leaders. The S&P 500 briefly entered bear market territory, and oil prices have declined, reflecting heightened uncertainty and fears of a potential recession.

Key Developments:

Market Volatility: The S&P 500 futures fell over 20% from their recent highs, positioning the index to confirm a bear market. This decline is one of the fastest since World War II, with the S&P 500 sinking significantly on Monday alone.

The benchmark S&P 500 index fell 10.5% and lost about $5 trillion in market value.

Trump’s Stance: President Trump remains firm on his tariff plan, framing it as necessary to address trade imbalances. He has stated that negotiations with China will not occur until the U.S. trade deficit is resolved.

Global Reactions: Other countries, including Taiwan and Israel, are seeking relief from the tariffs, while China has retaliated with its own tariffs, further escalating tensions.

Read also : Gold : Build Your Wealth and Freedom

Economic Impact: The tariffs have led to a massive loss in market value, with nearly $9.5 trillion erased in recent weeks. This has sparked fears of a global recession and prompted investors to seek safer assets like government bonds.

Market and Economic Outlook:

Bear Market Concerns: The S&P 500’s entry into bear market territory is a significant indicator of investor sentiment and economic health. Historically, bear markets have lasted around 13 months, with an average decline of 32%.

Interest Rate Speculation: The economic downturn has led to speculation about potential interest rate cuts by the Federal Reserve, with some traders estimating a 54% chance of a rate reduction in May.

Oil Prices: The decline in oil prices reflects reduced demand expectations due to economic uncertainty and potential recessionary pressures.

Overall, the ongoing trade tensions and tariff escalations continue to destabilize markets and raise concerns about global economic stability.

Our community already has nearly 150,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1477.