By John Meyer, consultant in financial affairs – Eurasia Business News, April 10, 2025. Article No 1479.

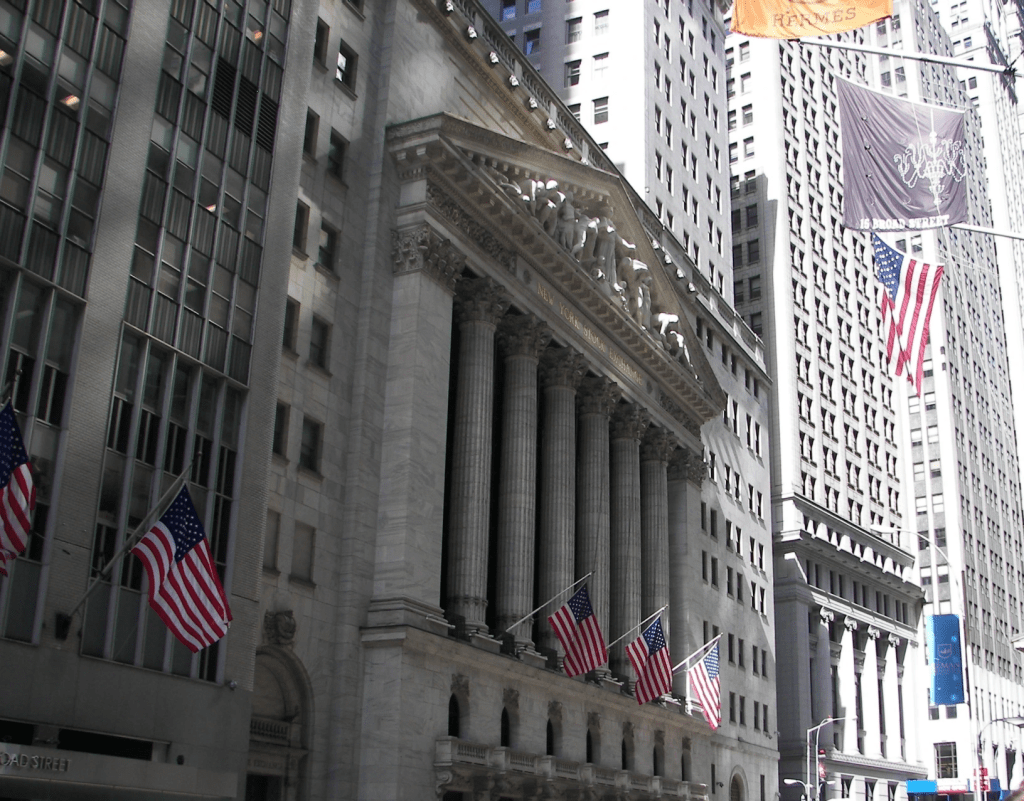

Dow Jones Stock Exchange, Manhattan, New York City- Photo credit : Swann Collins.

U.S. stock markets experienced a significant decline on Thursday, April 10, as investors began to fully grasp the implications of President Donald Trump’s trade policies, particularly the escalating tensions with China. Dow Jones, Nasdaq retreat more than 4% after global stocks surged in response to President Trump’s partial tariff pause.

President Trump said today while discussing his tariff policies that he expects “there’ll be a transition cost and transition problems.”

Overview of Market Decline

The S&P 500 dropped over 5%, while the tech-heavy Nasdaq Composite tumbled nearly 6%. The Dow Jones Industrial Average fell nearly 1,800 points, or more than 4.5%. The 10-year Treasury yield, in high focus amid bond market whiplash, fell to around 4.37%.

On April 7 the benchmark S&P 500 index fell 10.5% and lost about $5 trillion in market value.

The decline was largely attributed to concerns over Trump’s decision to raise tariffs on Chinese goods to 145%, despite temporarily suspending tariffs on many other countries. This move heightened tensions in the U.S.-China trade conflict.

Trump said on April 2 that the U.S. was going to be “charging a discounted reciprocal tariff” because the U.S. is kind. For China, the U.S. is levying a 34% tariff, then for Europe “we’re going to charge them 20%” and Japan 24%. U.S. President gave the list of more than a dozen countries. New tariffs are effective on April 9. Now, tariffs on China could reach 104%.

In response to the new US tariffs, the State Council of the People’s Republic of China announced the introduction of additional duties of 34% on all goods from the United States, which will take effect from April 10.

Read also : Gold : Build Your Wealth and Freedom

Goldman Sachs cut its growth outlook for China, citing the impact of tariffs. The bank now projects China’s economy will expand 4% this year and 3.5% in 2026.

Trade War Escalation

Tariff Increases: Trump increased tariffs on Chinese imports, which was seen as a significant escalation in the trade war. Beijing had previously retaliated by imposing tariffs on U.S. goods.

Analysts’ Views: Analysts noted that the trade conflict is evolving into a direct confrontation between the U.S. and China, which could lead to market fluctuations due to simultaneous escalation and de-escalation.

Economic Impact

Economic Concerns: Despite positive reports on inflation and joblessness, investors remained cautious due to potential future economic impacts from ongoing tariffs.

Global Trade Negotiations: The European Union’s decision to temporarily halt retaliatory tariffs against the U.S. was seen as a positive step toward negotiations, but overall market sentiment remained cautious.

In summary, while Trump’s decision to pause tariffs on many countries initially boosted markets, the ongoing and intensified trade conflict with China overshadowed these gains, leading to a decline in U.S. stock indices.

Our community already has nearly 150,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1479.