By John Meyer, consultant in financial affairs – Eurasia Business News, April 25, 2025. Article No 1498.

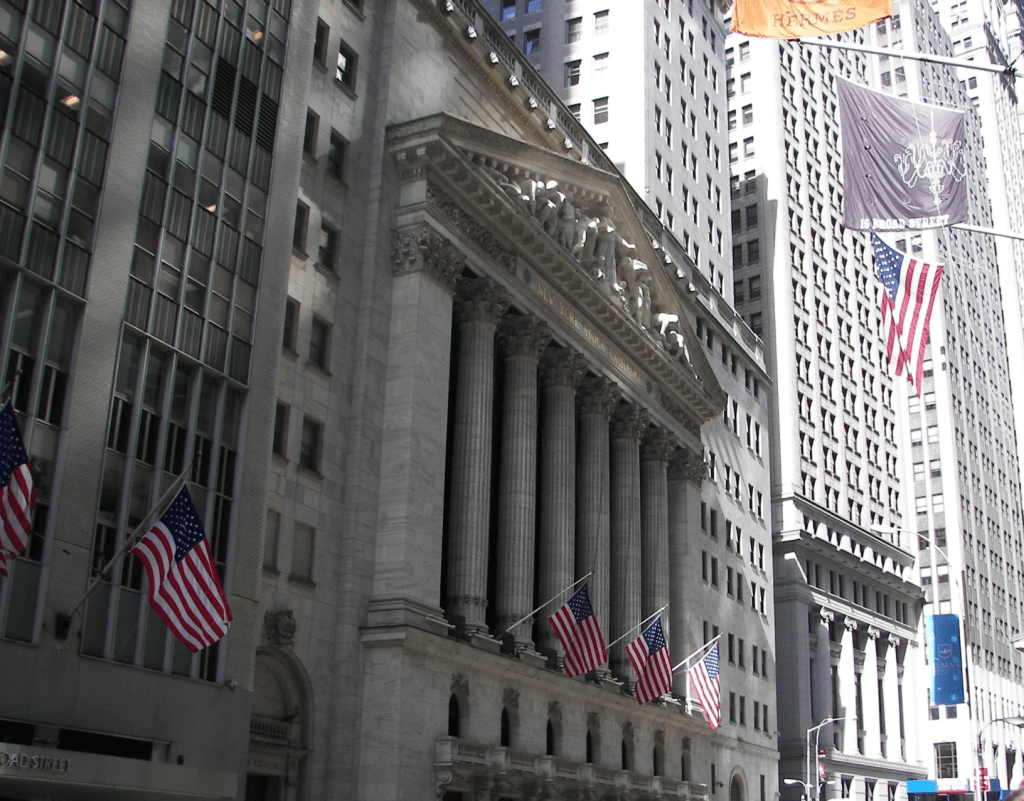

On Friday, April 25, the Nasdaq Composite turned higher in a mixed trading day, rising about 0.96% to approximately 17,331 points after opening near 17,182. The index fluctuated between a low of around 17,111 and a high near 17,404 during the session. This gain was supported by strength in several big technology stocks, contributing to the Nasdaq’s outperformance relative to other major indexes.

Meanwhile, the Dow Jones Industrial Average slipped modestly by about 0.2%, losing 76 points to around 40,017, while the S&P 500 edged up by roughly 0.4% to 5,509.

The market showed signs of volatility as investors weighed mixed signals on trade negotiations and the impact of tariffs. Recent comments from President Trump about easing trade tensions and approaching trade deals helped spur a relief rally earlier in the week, but momentum slowed toward the end of the session.

Read also : Gold : Build Your Wealth and Freedom

After a significant rally Tuesday evening, the gold market has cooled considerably heading into the weekend, as market volatility subsides and renewed interest emerges in the U.S. dollar and bond yields.

After a strong start to the week, gold is poised to end Friday with a sharp decline. Spot gold last traded at $3,284 an ounce, down more than 1% on the week. Prices are also down 6% from Tuesday’s intra-day all-time high of $3,500 an ounce.

Overall, the trading day was characterized by a divergence where tech-heavy Nasdaq advanced, buoyed by strong earnings and optimism, while the broader market indexes showed more cautious or mixed performance amid ongoing trade uncertainties.

Our community already has nearly 150,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1498.