By Paul Jouvenet, correspondent. Eurasia Business News, April 26, 2025. Article n°1503.

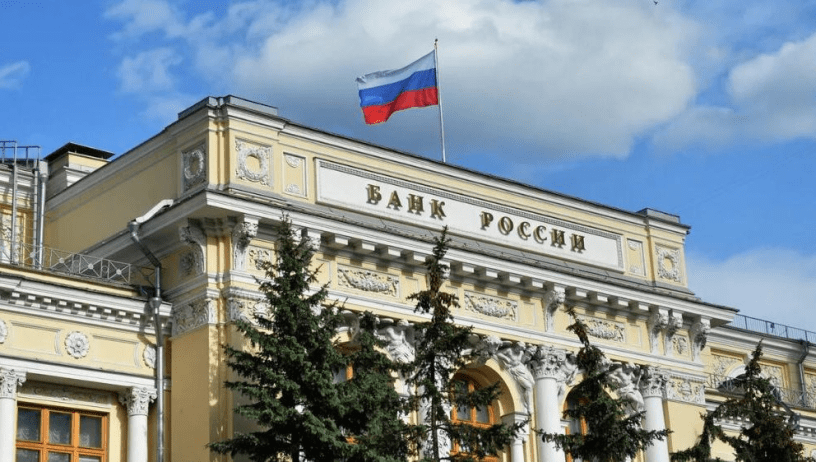

The Bank of Russia decided on April 25, to hold its key interest rate steady at a record high of 21% for the fourth consecutive time. This decision aligns with market expectations and reflects the central bank’s cautious approach amid easing but still elevated inflationary pressures. Inflation in Russia remains above 10%, with the central bank projecting it to slow to 7–8% in 2025 and return to the 4% target by 2026.

At the end of March, monthly inflation in the Russian Federation fell to 0.65% in annual terms after 0.81% in February, Rosstat noted.

The bank cited a consistent reduction in current inflation and inflation expectations, a slowdown in consumer activity, and easing pressures in the labor market as reasons for maintaining the rate. However, it also warned that global economic turbulence, including potential declines in oil prices and the impact of U.S. trade tariffs, could create pro-inflationary pressures through fluctuations in the ruble’s exchange rate.

Monetary policy will remain tight for an extended period to ensure inflation returns to target, with the central bank forecasting an average key rate between 19.5% and 21.5% for 2025. Economic growth is expected to slow slightly to around 1–2% this year, with the central bank emphasizing the need to maintain stringent monetary conditions despite some signs of easing inflationary pressure.

The Bank of Russia’s decision to keep the key rate at 21% reflects a balance between encouraging economic stability and controlling inflation amid external risks and domestic economic challenges.

Back in March, the Central Bank announced that it would consider further tightening of policy if inflation does not decline quickly enough. He has now removed this signal from the release, but promised that he “will maintain the tightness of monetary conditions that is necessary to return inflation to the target in 2026.”

“This means a long period of tight monetary policy. Further decisions on the key rate will be made depending on the speed and sustainability of the decline in inflation and inflation expectations,” the Central Bank writes. The regulator did not change the inflation forecast and kept it at 7-8% this year and 4% in the future.

Read also : Five Good Reasons to Own Gold Now

In the first quarter of 2025, inflation slowed down relative to the end of 2024, but remained significantly above the Central Bank’s target of 4%. As of April 21, it was 10.3%. In the coming months, inflationary pressure will continue to decline, the Bank of Russia expects.

Our community already has nearly 150,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1503.