By John Meyer, consultant in financial affairs – Eurasia Business News, May 29, 2025. Article No 1530.

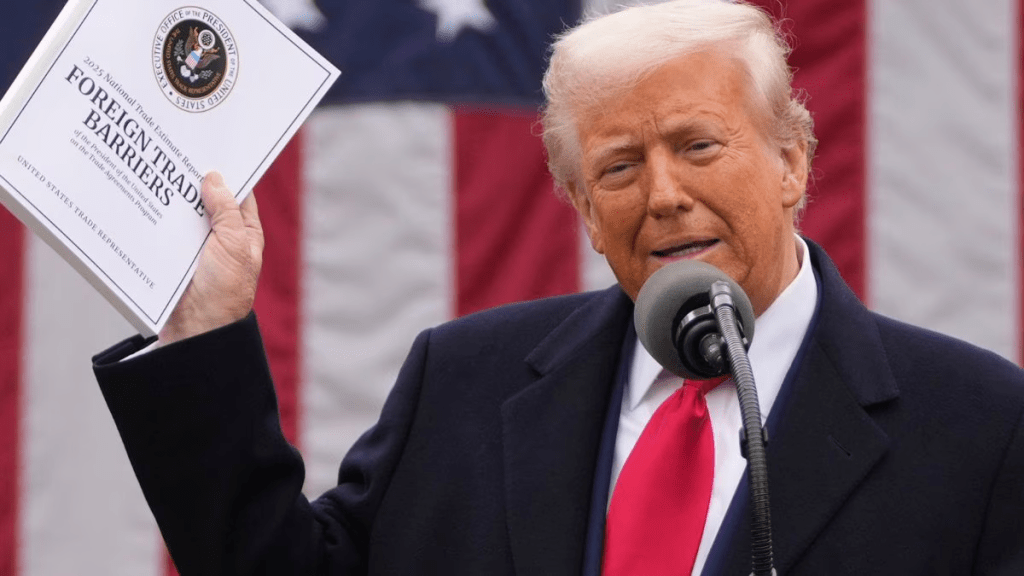

A U.S. federal court has blocked President Donald Trump’s “Liberation Day” tariffs, ruling that he exceeded his authority by imposing broad tariffs on imports from countries with trade surpluses against the U.S. The Court of International Trade in Manhattan stated that only Congress has the power to regulate trade, not the president under emergency powers.

The three-judge panel at the Court of International Trade in Manhattan assailed Trump’s actions against other countries across the globe as “contrary to law” – despite the president claiming emergency powers under the International Emergency Economic Powers Act allowed him to impose the controversial duties.

This ruling has led to a sharp rally in stock futures: Dow Jones futures rose about 1%, S&P 500 futures by 1.5-1.6%, and Nasdaq futures by around 1.6-1.8%, boosted further by strong earnings from Nvidia, a key player in the AI sector. Asian and European stocks also climbed following the news, reflecting increased investor optimism.

The dollar strengthened against safe-haven currencies like the Swiss franc and Japanese yen, while the euro weakened. Treasury yields rose slightly as markets lowered expectations for near-term Federal Reserve rate cuts.

The Trump administration has appealed the court decision, and the case may reach the Supreme Court. Meanwhile, analysts suggest the administration might seek alternative tariff measures to achieve similar trade policy goals despite the setback.

Read also : Gold : Build Your Wealth and Freedom

In summary, the blocking of Trump’s tariffs by the court sparked a positive market reaction with rallies in U.S. and global equities, a stronger dollar, and higher Treasury yields, reflecting relief over reduced trade tensions and optimism about global growth prospects.

On April 9, U.S. stock markets experienced a historic rally after President Donald Trump announced a 90-day suspension of most reciprocal tariffs, while simultaneously raising tariffs on Chinese imports to 125%. This decision marked a significant shift in trade policy amidst escalating tensions with China and other trading partners.

Trump then announced that if China did not remove its 34% tariff on U.S. products by April 8, 2025, the U.S. will impose an additional 50% tariff on Chinese imports starting April 9. Today, the 125% tariff on China came into force.

Read also : Tax Management strategies for Digital Nomads

The U.S. and China agreed to a 90-day truce starting May 14, lowering the reciprocal tariffs from as high as 125% down to 10%. However, the existing 20% fentanyl-related tariffs remain in place, making the effective tariff rate on most Chinese goods about 30% currently.

Our community already has nearly 150,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1530.