By John Meyer, consultant in financial affairs – Eurasia Business News, June 16, 2025. Article no. 1563.

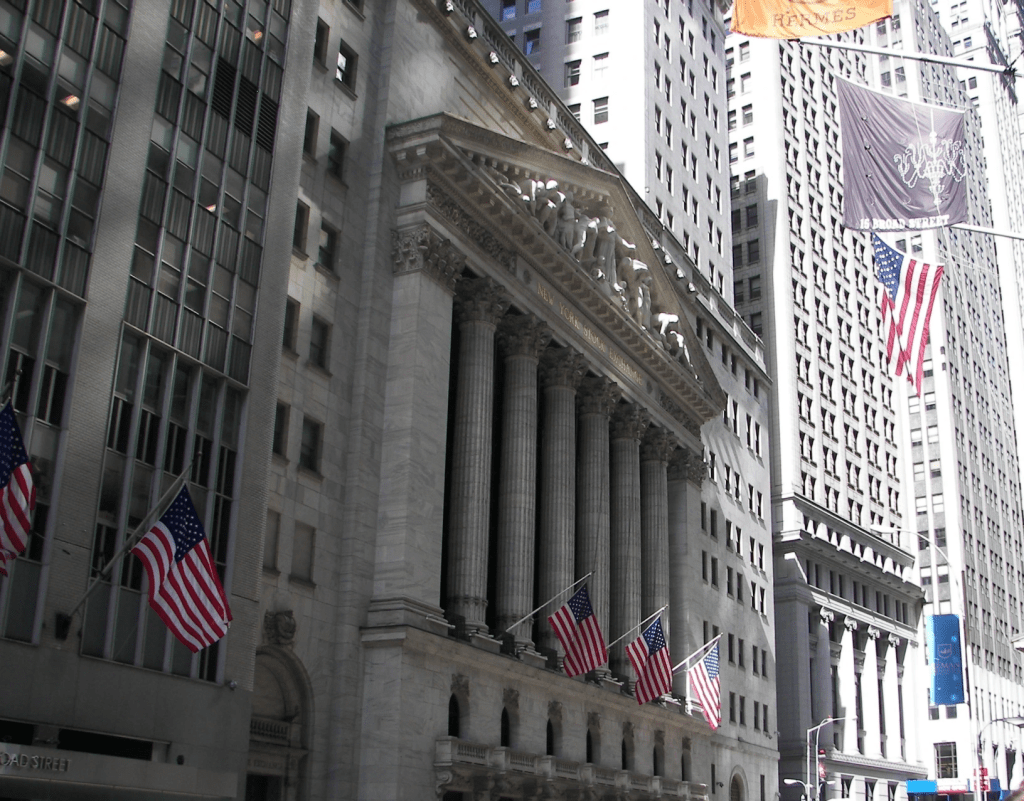

Dow Jones Stock Exchange, Manhattan, New York City- Photo credit : Swann Collins.

On Monday, June 16, the Dow Jones Industrial Average gained approximately 300 points, or about 0.7%, closing near 42,498.

This uptick in stocks followed news that Iran signaled a desire to de-escalate hostilities with Israel, which eased some investor concerns about the conflict in the Middle East.

Major indexes rose about 1% or more and crude prices dropped about 2%, reversing part of Friday’s runup. Israel and Iran struck at each other’s energy facilities over the weekend, and Israel said it had also hit command centers of Iran’s Revolutionary Guard.

U.S. President Trump meets with the leaders of G-7 countries, plus others, at a summit in Canada. Nations including Japan, Canada and Mexico hope face time with Trump will help them persuade the president to lower at least some of his tariffs.

Meanwhile, oil prices dropped around 1.8% to about $71.65 per barrel after surging last week amid fears of supply disruptions due to the Israel-Iran fighting.

The market rally reflects cautious optimism as investors monitor geopolitical developments and await the Federal Reserve’s upcoming interest rate decision.

Read also : Gold : Build Your Wealth and Freedom

Gold prices have fallen back below $3,400 an ounce as the conflict between Israel and Iran has not seen regional escalation. But while the precious metal continues its broader consolidation, commodity analysts at Bank of America say it still has a path to $4,000 an ounce.

Our community already has nearly 150,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1563.