By John Meyer, consultant in financial affairs – Eurasia Business News, June 19, 2025. Article no. 1572.

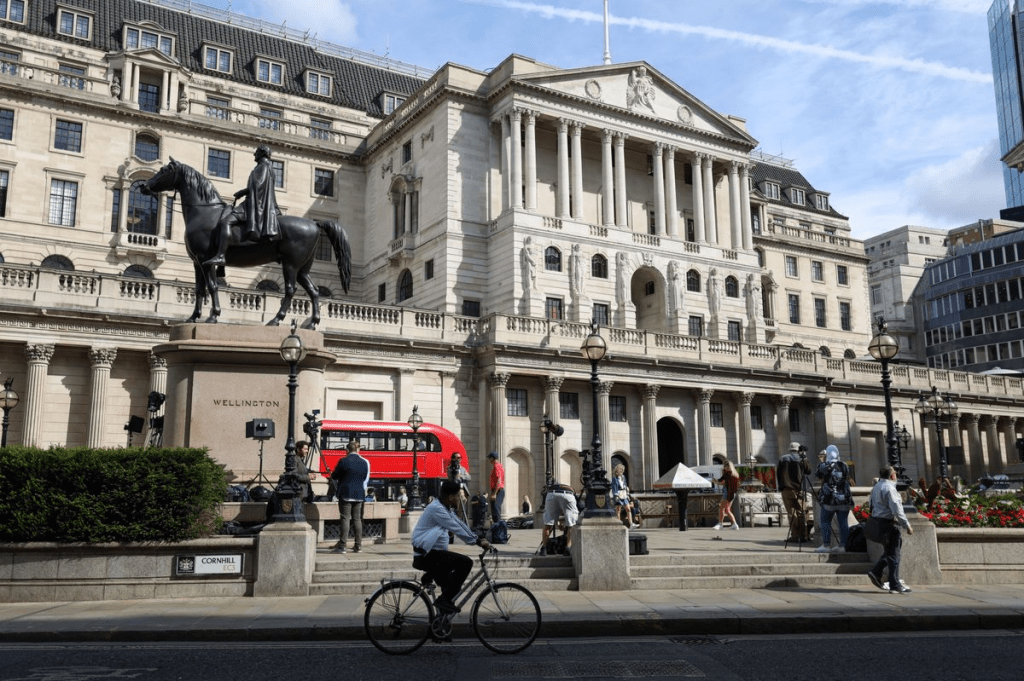

The Bank of England held its key interest rate steady at 4.25% during its June 2025 meeting, with six of the nine Monetary Policy Committee members voting to maintain rates and three members favoring a 25 basis point cut to 4.00%. The decision reflects ongoing concerns about persistent inflationary pressures, with UK inflation running at 3.4% in May, well above the Bank’s 2% target, and sticky wage growth contributing to inflation resilience.

The Bank emphasized a cautious and gradual approach to rate cuts, noting that the recent surge in oil prices due to the Iran-Israel conflict has heightened inflation risks and could delay the easing of monetary policy. While UK economic growth remains weak and the labor market shows signs of loosening, the Bank remains vigilant about inflation dynamics and the potential impact of global uncertainties, including geopolitical tensions and trade policies.

Market expectations are that the Bank may consider cutting rates later in the summer, possibly in August, if inflation pressures begin to ease as forecasted, with inflation expected to peak around 3.7% in the third quarter before declining. However, the path forward remains uncertain and dependent on evolving economic and geopolitical conditions.

Our community already has nearly 150,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1572.