By Alexander Miller, consultant in energy markets. Eurasia Business News, June 22, 2025. Article n°1578.

The Emirati oil boss, Sultan Ahmed Al Jaber, who is the CEO of Abu Dhabi National Oil Company (ADNOC) and UAE Minister of Industry and Advanced Technology, is banking heavily on U.S. energy investments as a core part of ADNOC’s global strategy. He announced that ADNOC plans to increase its U.S. energy investments six-fold, from $70 billion currently to $440 billion over the next decade, making the U.S. not just a priority but an “investment imperative”.

The key points about this strategy include :

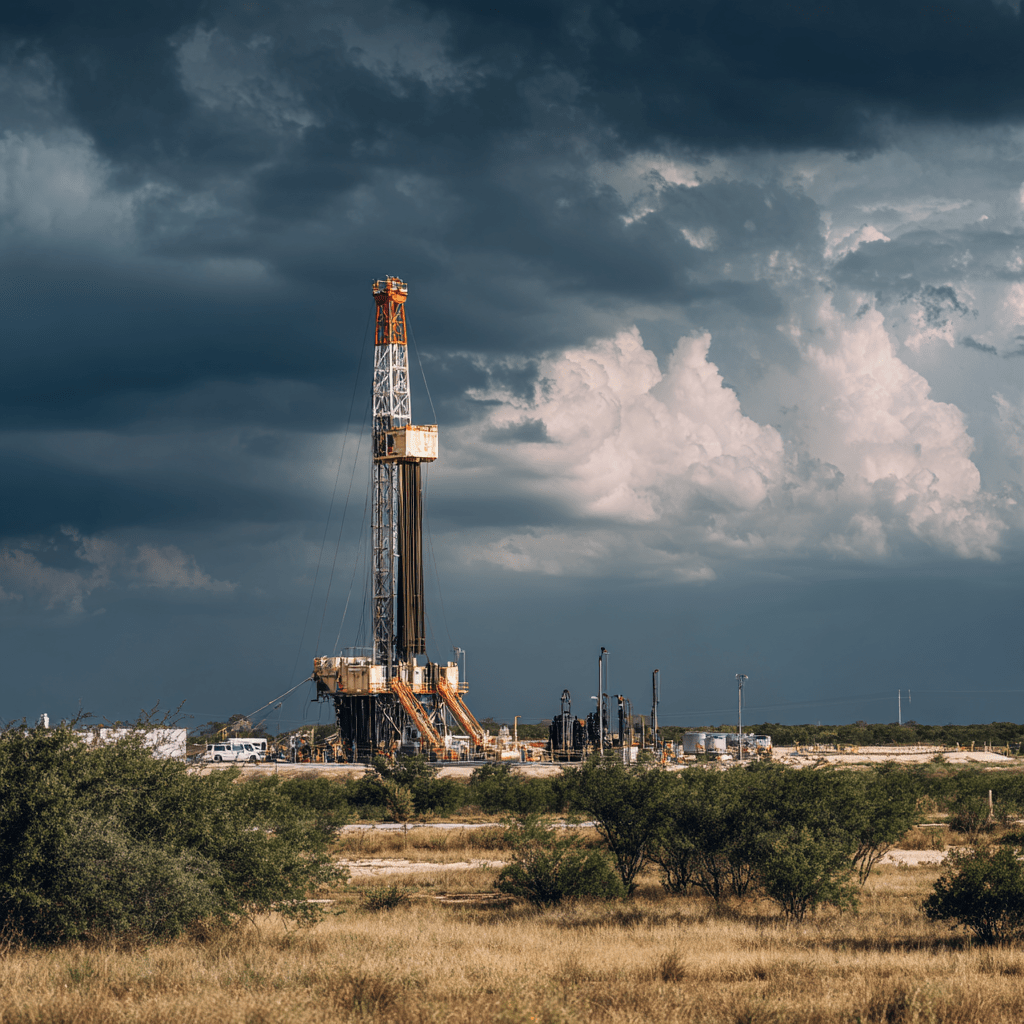

Massive Investment Scale: The $440 billion investment plan covers upstream oil and gas, petrochemical facilities, renewable energy, and energy storage projects across the U.S., including a recent major investment in a large liquefied natural gas facility in Texas.

AI and Energy Synergy: Al Jaber emphasized that the race for artificial intelligence supremacy is fundamentally an energy challenge, with AI demanding vast new gigawatts of power. He sees this as a “once-in-a-generation” investment opportunity, with the U.S. needing 50-150 gigawatts of new capacity over the next five years. ADNOC’s investments will support this growing energy demand and also leverage AI to optimize energy grids.

Mutual Investment and Collaboration: The UAE’s plan includes reciprocal investments by U.S. energy firms in UAE projects, with $60 billion committed by partners in upstream oil and gas and unconventional opportunities. This reflects a deepening bilateral energy partnership.

Economic Impact: The investment is expected to add $29 billion annually to the U.S. GDP and create around 470,000 jobs, highlighting its significance beyond just the energy sector.

Read also : Tax Management strategies for Digital Nomads

Geopolitical and Strategic Context: The announcement was made during high-level meetings involving U.S. and UAE officials, including former President Donald Trump, underscoring the geopolitical importance of this energy partnership amid global energy transitions and Middle East tensions. To the United Arab Emirates the U.S. plays the role of the main safety provider in the Middle East against Iran. Such huge investments in the U.S. energy industry can be seen as a “payback” for U.S. military protection against Iran.

Read also : How Russia is Reshaping Global Energy Markets

In summary, Sultan Al Jaber is positioning ADNOC as one of the world’s most ambitious and well-funded energy companies by massively scaling up investments in the U.S. energy sector, focusing on both traditional hydrocarbons and renewable energy to meet rising demand driven by AI and other technologies. This strategy also strengthens UAE-U.S. economic ties and reflects a long-term vision of energy collaboration

Our community already has nearly 150,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1578.