By John Meyer, consultant in financial affairs – Eurasia Business News, June 26, 2025. Article no. 1585

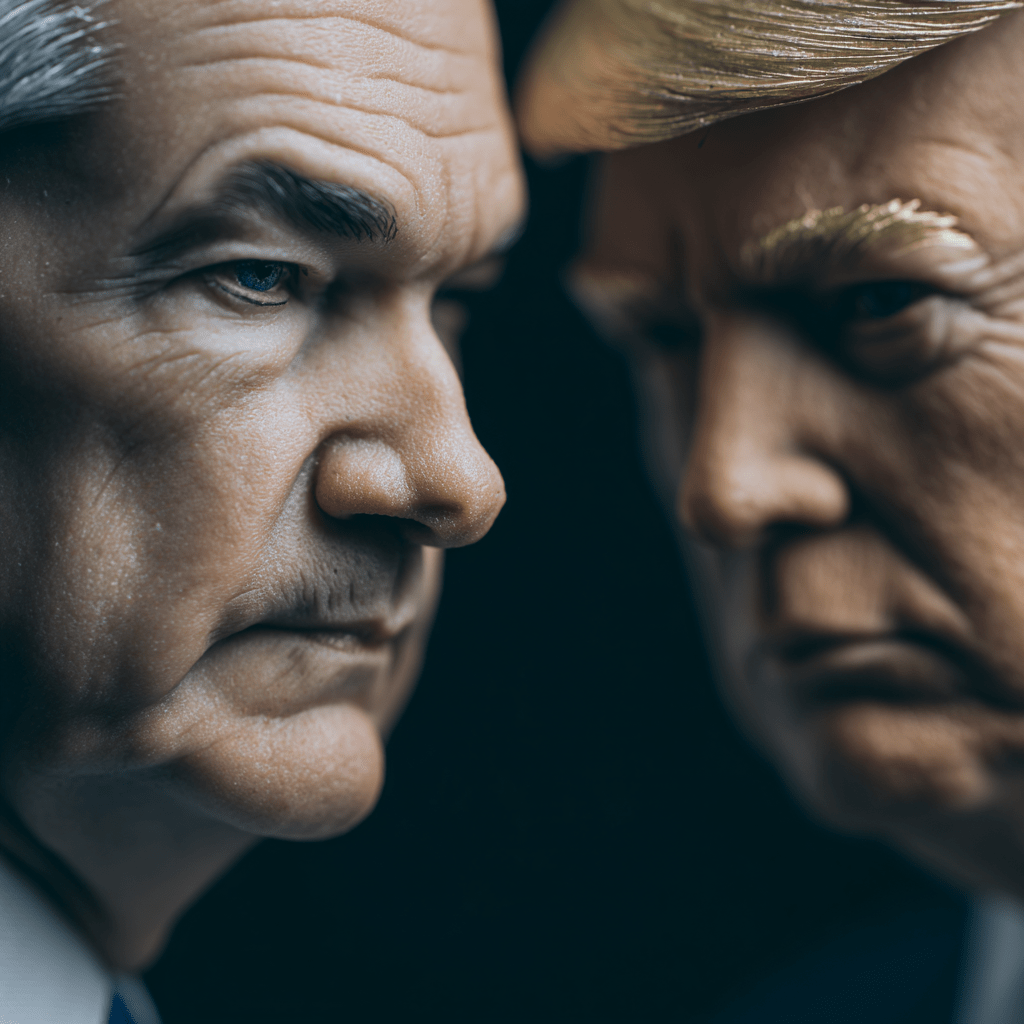

U.S. Treasury yields edged lower amid reports that former President Donald Trump is actively considering three or four candidates to replace Federal Reserve Chair Jerome Powell once his term ends in May 2026. Trump has repeatedly criticized Powell for not lowering interest rates quickly enough and has called him “terrible” and “very dumb, hardheaded,” blaming him for high costs to the U.S. government.

The market reaction to Trump’s potential early announcement of a successor—possibly as soon as September or October 2025—has been dovish. Investors interpret the move as signaling a future Fed chair more likely to cut interest rates, which tends to push Treasury yields down and weaken the U.S. dollar. The 10-year Treasury yield fell by about two basis points to around 4.26%, continuing a downward trend of roughly 30 basis points since the start of the year. The U.S. Dollar Index also declined, reflecting expectations of easier monetary policy.

In a statement made in late 2024, Powell emphasized that he has no plans to leave the Fed before this term concludes.

Among the candidates reportedly considered by Trump are former Fed Governor Kevin Warsh, National Economic Council Director Kevin Hassett, Treasury Secretary Scott Bessent, and current Fed governors Michelle Bowman and Christopher Waller. Some of these candidates have expressed support for interest rate cuts, aligning with Trump’s policy goals.

Read also : Gold : Build Your Wealth and Freedom

Powell has maintained a cautious stance, warning that tariffs could increase inflation and that the Fed is not in a hurry to reduce borrowing costs. This position contrasts with Trump’s push for aggressive rate cuts to stimulate the economy and reduce interest expenses on the federal debt.

The focus on Trump’s ambitions to replace Powell with a more rate-cut-friendly Fed chair has contributed to lower Treasury yields and a weaker dollar as markets anticipate looser monetary policy ahead.

Our community already has nearly 150,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1585.