By Swann Collins, investor, writer and consultant in international affairs – Eurasia Business News. June 30, 2025. Article no 1588.

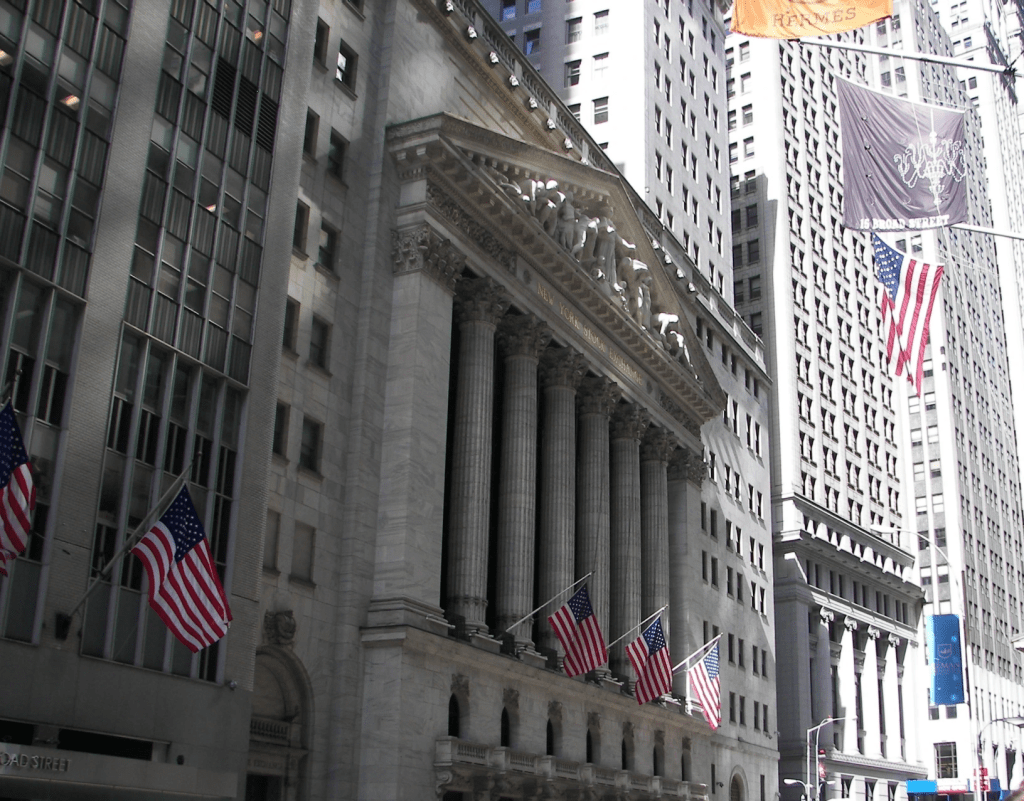

Dow Jones Stock Exchange, Manhattan, New York City- Photo credit : Swann Collins.

The S&P 500 posted its largest quarterly percentage gain since the fourth quarter of 2023, and the Nasdaq Composite had its best quarter in five years.

The S&P 500 has experienced a dramatic and volatile quarter on Wall Street, moving from sharp declines due to President Trump’s sweeping tariff announcements to reaching record highs. Initially, after Trump announced extensive tariffs in early April 2025, the S&P 500 plunged nearly 15%, reflecting investor fears about a potential trade war and its impact on the global economy. This drop brought the index close to bear market territory, defined as a 20% decline from recent highs.

However, the market staged a remarkable comeback. On April 9, Trump announced a 90-day pause on most tariffs against major trading partners (except China, where tariffs were increased), which triggered a sharp rally. The S&P 500 surged 9.5% in a single day, one of its best performances since World War II, and began a sustained recovery from the earlier losses.

Since that pause, the S&P 500 has added more than 9% and eventually surpassed its previous highs, reaching new all-time records by late June. This rebound has been driven by investor optimism that the administration would avoid further market disruptions and by signs of progress in trade negotiations. Despite ongoing challenges such as inflation and geopolitical tensions, the index has risen over 23% from its lows in March and early April, fully recovering all ground lost to the tariff turmoil.

Read also : Tax Management strategies for Digital Nomads

The stock market was hit hard in the spring following U.S. President Trump’s announcement of sweeping tariffs, which caused significant volatility and a sharp drop in equities. However, since bottoming out on April 8, the market has rebounded strongly, with stocks rising more than 19% from that low and recouping all their spring losses and more. This recovery has been largely driven by investor optimism that the worst effects of the tariffs may be avoided, such as expectations of rollbacks, delays, or reversals of some tariff measures, which has helped ease fears of a debilitating trade war.

Read also : Gold : Build Your Wealth and Freedom

In summary, the quarter was marked by initial tariff-induced pain followed by a strong recovery, with the S&P 500 climbing from near bear market levels to record highs, reflecting a wild but ultimately bullish period on Wall Street.

Our community already has nearly 150,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1588.