By John Meyer, consultant in financial affairs – Eurasia Business News, July 10, 2025. Article no. 1606

President Trump unveiled a 50% tariff on Brazilian goods starting Aug. 1, the highest tariff announced so far this week in a flurry of missives to foreign leaders.

Unlike the form letter the president has sent to many other countries, Trump used his letter to Brazil’s president, Luiz Inácio Lula da Silva, to criticize the country’s legal case against Jair Bolsonaro, Brazil’s former president.

Trump Announces 50% Tariff on Brazil

President Trump declared a 50% tariff on all Brazilian imports, escalating trade tensions between the U.S. and Brazil. The move is partly in retaliation for Brazil’s ongoing trial of former President Jair Bolsonaro, a Trump ally, whom Trump claims is the target of a political “witch hunt.” The tariffs are set to take effect on August 1 and cover a wide range of Brazilian exports, including steel and coffee.

Trump’s letter to Brazilian President Luiz Inácio Lula da Silva explicitly demanded an end to Bolsonaro’s trial, framing it as political persecution. The U.S. administration also cited Brazil’s proposed digital services tax and actions against U.S. tech companies as reasons for the punitive measures.

The announcement marks a notably aggressive stance compared to recent tariff threats against other countries, with Trump also warning of potential broader trade investigations into Brazil’s economic policies.

On July 8 president Donald Trump threatened to impose an additional 10% tariff on any country that aligns itself with what he calls the “anti-American policies” of the BRICS group.

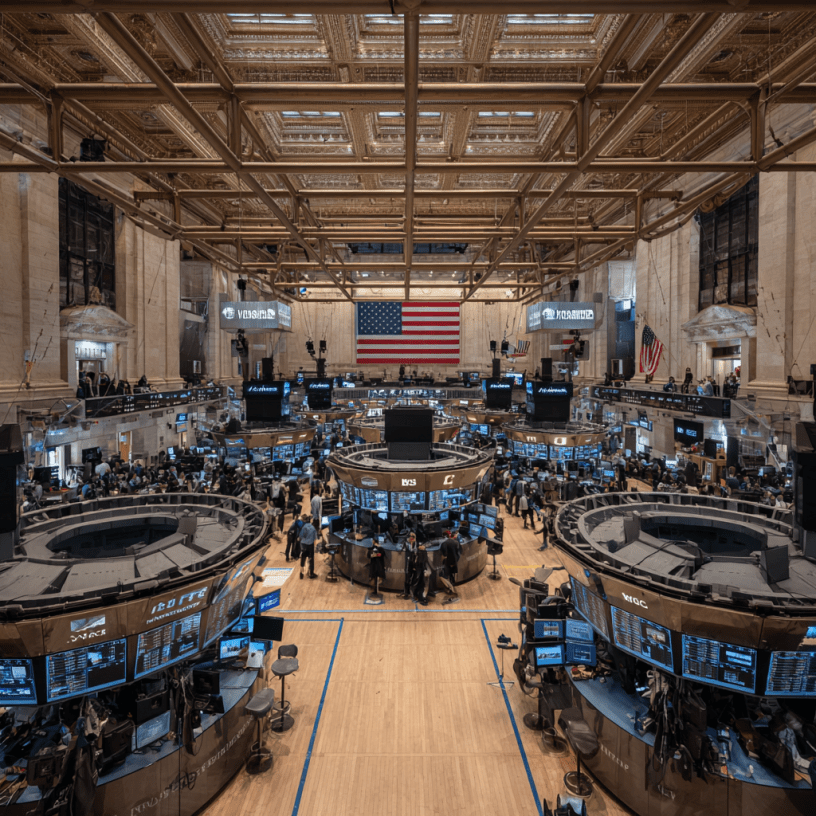

Market Reaction: Nasdaq Hits Record High

Despite the tariff news, U.S. stock markets rallied, led by technology shares. The Nasdaq Composite climbed 0.9% to close at a new all-time high, buoyed by strong performances from major tech companies, including Nvidia, which reached a record market capitalization of $4 trillion.

The S&P 500 also closed at a record level, while the Dow Jones Industrial Average posted moderate gains. Investors appeared to shrug off immediate concerns about the trade escalation, focusing instead on robust tech sector earnings and expectations for future Federal Reserve policy.

Recent volatility in the markets has been driven by a mix of trade policy uncertainty, strong tech sector momentum, and speculation about potential interest rate cuts later in the year.

Gold price still strong

The gold market has managed to secure its footing above $3,300 an ounce as the precious metal finds some support, with the Federal Reserve continuing to tread carefully on U.S. monetary policy—even amid some support for a potential rate cut in July. Gold price hit $ 3,314 per ounce today, a +0.06% growth over the day.

Read also : Gold : Build Your Wealth and Freedom

Broader Implications

The 50% tariff on Brazilian goods is expected to have significant repercussions for global trade, particularly in sectors where Brazil is a major exporter. The move has been criticized by Brazilian officials, with President Lula da Silva rejecting what he called external interference in Brazil’s judicial process.

The escalation comes amid a series of new U.S. tariffs targeting multiple countries, with rates ranging from 20% to 50%, as part of a broader push by the Trump administration to leverage trade policy for both economic and political objectives.

Read also : Tax Management strategies for Digital Nomads

The stock market was hit hard this spring following U.S. President Trump’s announcement of sweeping tariffs, which caused significant volatility and a sharp drop in equities. However, since bottoming out on April 8, the market has rebounded strongly, with stocks rising more than 19% from that low and recouping all their spring losses and more. This recovery has been largely driven by investor optimism that the worst effects of the tariffs may be avoided, such as expectations of rollbacks, delays, or reversals of some tariff measures, which has helped ease fears of a debilitating trade war.

Our community already has nearly 150,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1606.