By John Meyer, consultant in financial affairs – Eurasia Business News, July 23, 2025. Article no. 1651

U.S. stock markets are rallying on Wednesday morning, July 23, after the announcement of a significant trade agreement between the United States and Japan. The new deal removed considerable uncertainty from global markets and sharply improved investor sentiment.

Dow Futures displayed optimistic momentum as they ticked 200 points after the US-Japan trade deal was finalised and President Donald Trump indicated that more trade deals may be announced soon.

Dow Jones Futures rose by 217 points while S&P 500 futures climbed 0.4% and Nasdaq-100 futures edged up 0.2%.

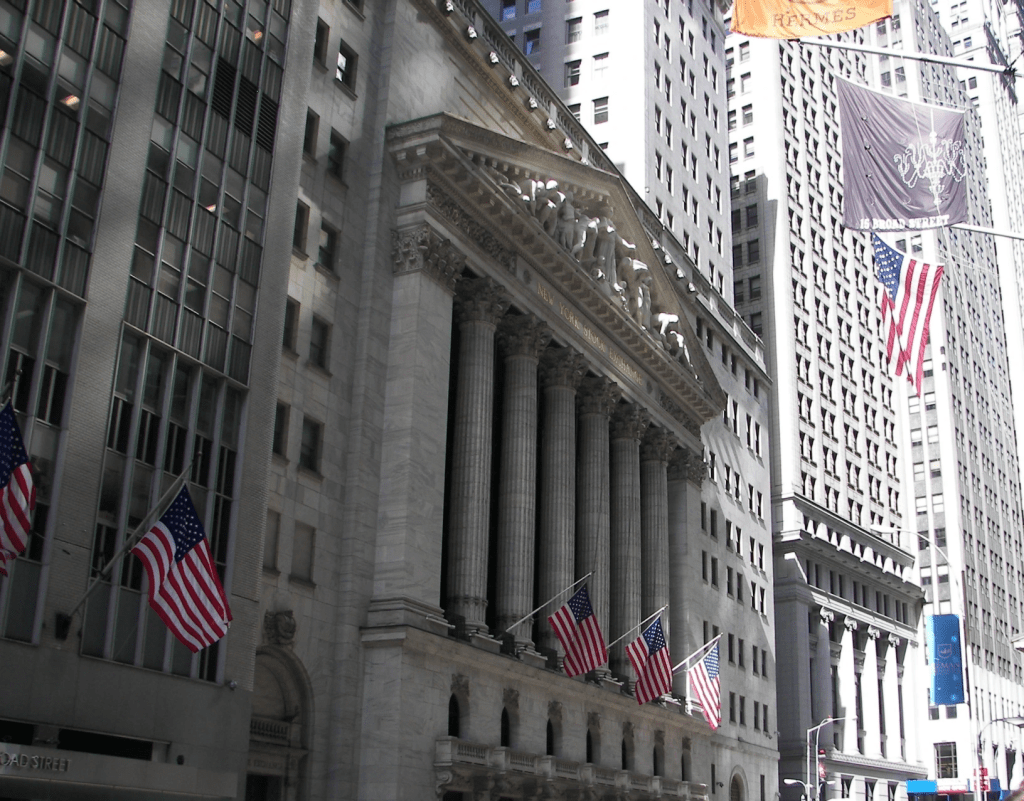

The rally on Wednesday came as the Wall Street indices continue to trade near record highs.

Japanese automakers like Toyota and Mazda saw rapid gains in premarket trading, with increases between 10–17%.

Other auto stock gainers included Honda Motor (NYSE:HMC) with a 10.5% rally, Stellantis (STLA) with a 5.9% gain, and General Motors (GM) with a 2.1% gain. Nissan (OTCPK:NSANY) jumped 8.3% in Tokyo trading following the deal announcement. On a year-to-date basis, Chinese automakers XPeng (XPEV) +61%, Li Auto (LI) +29%, and NIO (NIO) +18% have some of the strongest gains in the sector amid the trade war anxiety.

Read also : Tax Management strategies for Digital Nomads

Tuesday marked the benchmark’s 11th record finish of 2025. The Dow Jones Industrial Average gained nearly 180 points, while the tech-focused Nasdaq Composite slipped around 0.4% due to weakness in chip stocks.

Trump also said EU representatives would be visiting for trade negotiations on Wednesday. That stirred hopes for a deal with Europe, even as the EU was reportedly refining countermeasures in case of a deadlock before the August 1 deadline.

Euro STOXX 600 (.STOXX) added 0.9%, with auto shares (.SXAP) surging 3.4%. UK shares (.FTSE) hit a record high, climbing 0.5%.

Additional Market Drivers

U.S. Corporate Earnings: Major companies such as Tesla and Alphabet (Google) were set to report Q2 earnings, adding further anticipation to Wednesday’s trading session. Tesla’s stock was volatile given ongoing trade policy uncertainty and its robotaxi initiatives.

Read also : Gold : Build Your Wealth and Freedom

Federal Reserve Outlook: Lower trade tensions raised hopes that inflation would moderate, possibly allowing the Federal Reserve to consider interest rate cuts later in the year.

Our community already has nearly 150,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1651