By Anthony Marcus for Eurasia Business News, July 27, 2025. Article no.1656.

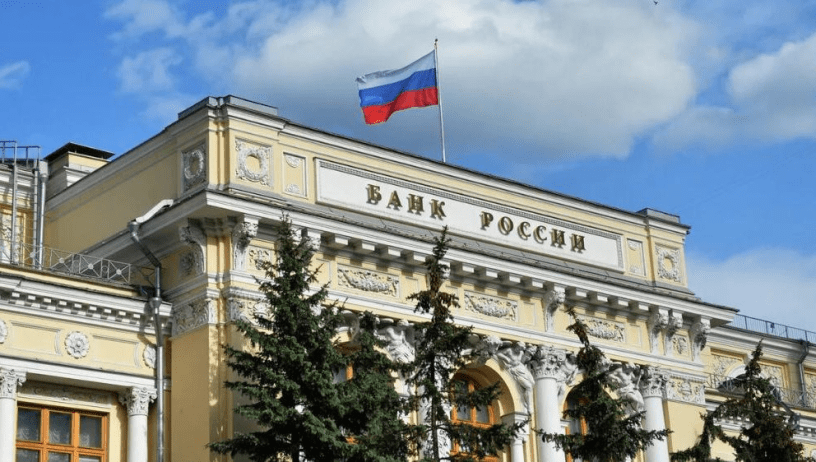

The Bank of Russia cut its key interest rate by 200 basis points, lowering it from 20% to 18% on July 25. This cut aligns with market expectations and reflects the bank’s response to faster-than-anticipated easing inflationary pressures and slowing domestic demand. The bank signaled that monetary conditions will remain tight for a prolonged period to achieve an inflation target of 4% by 2026.

The rate cut is the second consecutive decrease in 2025, following a previous cut from 21% to 20% in June.

The inflation rate in Russia was about 9.2-9.4% in mid-2025 and is forecasted to decline to 6-7% by the end of 2025 and reach 4% in 2026.

The central bank noted slower growth in domestic demand and a return toward balanced economic growth.

Tighter monetary policy will continue, with expected average key rates of around 18.8-19.6% in 2025 and 12-13% in 2026.

This rate reduction aims to stimulate lending and support the Russian economy amid concerns over slowing growth and inflation easing more rapidly than expected.

This cut is part of managing inflation and growth amid Russia’s economic conditions influenced by geopolitical and internal factors.

Our community already has nearly 150,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1656.