By John Meyer, consultant in financial affairs – Eurasia Business News, August 2, 2025. Article no. 1675

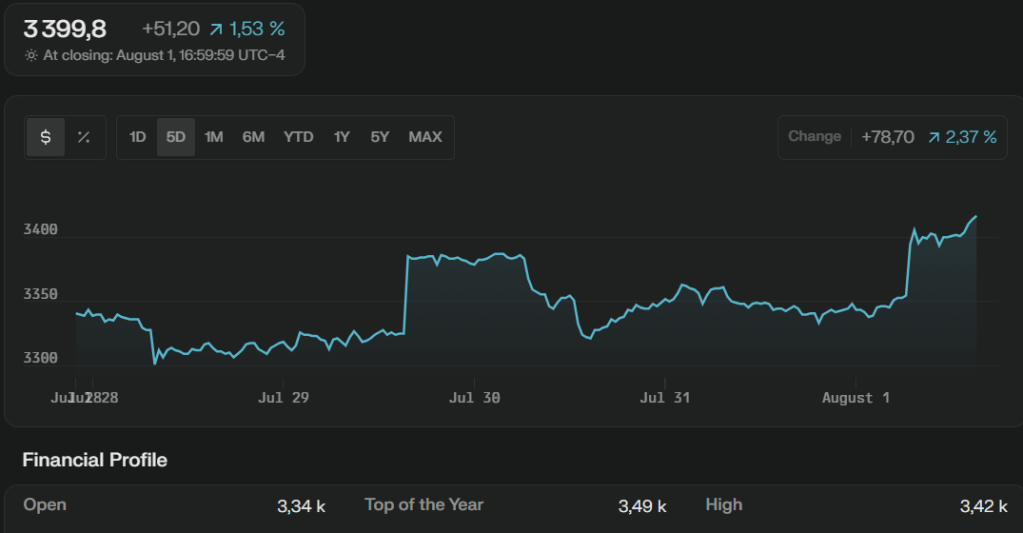

For the week of August 1, gold prices showed a positive performance with the following highlights, with gold future contract hitting +2.37% performance over the past 6 days, at $ 3,416 on Friday August 1.

Gold futures were trading around $3,399.80 per ounce at the close of the recent session, reflecting a gain of about 1.53% or $51.20 on the day.

Intraday, gold prices ranged between approximately $3,331.40 and $3,416.90 per ounce.

Earlier in the week on August 1, gold rose to about $3,362.51 per ounce, representing a daily gain of around 2.25% from the previous day, and hovered near the $3,350-$3,400 level through the week.

The overall price increase this week is influenced by factors including renewed trade uncertainties, weaker-than-expected US payrolls data boosting expectations for Federal Reserve rate cuts, and safe-haven demand amid geopolitical tensions.

Read also : Gold : Build Your Wealth and Freedom

Gold remains significantly higher year-over-year, with about a 34-35% increase compared to last year.

Market participants currently expect gold to trade in the $3,300 to $3,430 range near term, with forecasts anticipating a possible rise toward $3,530 within 12 months.

Read also : Tax Management strategies for Digital Nomads

Gold has a long history of maintaining its intrinsic worth regardless of economic turmoil or currency devaluation. Unlike paper money, which can lose value due to inflation or political instability, gold’s physical and enduring nature makes it a reliable store of wealth when other assets falter.

Read also : Five Good Reasons to Own Gold Now

Gold is a long-term store of value and this storage capacity is standardized internationally. Each troy ounce of gold has the same value. The yellow metal is an asset with intrinsic value in itself, capable of maintaining its purchasing power throughout the centuries and around the world.

To conclude, we can say that gold price demonstrated solid gains and safe-haven appeal in early August, supported by stock market uncertainty amid U.S. tariffs and dovish signals from US economic data and Fed policy expectations. The yellow metal is trading near recent highs within a range roughly between $3,330 and $3,420 per ounce for the week so far.

Our community already has nearly 150,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1675