By John Meyer, consultant in financial affairs – Eurasia Business News, August 4, 2025. Article no. 1676

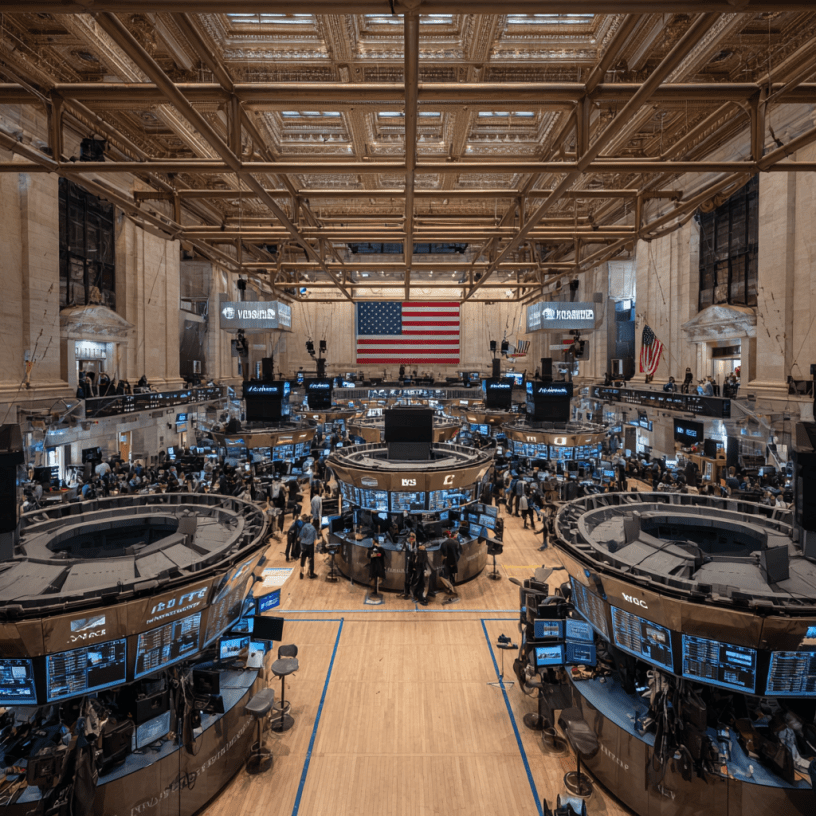

On Monday, August 4, the U.S. stock market experienced a strong rebound, with the Dow Jones Industrial Average gaining nearly 600 points—specifically, it soared by 585.06 points, or 1.3%, to close at 44,173.64. This rally was mirrored by the S&P 500, which climbed about 1.5%, and the Nasdaq Composite, which surged roughly 2%—its best performance since May.

Key Drivers of the Rally:

Fed Rate Cut Optimism: A weaker-than-expected July jobs report (only 73,000 jobs added) fueled expectations that the Federal Reserve might cut interest rates as soon as September. Traders are now pricing in strong odds (over 85%) of a September rate cut, and potentially more before the end of the year.

President Trump said late Sunday he will name this week successors for BLS Commissioner Erika McEntarfer and departing Fed governor Adriana Kugler. The surprise resignation of Biden appointee Kugler opens up a seat that Trump could fill with his intended successor to Fed Chair Jerome Powell.

Earnings Momentum: Major tech names like Nvidia, Microsoft, and Apple led the gains, with Nvidia up about 3% and Microsoft/Apple both reaching new highs. Over 80% of S&P 500 firms have beaten earnings forecasts, further boosting investor sentiment.

Political Factors: President Trump responded to the disappointing jobs data by firing the head of the Bureau of Labor Statistics, adding a layer of political intrigue to the economic backdrop. This move has heightened speculation about future Federal Reserve leadership and potential policy changes.

Sector Highlights:

Technology stocks, especially AI-related firms, were the day’s top performers.

Shares of companies like Idexx Laboratories surged after strong quarterly profits, while consumer discretionary and real estate stocks also rode the wave of optimism. Idexx Laboratories lifted its 2025 revenue outlook to a range between $4.21B and $4.28B compared to consensus of $4.15B and above the previous range between $4.10B and $4.21B.

Read also : How Russia is Reshaping Global Energy Markets

Market Context

This bounce followed a sharp sell-off the previous Friday, when all three major indices posted their worst weekly losses in months, driven by weak jobs data and escalating tariff news.

The Dow’s rise on Monday offset nearly all of Friday’s losses, signaling renewed investor confidence in a Fed policy pivot and the resilience of tech earnings leadership.

Read also : Gold : Build Your Wealth and Freedom

The Dow Jones’ gain of nearly 600 points reflects a U.S. stock market driven by interest rate cut expectations, strong tech sector earnings, and major shifts in economic and political leadership as the U.S. approaches a pivotal period for both monetary policy and broader economic management.

Our community already has nearly 150,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1676