By John Meyer, consultant in financial affairs – Eurasia Business News, August 4, 2025. Article no. 16854

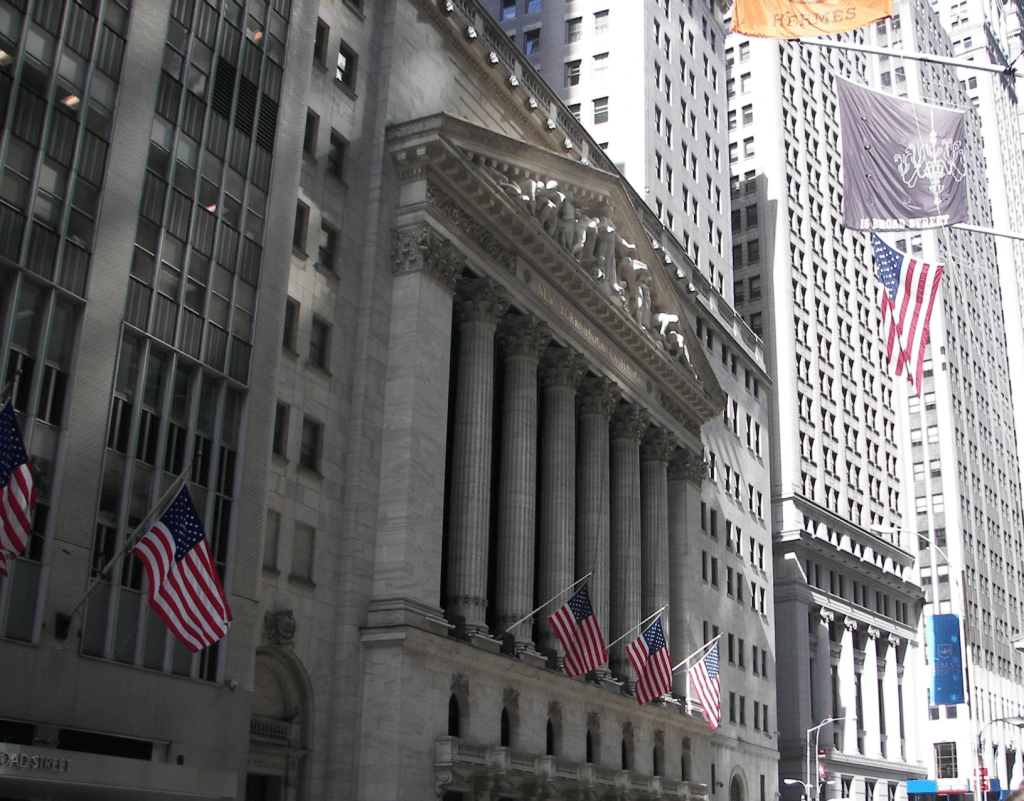

President Trump’s announcement of new tariffs on various imports, including semiconductors and pharmaceuticals, caused a significant drop in U.S. stock markets in early August 2025.

The Dow Jones Industrial Average fell about 530 to 540 points, approximately 1.2%, on August 5, 2025, following the announcement of weak July hiring data and new tariff hikes by the U.S. administration. This decline reflected market concerns over slower economic growth and the impact of tariffs on trade. The drop on that day was part of a broader market reaction where the S&P 500 dropped around 1.6% and the Nasdaq Composite slid over 2%.

The tariffs, planned to take effect around August 7, involve import taxes ranging from 10% up to 41% on goods from approximately 70 countries. This renewed wave of tariffs exacerbated market worries already heightened by a weaker-than-expected U.S. jobs report released simultaneously, which showed only 73,000 jobs added in July—below economists’ forecasts. These factors together spooked investors and led to sell-offs in equities, as they anticipated higher costs for businesses and slower economic growth ahead.

Globally, stock markets also faced pressure following these developments, with European and Asian indices falling. Markets experienced increased volatility amid uncertainty about the economic impact of these protectionist measures and the trajectory of U.S. trade policy.

President Trump’s tariff announcements on semiconductor, pharmaceutical, and other imports triggered notable declines in U.S. stock indices, including the Dow, as investors reacted to the potential disruptions from heightened global trade tensions amid already fragile economic signals.

Our community already has nearly 150,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1685