By John Meyer, consultant in financial affairs – Eurasia Business News, August 19, 2025. Article no. 1726

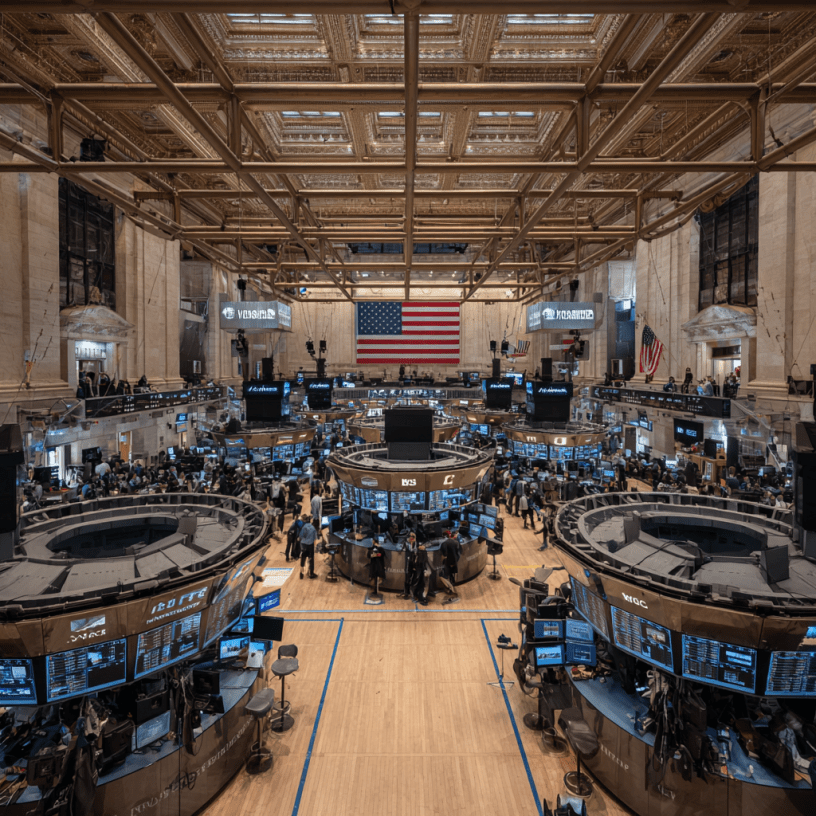

Wall Street began this week with major indexes sliding or staying flat as investors braced for a wave of retail earnings and looked ahead to the pivotal Federal Reserve symposium in Jackson Hole, scheduled for August 21–23. This pullback comes after recent gains, with the Dow having hit a record intraday high the previous Friday. However, uncertainty around corporate earnings, inflation, and monetary policy has kept equities in a narrow trading range.

The blue-chip Dow (DJI) was down 0.1%, while the benchmark S&P 500 (SP500) slid by 0.6% on the session and the tech-focused Nasdaq Composite (COMP:IND) has suffered the most as it is down by 1.4%.

Intel (INTC) stock experienced a significant rally today. The stock surged around 7.3% to $25.38, with intraday highs up to $26.53. This strong move was driven by the announcement of a $2 billion investment from SoftBank, which acquired a 2% stake in Intel. This boosted investor confidence in the company’s ongoing turnaround efforts and reinforced optimism about its position in AI and semiconductor manufacturing.

Over in the bond market yields have slipped. The longer-end U.S. 10-year Treasury yield (US10Y) is lower by 3 basis points to 4.30%, and the shorter-end U.S. 2-year Treasury yield (US2Y) moved down 3 basis point to 3.74%.

Retail sector in the spotlight

Retail giants such as Walmart, Home Depot, and Target are slated to report earnings this week, providing crucial insights into consumer sentiment and the broader economic climate. Recent economic data showed that, while retail sales remain broadly positive, consumer sentiment has deteriorated due to persistent inflation concerns.

Jackson Hole symposium’s significance

The symposium is regarded as the most important monetary policy event of the summer. Federal Reserve Chair Jerome Powell is anticipated to give guidance that could signal the central bank’s future rate policy. Investors are watching closely for hints about possible rate cuts or a shift towards a more dovish stance, as markets currently price in the possibility of a 25-basis-point cut next month.

Our community already has 155,000 readers, joins us !

Subscribe to our Telegram channel