By Alexander Miller, consultant in energy markets. Eurasia Business News, August 29, 2025. Article n°1734.

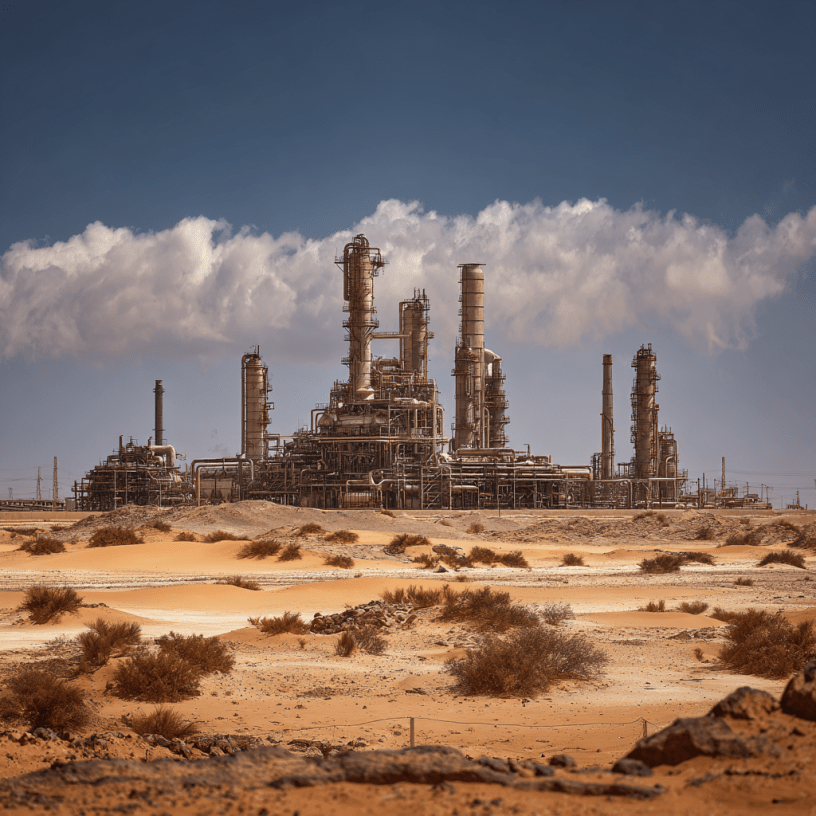

The oil deal between China and the Taliban has collapsed. The deal was a 25-year agreement signed in 2023 between the Taliban and China’s Xinjiang Central Asia Petroleum and Gas Company (CAPEIC) for the development of oil fields in Afghanistan’s Amu Darya basin, with China committing to invest $540 million annually in the first three years.

The collapse occurred amid mutual accusations of contract breaches. The Taliban accused the Chinese company of failing to meet investment commitments, not paying royalties on time, and neglecting key infrastructure and geological survey projects. Meanwhile, the Chinese side accused the Taliban of forcibly taking over the oil fields, expelling Chinese personnel at gunpoint, detaining Chinese workers, and confiscating their passports. The Taliban reportedly demanded the Chinese leave their equipment and transfer millions of dollars from a Kabul bank account to the Taliban.

Read also : How Russia is Reshaping Global Energy Markets

The oil fields were previously producing around 12,000 barrels of oil daily and were expected to generate significant revenue and jobs, but the dispute led to a halt in Chinese involvement, with the Taliban now managing the oil fields despite lacking technical expertise. This incident has strained relations but has not derailed the overall strategic relationship between China and the Taliban.

This situation reflects broader concerns about Chinese overseas investments, including issues of contract enforcement, project execution, and geopolitical complexities in unstable regions.

The Taliban retook power in Kabul and Afghanistan in August 2021, when the U.S. President Joe Biden announced unexpectedly that the U.S. troops were going to leave the country.

Our community already has 160,000 readers, joins us !

Subscribe to our Telegram channel