By William Collins, consultant in stock markets – Eurasia Business News, September 4, 2025. Article no 1768

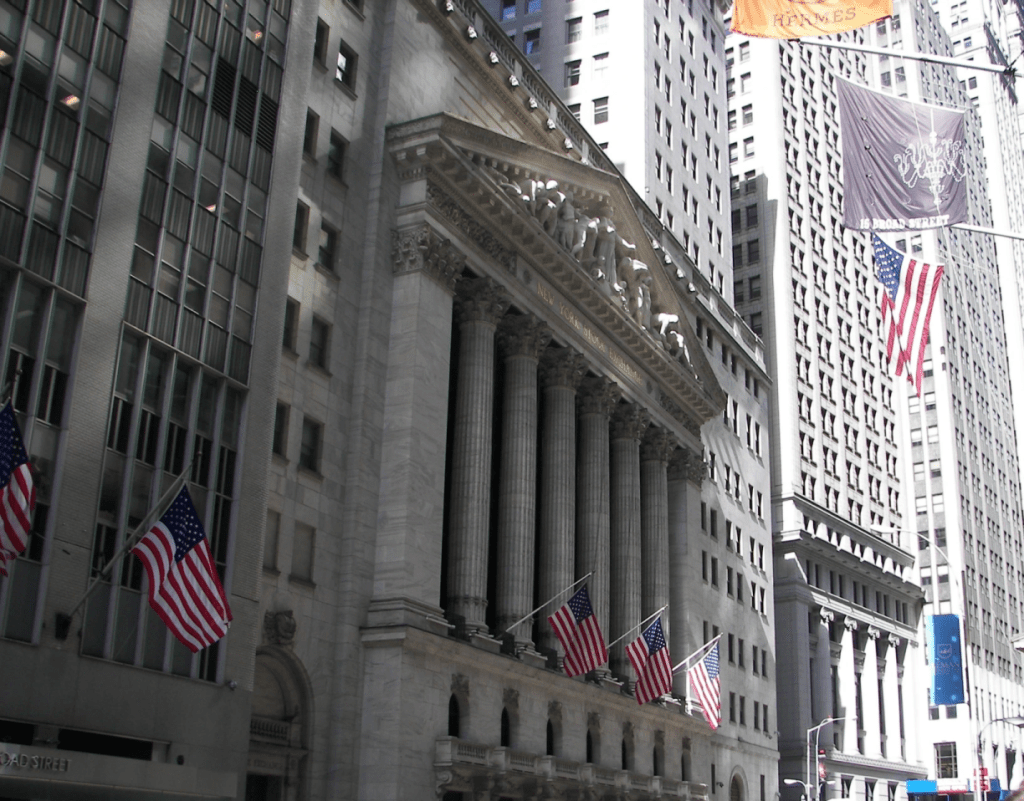

The U.S. stock market saw moderate gains with the S&P 500 rising about 0.56% to close near 6,484 points, edging closer to record highs, stocks are higher on fresh U.S. labor market data and with an eye toward Friday’s August jobs report.

The Nasdaq rose around 1%, led by strong performances in technology stocks such as Apple and Alphabet, which gained significantly. Meanwhile, the Dow Jones Industrial Average gained approximately 0.5% as well.

Market sentiment was cautiously optimistic, supported by expectations of the Federal Reserve cutting interest rates at its upcoming September meeting, amid signs of a weakening labor market with slower job growth and rising unemployment claims. Consumer discretionary was the top-performing sector, while energy and materials lagged.

This positive momentum coincided with growing investor confidence following Stephen Miran’s nomination as a Fed Governor, with markets watching closely for the central bank’s policy direction.

Miran, chairman of the Council for Economic Advisers, was on Capitol Hill as the Senate weighed his nomination to fill an empty seat on the Fed’s board of governors. He told the Senate Banking Committee Thursday that if confirmed, “I will act independently as the Federal Reserve always does.” In his opening statement, Banking Committee Chair Tim Scott didn’t address Trump’s attempt to remove Lisa Cook from the Fed’s board.

Gold futures opened around $3,620 per ounce, maintaining levels above $3,600 despite a modest intraday pullback. The spot price closed near $3,557 per troy ounce, slightly down about 0.4% from the previous day but still close to all-time highs reached earlier in the week. Gold has surged over 35% year-to-date, fueled by safe-haven demand amid geopolitical tensions and expectations of Federal Reserve interest rate cuts.

Read also : Gold : Build Your Wealth and Freedom

Silver prices also retreated slightly, closing around $41.29 per ounce, down nearly 1.8% for the day. However, silver has posted strong gains of over 40% year-to-date, driven by industrial demand and inflation hedging.

Our community already has 160,000 readers, joins us !

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1768