By William Collins, consultant in stock markets – Eurasia Business News, September 24, 2025. Article no 1804

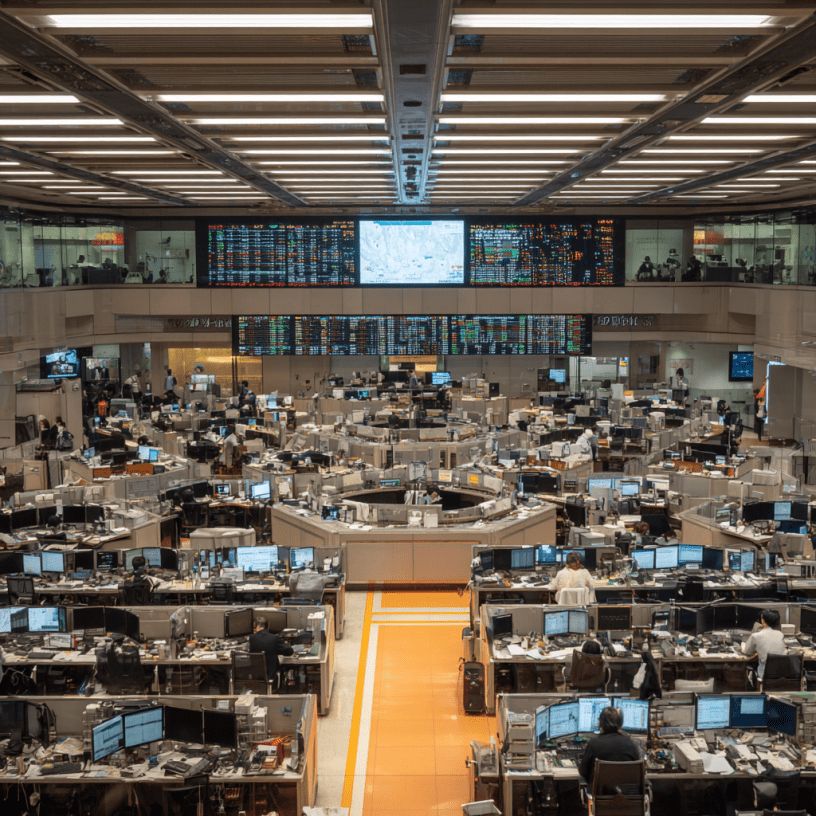

Asian stock markets saw mixed performances on September 24, with a notable boost from Chinese tech shares—particularly Alibaba—while other markets remained cautious due to U.S. Federal Reserve signals and external pressures.

Major Index Performances

- MSCI Asia Pacific Index: Down 0.1%, improving from earlier steeper losses as Chinese tech rallied.

- Shanghai Composite (China): Closed up 0.83% at 3,853.64, supported by surging semiconductor and tech stocks.

- CSI 300 (China): Rose 1.02% to end at 4,566.07, reflecting momentum in the broader Chinese market.

- Hong Kong Hang Seng: Closed up 1.37% at 26,518.65, driven by Alibaba’s 7.2% rally and semiconductor optimism.

- Japan: Markets were closed for a public holiday; previous sessions reflected caution.

- India (BSE Sensex): Fell by 386 points to close at 81,715, while NSE Nifty dropped 112 points to 25,056, both down for a fourth consecutive session amid concerns over U.S. policy and visa issues.

- Australia and South Korea: Both saw declines, with risk-off sentiment lingering amid mixed Fed signals.

Chinese tech stocks led a late-session rebound across Asia, highlighted by Alibaba’s significant AI investment announcement, which also helped other semiconductor names surge.

Equity sentiment elsewhere remained muted due to uncertainty about U.S. interest rate policy and global economic outlook.

Read also : Tax Management strategies for Digital Nomads

Increased volatility due to Typhoon Ragasa kept Hong Kong’s trading volumes reduced, despite the overall market gain.

Overall, Asian stock markets reversed earlier losses with strength from China’s tech sector but remained cautious in most regions, reflecting ongoing global economic uncertainty.

Our community already has 160,000 readers, joins us !

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1804