By William Collins, consultant in stock markets – Eurasia Business News, October 6, 2025. Article no 1819

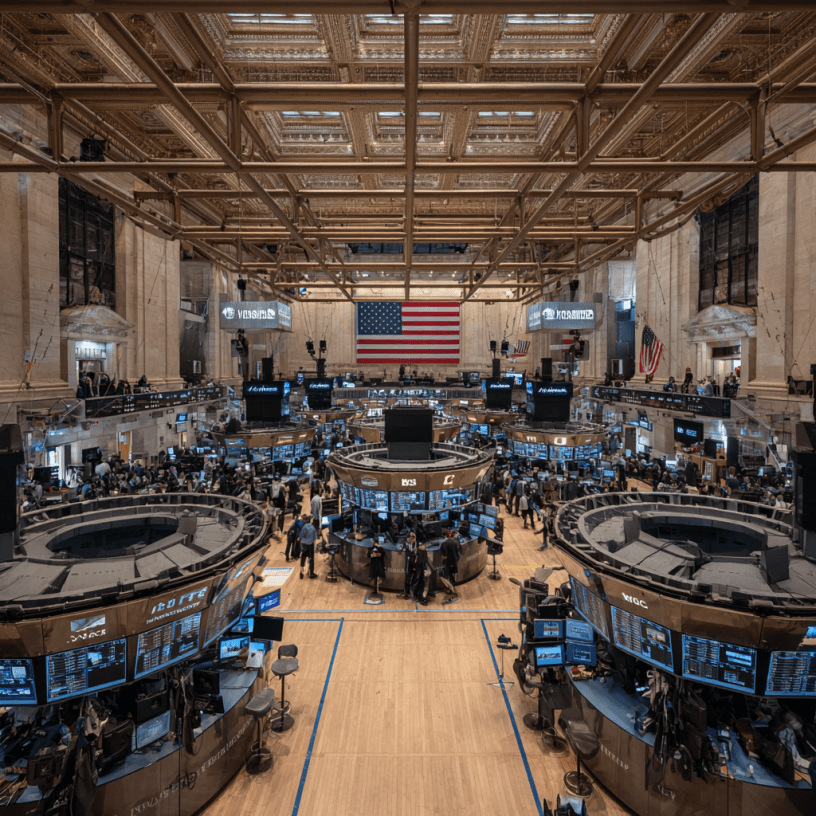

The Nasdaq rose 0.7% to a new all-time high, largely driven by a sharp rally in Advanced Micro Devices (AMD) shares, which surged over 23% following news of a major multi-year AI chip supply deal with OpenAI. Under the agreement, OpenAI will deploy up to 6 gigawatts of AMD GPUs over several years starting in the latter half of 2026. The partnership also gives OpenAI the option to acquire roughly a 10% stake in AMD as milestones are met. This deal is expected to generate tens of billions of dollars in annual revenue for AMD and strengthens AMD’s position as a key AI chip supplier, competing more directly with Nvidia.

The broader stock market saw the S&P 500 rise 0.4% to another record high, while the Dow Jones dipped slightly.

Gold prices remained strong, closing near $4,000 per ounce, fueled by rate-cut optimism and geopolitical uncertainties. The gold price rose by approximately 1.9% today and was up nearly 50% year-to-date. This marks one of the highest levels gold has ever reached, just shy of the $4,000 milestone.

Silver prices on the same day closed around $48.55 per ounce, up about 1.16%, and have appreciated over 53% year-to-date. The gains in silver also reflect its safe-haven appeal amid uncertain economic and political conditions.

Read also : Gold : Build Your Wealth and Freedom

Bitcoin also rallied, contributing to a general risk-on sentiment in the market, supported by optimism about easing monetary policy and AI-driven growth.

In Japan, stocks surged and the yen sank, after Sanae Takaichi was elected leader of Japan’s ruling party. Her victory raises the prospect of a freer-spending Japanese government and looser-than-expected monetary policy.

The European stock markets saw a slight decline following record highs the previous week. The STOXX Europe 600 index fell by about 0.05%, closing around 570.16 points, while the Euro STOXX 50 dipped approximately 0.41% to close near 5628.28 points. The market pullback was influenced by political uncertainty in France with the resignation of the French Prime Minister Sébastien Lecornu just weeks after taking office, raising concerns over budget plans and government stability. French equities notably underperformed, with major companies like LVMH, Hermès, L’Oréal, AXA, BNP Paribas, and Vinci posting losses.

Read also : Tax Management strategies for Digital Nomads

Conversely, some sectors such as technology and energy limited the overall decline, with shares of companies like ASML Holding, BP, Glencore, and Thyssenkrupp showing gains. Despite the slight fall on the day, the Euro STOXX 50 index remained up 13.26% year-over-year and 4.97% over the past month, reflecting underlying strength in the region’s markets amid ongoing macroeconomic and geopolitical uncertainties.

Our community already has 170,000 readers, joins us !

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1819