By William Collins, consultant in stock markets – Eurasia Business News, November 4, 2025. Article no 1880

Asia remains the key engine for emerging market growth in 2025, with sustained but slightly moderated expansion expected across the region. China retains its role as an innovation hub despite near-term economic slowdown risks, aided by government stimulus and a focus on strategic sectors like digital technology and green energy. India continues to accelerate with robust demographics, urbanization, and ongoing reforms supporting its strong growth trajectory. Southeast Asian countries such as Indonesia, Vietnam, and the Philippines also contribute meaningfully, driven by digital transformation, young populations, and expanding middle classes.

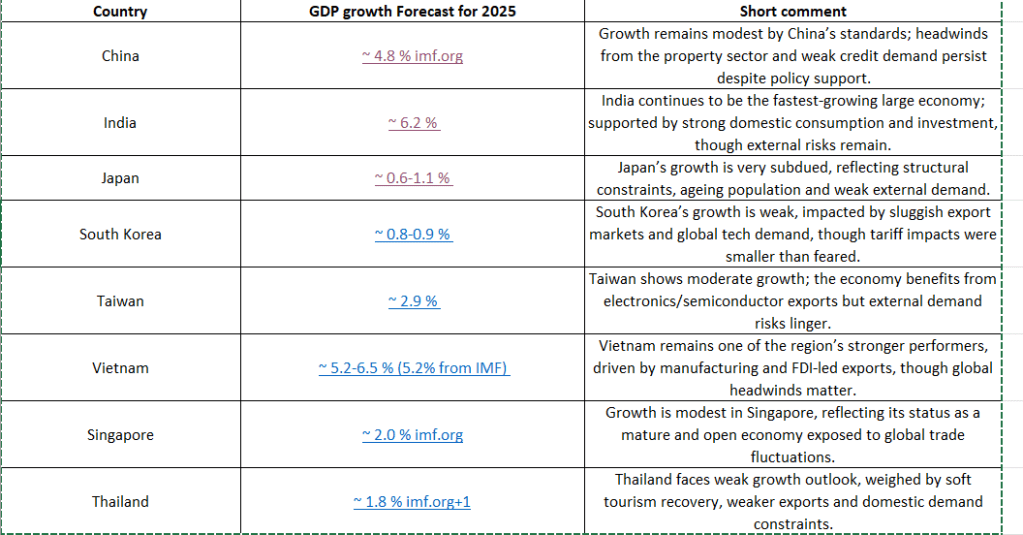

Economic growth rates in Asia are forecast to range mostly between 4% and 6%, with India leading at around 6.2%, China around 4.2%, and ASEAN nations about 4.3%. This growth is supported by a mix of domestic demand expansion, regional supply chain integration, and ongoing investment in technology and infrastructure. Investors are showing renewed interest given the region’s improving fundamentals and prospects for earnings growth through diversification into technology, consumer goods, and financial services.

Read also : 7 ways to retire comfortably with $1 million

For long-term investment strategies, Asia’s dynamic growth markets represent opportunities to tap into tech-led innovation, rising consumption, and demographic dividend advantages. However, cautious stock and sector selection remain important due to geopolitical uncertainties and evolving trade landscapes. Active management and diversified exposure to key economies like China and India, alongside fast-growing Southeast Asian markets, are prudent approaches to optimize returns in this evolving environment.

Forecasts derive from latest IMF World Economic Outlook April/July 2025 (and other institutional sources) and are subject to revision.

Some of these Asian economies face downside risks: global trade tensions, supply-chain disruptions, weak external demand, structural/debt issues.

The spread between higher-growth (India, Vietnam) and slower-growth (Japan, Korea, Thailand) economies reflects differences in structural dynamics, maturity of the economy and exposure to global headwinds.

However, Asia is reaffirming its position as the core of global emerging markets, with resilient and sustained growth prospects.

Read also : Gold : Build Your Wealth and Freedom

China, the second-largest economy in the world, with a GDP of approximately 18.74 trillion dollars as of 2024, is driving innovation, India is accelerating its economic momentum, and investors are returning to the region — a structural trend that could reshape long-term investment strategies worldwide.

Attracting foreign investors

Across the region there is clear momentum: governments are actively competing for foreign capital, focusing more on high-value industries such as tech, services, green/clean manufacturing and supply-chain diversification.

The typical tool-kit includes: opening-up of previously restricted sectors, targeted subsidy or grant facilities, creation of special zones or regulatory sandboxes, efforts to improve business-environment (language, procedures, investor services).

Read also : Tax Management strategies for Digital Nomads

Investors evaluating opportunities should consider not just incentives, but also infrastructure, market access, labour-skills, regulatory stability and the country’s role in regional/global supply chains. Vietnam announced it will introduce a new 10-year golden visa program.

For long-term strategy, countries which combine size + growth potential + openness + innovation orientation will likely offer stronger structural value (e.g., China, India, Vietnam). Meanwhile, developed Asian economies (Japan, Singapore, Korea) offer stability, sophistication and strategic risk-diversification potential.

Read also : Why Digital Nomads love living in Da Nang, Vietnam ?

Our community already has 175,000 readers, joins us !

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1880