By John Meyer, consultant in financial affairs – Eurasia Business News, November 25, 2025. Article no 1915

U.S. mortgage rates did edge down going into the Thanksgiving holiday, but only by a small amount, and they remain just above 6% for typical 30‑year loans. The move reflects easing inflation and expectations of further Federal Reserve rate cuts, but not a dramatic shift in borrowing costs yet.

Where rates stand now

The average 30‑year fixed‑rate conforming mortgage is around 6.2% nationally, down only a few basis points from the prior week, while typical 15‑year fixed rates are in the mid‑5% range. Weekly data also show the widely followed 30‑year average ticking down from about 6.26% to roughly 6.23% into the Thanksgiving week.

Why they’re easing

Softer inflation readings and a cooling labor market have increased expectations that the Federal Reserve will trim policy rates again, pulling long‑term Treasury yields and mortgage rates slightly lower. At the same time, lenders have already priced in much of this outlook, so changes day to day are modest rather than sharp drops.

What this means for borrowers

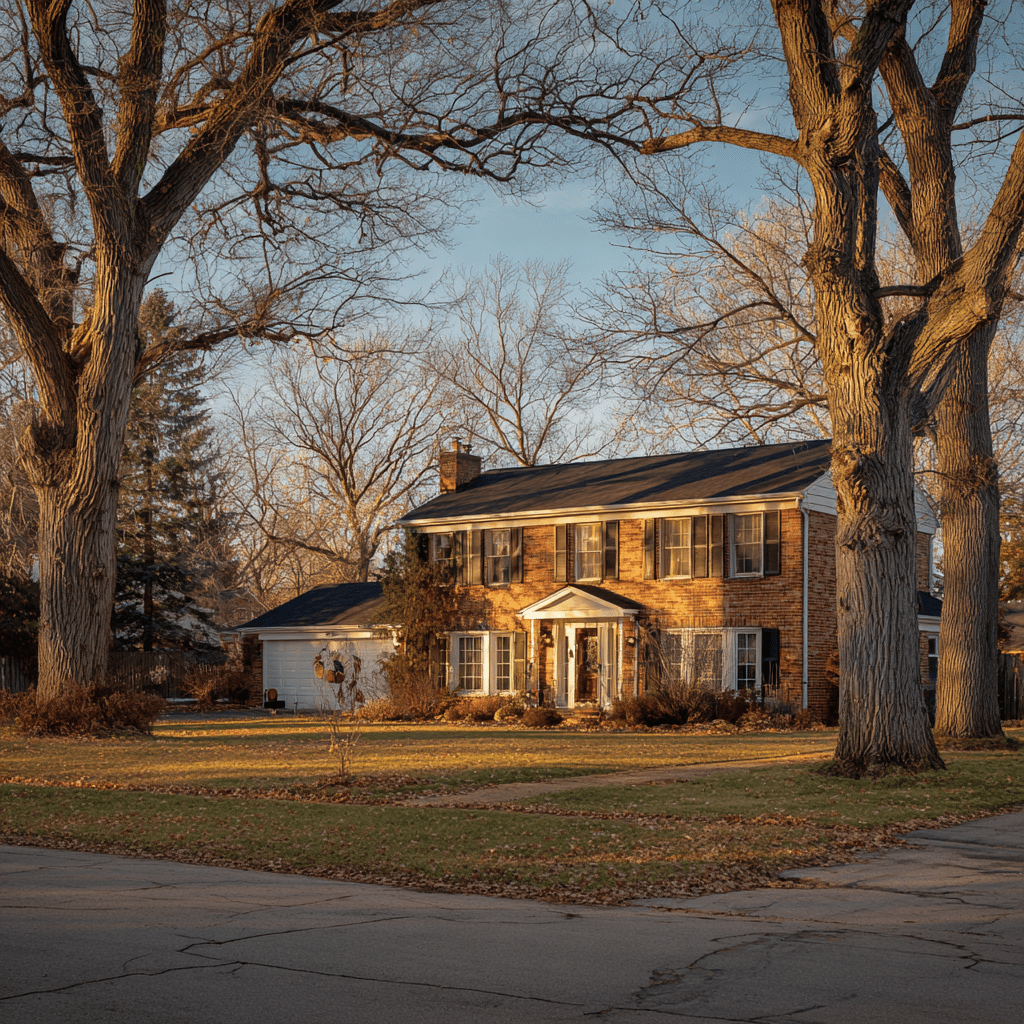

For buyers in the U.S. housing market, the dip improves affordability a bit compared with earlier in 2025 when many quotes were well above 7%, but monthly payments are still far higher than during the ultra‑low‑rate era. Borrowers considering locking a rate around Thanksgiving are effectively betting that any further declines will be gradual, not a sudden plunge, so decisions should focus on whether current payments fit their budget rather than waiting for a large, uncertain move lower.

Our community already has 190,000 readers, joins us !

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1915