By William Collins, investor and consultant – Eurasia Business News, November 27, 2025. Article no. 1917

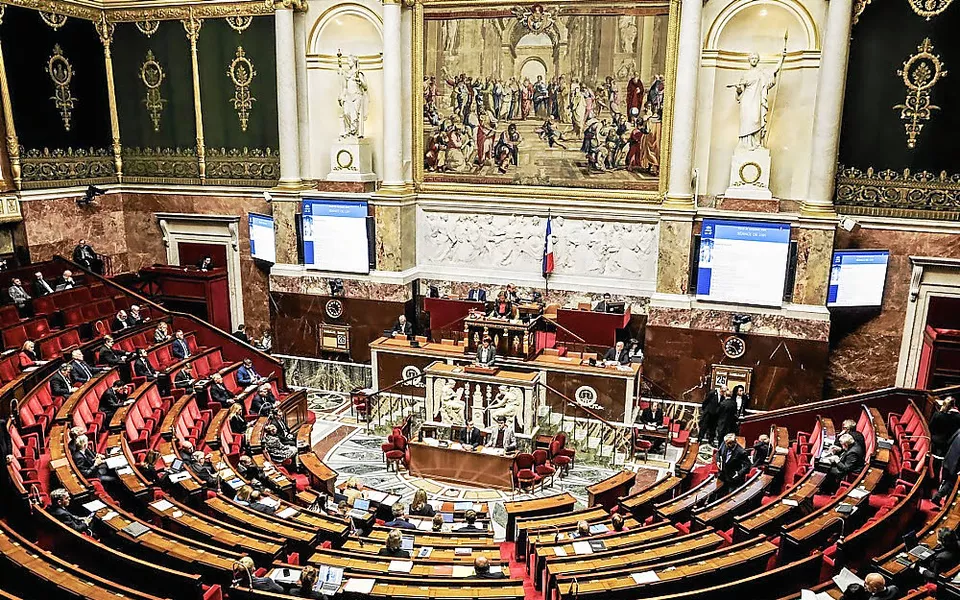

The “forced loan” proposal to help funding the French state budget for 2026, put forward by three Socialist senators, would require the richest households to provide interest-free loans to the state as a way to contribute to budgetary recovery.

This measure, inspired by a similar mechanism used in 1983 under the socialist president François Mitterrand, targets around 20,000 wealthy households and aims to raise about €6 billion in 2026 without raising tax rates. The loan would be repayable over three years and deducted from future tax bills, effectively turning wealthy taxpayers into short-term lenders to the state without cost to the government.

The proposal has met strong opposition from the government and Senate majority. The Economy Minister Roland Lescure publicly opposed it, saying it would not send a positive message and France “does not need” such a forced loan.

Centrist and Republican senators in the Senate also reject the measure, with some describing it as a postponement of the problem rather than a real solution.

Critics warn it could have negative economic effects such as diverting capital from investments and stifling growth. The measure’s future is uncertain as it faces tough debate and opposition in the Senate.

Read also : Gold : Build Your Wealth and Freedom

This initiative arises amid France’s high public debt level (3,400 billions € or 115% of GDP) and ongoing budget challenges faced by Prime Minister Sébastien Lecornu’s minority government.

Supporters see it as a solidarity tool that avoids permanent tax hikes while bridging immediate funding gaps for social spending and debt servicing. However, the debate remains polarized between those advocating for stronger fiscal measures on the wealthy and those fearing adverse economic and political impacts.

Read also : Tax Management strategies for Digital Nomads

In 2024, the tax burden in France amounted to 42.8% of GDP according to INSEE. This rate varies according to the source, Eurostat placing it at 45,3 % for 2024, which positions France second in Europe. This distinction is explained by the fact that the INSEE rate excludes imputed social contributions and tax credits, while the Eurostat rate includes all compulsory levies. The EU average for tax burden in 2022 was 41.1% of GDP.

Read also : 7 ways to retire comfortably with $1 million

France’s richest individuals have shown increased emigration in 2025 amid debates over tax hikes, including the “forced loan” proposal and wealth taxes like the Zucman tax, prompting more and more French millionaires to relocate for lower-tax jurisdictions. Reports indicate 2025 marks a year of “exode” (exodus) for millionaires, reversing a 2023 influx from Brexit, with wealthy households seeking destinations like Belgium, Switzerland, or the UAE to avoid potential levies on high earners and assets.

Our community already has 190,000 readers, joins us !

Subscribe to our Telegram channel