By Alexander Miller, consultant in energy markets. Eurasia Business News, January 4, 2026. Article n°1968

Oil markets are likely to see heightened volatility and some upward price pressure in the short term after the U.S. capture of Venezuelan President Nicolás Maduro, mainly because traders are repricing geopolitical risk and uncertainty around Venezuela’s future exports.

Why volatility is rising

The sudden removal of Maduro and U.S. military action on January 3 introduce political and security risks, including fears of civil conflict, sanctions shifts, or disruption to oil operations and shipping from Venezuela.

Markets are reacting to a wider geopolitical shock in a country that holds the world’s largest proven oil reserves, so even modest near‑term supply questions can trigger sharp moves in futures and spreads.

Why the supply shock may be limited for now

Venezuela currently produces well under 1 million barrels per day, less than 1% of global supply, so immediate physical loss to the market is relatively small even if some exports are temporarily disrupted.

Read also : Gold : Build Your Wealth and Freedom

Analysts note that if infrastructure remains intact and a transition eventually enables more investment and sanctions relief, Venezuela’s output could rise over time, which would act as a medium‑term brake on prices rather than a sustained bullish shock.

Read also : How Russia is Reshaping Global Energy Markets

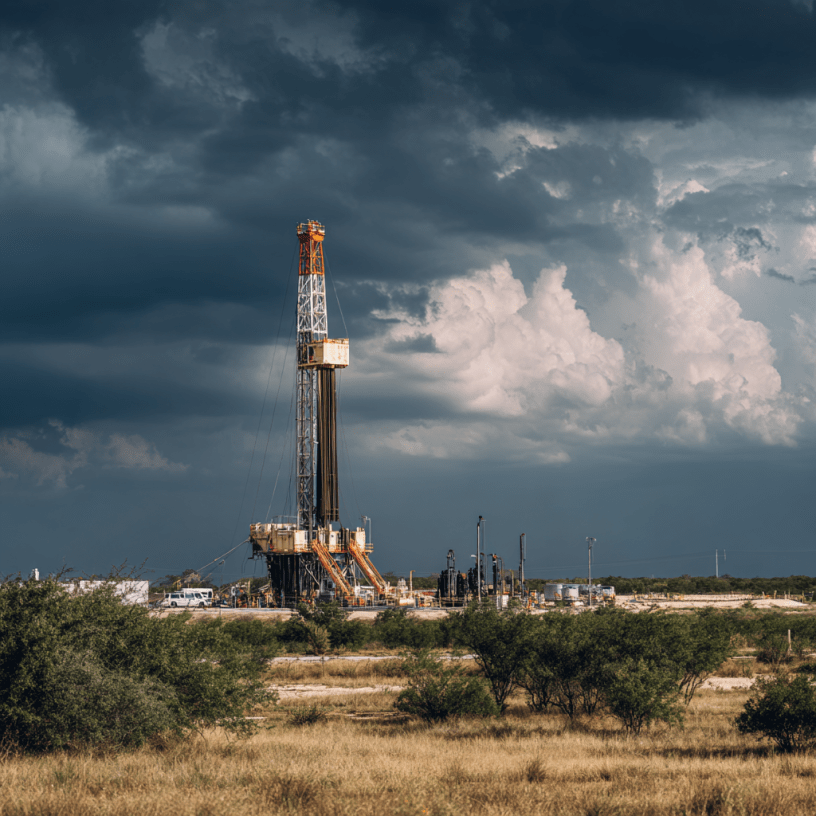

Venezuela has the world’s largest proven crude oil reserves, at roughly 303 billion barrels, equal to about 17–20% of global reserves. These reserves are largely extra‑heavy crude concentrated in the Orinoco Belt, which makes extraction and processing more complex and capital‑intensive than many Middle Eastern light crudes. However, the U.S. oil extraction companies have the technology and the funds to extract this extra‑heavy crude.

Our community already has nearly 200,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1968