By William Collins, consultant in stock markets – Eurasia Business News, January 5, 2025. Article no 1970

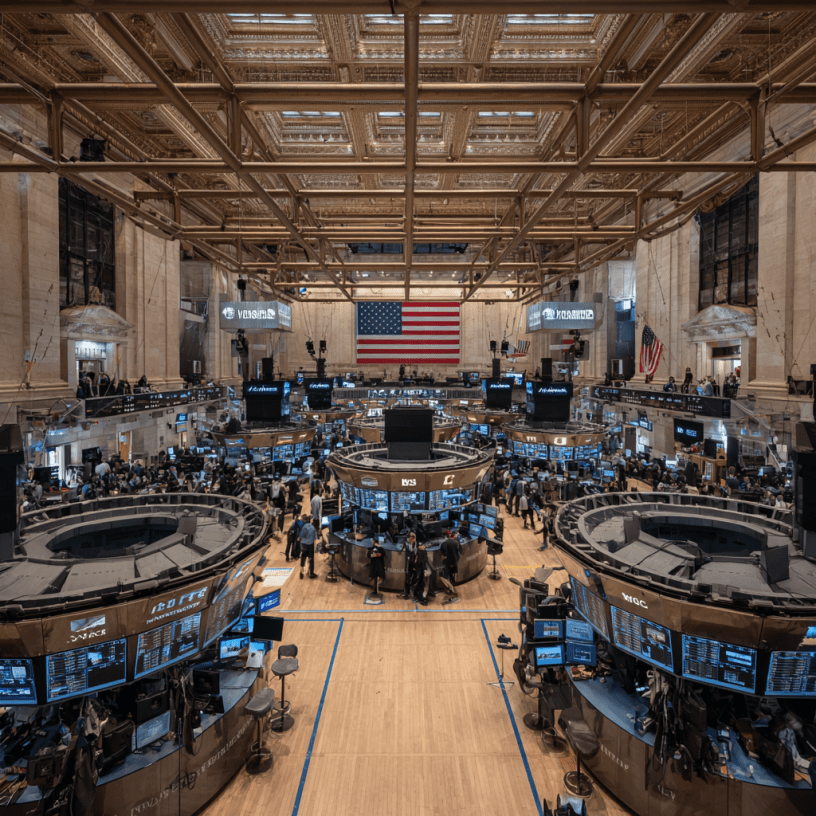

U.S. stock markets rallied strongly on January 5, with the Dow, Nasdaq, and S&P 500 surging after U.S. forces captured Venezuelan President Nicolás Maduro over the weekend. Oil stocks led the gains amid expectations of U.S. investment in Venezuela’s energy sector, while tech optimism added to the momentum.

The Dow Jones Industrial Average gained around 700 points, or 1.4%, reaching above 49,000 for the first time, closing at 49,072.

The S&P 500 rose about 0.8%, and the Nasdaq Composite jumped roughly 0.9-1.0%.

Key Drivers

Oil companies like Chevron, Halliburton, and SLB jumped 5-9% as crude prices rose, with West Texas Intermediate futures, the U.S. crude oil benchmark, rose 1.6% Monday to $58.25 per barrel, while shares of Chevron (CVX), the only U.S.-based oil company currently active in Venezuela, advanced nearly 6% to pace the Dow.

President Trump stated the U.S. would manage Venezuela temporarily to enable reconstruction and oil investments in the giant oil fields of the country.

Venezuela has the world’s largest proven crude oil reserves, at roughly 303 billion barrels, equal to about 17–20% of global reserves. These reserves are largely extra‑heavy crude concentrated in the Orinoco Belt, which makes extraction and processing more complex and capital‑intensive than many Middle Eastern light crudes. However, the U.S. oil extraction companies have the technology and the funds to extract this extra‑heavy crude.

In addition, the prospect of greater geopolitical tensions in Latin America, Greenland and Asia lifted global defense stocks.

The 10-year Treasury yield, which influences interest rates on a variety of commercial and consumer loans, fell to roughly 4.16% from Friday’s close around 4.19%.

Tech and crypto reaction

Investors shrugged off initial geopolitical concerns, focusing on limited disruptions and AI-driven tech rebounds, with Bitcoin also surpassing $93,000.

Bitcoin dropped about 0.5% to around $89,300-$89,600 shortly after President Trump’s announcement of the military strike and capture, then rebounded to near $90,000-$91,000 within hours, showing strong support levels. This muted reaction—compared to sharper moves in prior crises—highlighted Bitcoin’s maturation as a 24/7 global asset that repriced the event without panic liquidations. By January 4-5, it held above $90,000 amid neutral-to-bullish sentiment shifts.

Ethereum slipped from $3,000 to $2,900 before recovering, while XRP dipped near $1.90 and stabilized; both mirrored Bitcoin’s pattern without sustained sell-offs. Broader crypto markets faced volatility but demonstrated adaptability, with analysts noting limited economic spillover from Venezuela’s instability despite its high crypto adoption ranking.

Gold and silver prices

Gold and silver prices surged significantly, driven by heightened safe-haven demand following the U.S. capture of Venezuelan President Nicolás Maduro.

Read also : Gold : Build Your Wealth and Freedom

Gold futures opened around $4,368 per ounce, up 0.9% from the prior close, and climbed above $4,400 during early trading, marking gains of up to 2.3% intraday.

Silver futures also rallied sharply, rising over 5% to levels near $76 per ounce.

Gold hit intraday highs around $4,467 while silver reached approximately $77.81, reflecting strong buying amid geopolitical tensions from the U.S. operation in Venezuela. These gains occurred despite a strengthening U.S. dollar, underscoring gold’s appeal as a safe-haven asset during the event. Year-to-date, both metals had already posted massive advances, with silver up over 147%.

Geopolitics

The U.S. military action apprehended the Venezuelan president Maduro on charges including drug trafficking, funding terrorism and weapons smuggling, prompting backlash from nations like Russia and Iran while the U.S. President Trump announced U.S. oversight of Venezuelan oil. Markets repriced risks tied to U.S. unpredictability and Latin American instability, boosting precious metals demand. Spot gold peaked near $4,433 early that day before some pullback.

Read also : Tax Management strategies for Digital Nomads

Our community already has nearly 200,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1970