By Swann Collins, investor, writer and consultant – Eurasia Business News. January 7, 2025. Article no 1978

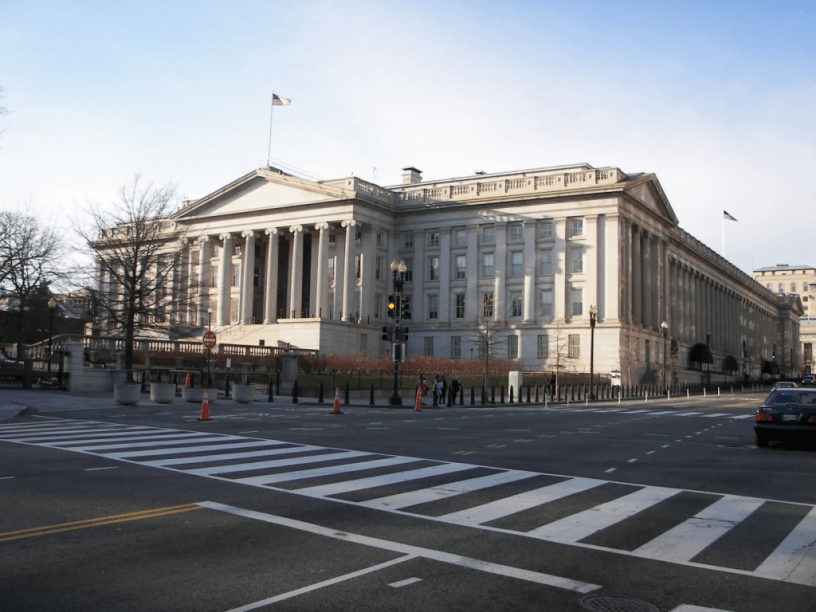

US Treasury building in Washington D.C., United States. Photo credit : Eurasia Business News.

U.S.-based multinational groups will not have to pay the 15% top‑up under the OECD’s Pillar Two global minimum tax rules; instead, they remain subject only to U.S. minimum tax provisions under a new “side‑by‑side” arrangement.

What the OECD deal changes

Nearly 150 countries in the OECD/G20 Inclusive Framework agreed to modify the global minimum tax so that U.S.-headquartered multinationals are carved out of Pillar Two’s core enforcement tools, including the income‑inclusion and undertaxed‑profits rules.

The framework is recast as a parallel system in which countries that, like the U.S., run their own worldwide minimum‑tax regimes can treat those domestic rules as satisfying Pillar Two’s objectives.

U.S. government position

The Trump administration argued that the original Biden‑era agreement infringed on U.S. tax sovereignty and threatened American competitiveness, and pressed partners to accept that U.S. firms would only be governed by U.S. law on their global income.

U.S. Treasury Secretary Scott Bessent hailed the outcome as preserving U.S. control over its corporate tax base and protecting domestic incentives such as research and development credits from being neutralized by foreign top‑up taxes.

Criticism and risks

Tax‑justice and transparency advocates warn the carve‑out undermines the original purpose of the global minimum tax by allowing large American groups to continue shifting substantial profits to low‑tax jurisdictions.

Read also : Tax Management strategies for Digital Nomads

They argue the change weakens efforts to end the “race to the bottom” in corporate taxation and could reduce expected global revenues from clamping down on profit‑shifting.

Our community already has nearly 200,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1977