By William Collins, consultant in stock markets – Eurasia Business News, January 8, 2025. Article no 1979

The Dow Jones Industrial Average rose while the S&P 500 and Nasdaq finished lower on January 8 trading day, reflecting a rotation out of technology and into defense shares. The pattern fits a market reacting to both sector‑specific news and shifting interest‑rate and growth expectations. Oil prices gained today, while gold and silver prices were stable.

Trading reflected a pause in the early‑year rally as investors rotated out of big technology names and into more defensive and cyclical areas, including defense stocks boosted by budget headlines.

Dow Jones Industrial Average: Rose roughly about 0.5% in afternoon trade, supported by gains in non‑tech components such as industrials, financials, and defense‑linked names.

S&P 500: Was modestly lower (around 0.1–0.3%) as losses in large tech and some rate‑sensitive sectors offset strength in defense and select cyclicals.

Nasdaq Composite: Traded down on the day as investors took profits in mega‑cap technology after a strong early‑year rally and digested softer labor‑market data

Sector and thematic drivers

Defense and aerospace shares outperformed, rallying after President Donald Trump called for a steep increase in the U.S. defense budget, which lifted expectations for future military spending.

Some rate‑sensitive and economically cyclical groups saw choppy trading as investors digested fresh labor‑market data and reassessed how quickly the Federal Reserve may adjust interest rates in 2026.

Market tone and context

Futures and intraday trading suggested the early‑January rally was losing momentum, with traders locking in profits after strong gains to start the year.

Volatility remained contained and there were no signs of panic selling, indicating a normal consolidation phase rather than the start of a sharp downturn

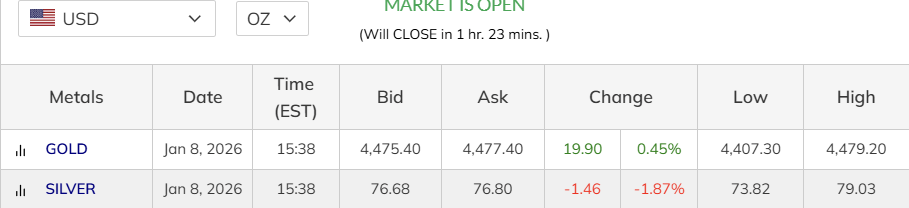

Gold price stable

Gold traded around 4,470 USD – 4,480 USD per troy ounce during January 8, a small gain (roughly 0.45%) from the prior day.

The move was framed as a mild pullback or consolidation after a powerful multi‑month rally driven by geopolitical risk and expectations for easier monetary policy.

Mounting geopolitical risks and rising debt could push gold prices as high as $5,050 per ounce in the first half of 2026, but this could also mean a more significant pullback in the second half, according to analysts at HSBC.

Read also : Gold : Build Your Wealth and Freedom

Silver price

Silver prices were roughly in the mid‑70s USD per ounce intraday on January 8, slipping on the day in tandem with gold after recent sharp gains.

Commentators noted that silver remained far above year‑earlier levels and more volatile than gold because of its dual role as both a precious and industrial metal.

Bitcoin price

Bitcoin traded with intraday swings on January 8, consolidating after a strong advance in late 2025 and early 2026; on the day, it was roughly flat to slightly lower versus the previous close, depending on the exchange and reference time. Bitcoin price slightly fell to 90,564.43, down 0.34%. Nothing critical.

Market coverage tied the choppy action to shifting expectations for interest‑rate cuts and ongoing flows into and out of crypto‑related investment products.

Crude oil

Crude Climb Nearly 2% as Venezuela Uncertainty Keeps Traders on Edge. Today’s trading range for Crude Oil WTI futures is between 55.98 and 58.00 USD per barrel.

Analysts attributed the muted move to a balance between geopolitical supply concerns and softer‑than‑expected economic data that weighed on the demand outlook;.

Venezuela is currently producing on the order of about 1 million barrels of oil per day, which translates to roughly 365 million barrels per year when annualized. This is only a fraction of its historical output of more than 3 million barrels per day in the 1990s and early 2000s.

Read also : Tax Management strategies for Digital Nomads

Different sources quote daily production between roughly 0.8 and 1.0 million barrels per day around late 2025 and early 2026, implying an annual range of roughly 290–365 million barrels per year.

Our community already has nearly 200,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 1979