By William Collins, consultant in stock markets – Eurasia Business News, January 28, 2026. Article no 2015

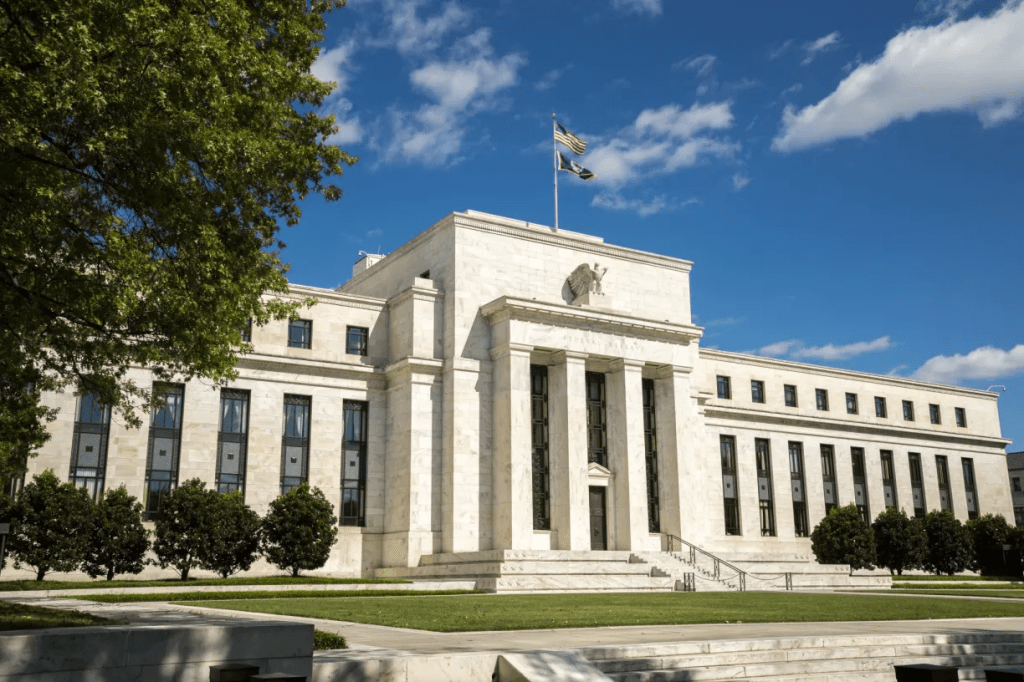

The Federal Reserve kept interest rates unchanged at its January 28 meeting, holding the target range for the federal funds rate at 3.5% to 3.75% and pausing its recent series of cuts.

“Available indicators suggest that economic activity has been expanding at a solid pace. Job gains have remained low, and the unemployment rate has shown some signs of stabilization,” the central bank said in its post-meeting statement. “Inflation remains somewhat elevated.”

What the Fed decided

Policymakers voted to leave the benchmark federal funds rate at 3.5%–3.75%, ending a run of three consecutive 0.25‑point cuts in September, October, and December 2025.

This is the first meeting since July in which the Fed has not changed rates, marking a clear shift from the late‑2025 easing cycle to a “wait‑and‑see” stance.

The decision was not unanimous: at least two officials, including Governor Christopher Waller and Governor Stephen Miran, dissented in favor of another 0.25‑point cut.

Why the Fed paused

The Fed upgraded its view of the economy, describing growth as solid and dropping earlier language that emphasized risks to the labor market, suggesting less fear of imminent job weakness.

Inflation has come down from its 2022 peak but is still running closer to 3% than the 2% target, leading many officials to worry that additional cuts could reignite price pressures.

With unemployment relatively stable and prior cuts still working through the economy, the committee signaled it would base future moves on incoming data rather than continue a preset easing path.

Political backdrop and next steps

The meeting comes amid escalating pressure from President Donald Trump, who has repeatedly demanded faster and deeper rate cuts and is in the process of choosing Jerome Powell’s successor when his term ends later in 2026.

Powell, in one of his last press conferences as chair, emphasized the Fed’s dual mandate and independence, while offering little specific guidance beyond keeping options open for a possible cut later in the year, with markets focusing on June as a likely window.

Our community already has nearly 205,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2026 – Eurasia Business News. Article no. 2015