By Swann Collins, investor and consultant in international affairs – Eurasia Business News, January 28, 2026. Article no. 2014

For more than a decade, I have advised U.S. citizens, entrepreneurs, executives, investors, and families who live outside the United States — in Europe, Asia, the Middle East, and Latin America. Despite their talent and wealth, many are still surprised by one fundamental reality of U.S. law:

If you are a U.S. citizen, you remain subject to U.S. federal income tax on your worldwide income — no matter where you live.

As the 2026 tax declaration period approaches (covering 2025 income), it is critical for wealthy Americans abroad to understand not only what must be filed, but how to file strategically, compliantly, and efficiently.

This article explains the rules, common pitfalls, planning opportunities, and recent enforcement trends — in plain language, but with the precision you would expect from an experienced tax attorney.

1. Citizenship-Based Taxation: The Cornerstone of the U.S. System

The United States is one of the very few countries in the world that taxes based on citizenship rather than residence. Alongside Eritrea, it stands alone in this approach.

What this means in practice

If you are:

- A U.S. citizen, or

- A lawful permanent resident (green card holder),

you are required to file a U.S. federal income tax return (Form 1040) every year if your worldwide gross income meets or exceeds the filing thresholds, regardless of:

- Where you live,

- Where your income is earned,

- Whether you pay tax abroad.

This obligation applies whether you reside in:

- Paris or London,

- Dubai or Singapore,

- Hong Kong, Zurich, or Mexico City.

The IRS does not care where you live. It cares about your U.S. passport.

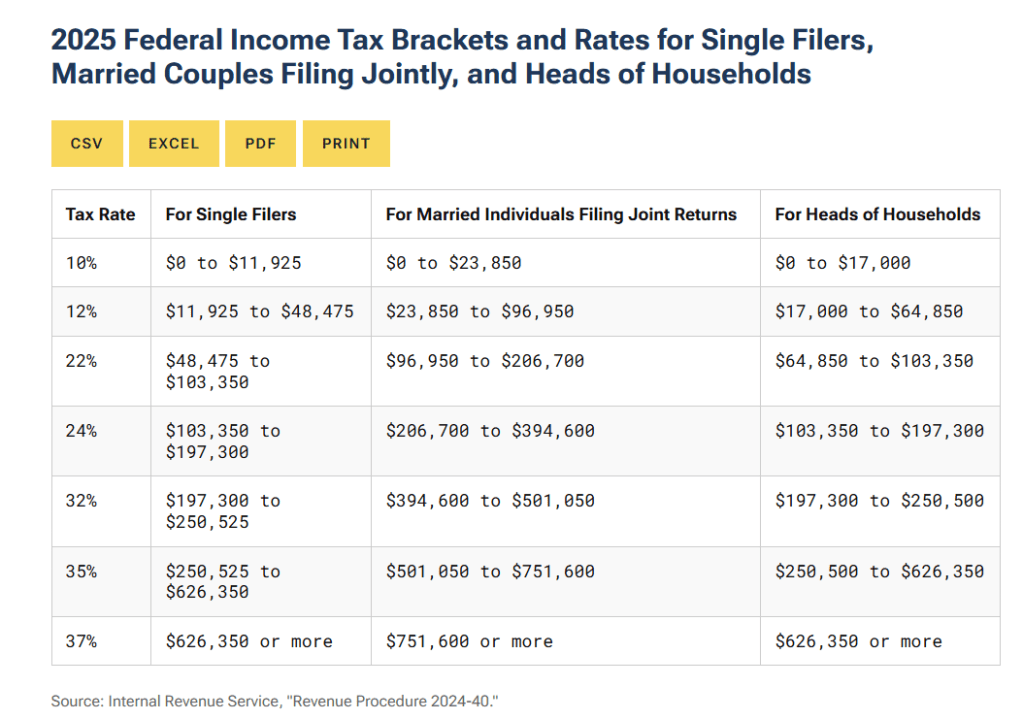

2. Filing Thresholds for U.S. Citizens Living Abroad (2026 Filing Season)

Many expatriates mistakenly believe that living abroad exempts them from filing. This is incorrect.

For the 2026 filing season (covering 2025 income), U.S. citizens abroad must file Form 1040 if their gross worldwide income exceeds the standard thresholds applicable to all Americans. Filing

The 2026 U.S. tax filing season for 2025 returns opened on Monday, January 26, and the regular federal filing deadline is Wednesday, April 15.

2025 income – indicative filing thresholds

(Exact figures are indexed annually for inflation; final IRS amounts will be published late 2025.)

These thresholds apply before:

- The Foreign Earned Income Exclusion (FEIE),

- Foreign tax credits,

- Deductions or exclusions.

Key point: Even if you ultimately owe zero U.S. tax, you may still be legally required to file.

3. Worldwide Income: What Must Be Reported

On Form 1040, U.S. citizens abroad must report all worldwide income, including:

- Salaries and bonuses earned abroad

- Self-employment income

- Business profits

- Dividends and interest from foreign accounts

- Rental income from foreign real estate

- Capital gains on foreign securities or property

- Foreign pensions (with treaty nuances)

- Certain foreign trust and estate distributions

From the IRS’s perspective, income is income — geography is irrelevant.

According to IRS data, international individual filings have increased by more than 35% over the past decade, driven by global mobility and improved enforcement mechanisms.

4. Automatic Extension for Americans Abroad

One practical relief for U.S. citizens living abroad is the automatic filing extension.

How it works

If your tax home and residence are outside the United States on April 15, you automatically receive:

An extension to June 15, 2026 to file your return.

No form is required to obtain this extension — but you must attach a statement to your return explaining that you qualify as living abroad.

Important caveat

- This is an extension to file, not to pay.

- Any tax due is still legally owed by April 15, 2026.

- Interest accrues from April 15 on unpaid balances.

High-net-worth taxpayers often mitigate this by making a protective payment in April, then reconciling later.

5. Key Tax Relief Mechanisms for Americans Abroad

The U.S. tax code does provide tools to reduce — and often eliminate — double taxation. However, these tools must be used correctly.

1. Foreign Earned Income Exclusion (FEIE)

For 2025 income (filed in 2026), the FEIE is expected to be $132,900 per qualifying individual. This represents a $2,900 increase from the 2025 FEIE of $130,000, marking one of the largest dollar increases in recent years.

Requirements:

- You must have foreign earned income (salary or self-employment),

- You must meet either:

- The Physical Presence Test (330 days abroad in a 12-month period), or

- The Bona Fide Residence Test.

Limitations:

- Does not apply to passive income (dividends, interest, capital gains),

- Can reduce eligibility for certain credits,

- Must be elected carefully — revocation rules are restrictive.

In my practice, FEIE misuse is one of the most common planning errors.

2. Foreign Tax Credit (FTC)

For wealthy Americans abroad, the Foreign Tax Credit is often more powerful than the FEIE.

- Allows a dollar-for-dollar credit for foreign income taxes paid,

- Applies to both earned and passive income,

- Excess credits can be carried forward up to 10 years.

For U.S. citizens living in high-tax jurisdictions (France, Germany, UK, Canada), the FTC often reduces U.S. tax liability to near zero — if properly structured.

Read also : Gold : Build Your Wealth and Freedom

6. High-Net-Worth Pitfalls I See Repeatedly

After 20 years advising expatriate clients, certain mistakes recur with alarming frequency.

1. Assuming “no U.S. tax” means “no U.S. filing”

This is legally false and dangerous.

Failure to file can trigger:

- Penalties,

- Interest,

- Loss of treaty benefits,

- Difficulty re-entering compliance.

- The IRS can impose a Failure to File penalty of 5% of the unpaid tax for each month a return is late, capping at 25% of your unpaid tax bill.

2. Ignoring foreign reporting forms

Beyond Form 1040, many wealthy Americans abroad must file:

- FBAR (FinCEN Form 114) – foreign accounts exceeding $10,000 aggregate

- Form 8938 (FATCA) – higher thresholds, more detail

- Forms 5471 / 8865 – foreign companies and partnerships

- Form 3520 / 3520-A – foreign trusts, gifts, inheritances

Penalties for noncompliance can reach $10,000–$100,000 per form, per year, regardless of tax owed.

7. Enforcement Has Changed: CRS, FATCA, and Data Transparency

In 2026, the idea that foreign income is “invisible” is obsolete.

Key enforcement tools

- FATCA forces foreign banks to report U.S. account holders.

- CRS (while not U.S.-based) has improved global transparency.

- Data analytics allow the IRS to cross-check inconsistencies.

According to the U.S. Treasury, offshore compliance recoveries exceed $10 billion since FATCA’s implementation. This amount of $10 billion includes initiatives like the Offshore Voluntary Disclosure Program (OVDP) and Streamlined Filing Compliance Procedures tied to FATCA data.

Living abroad does not reduce audit risk — in some cases, it increases it.

8. Strategic Tax Planning for Wealthy Americans Abroad

Compliance is the floor, not the ceiling.

Well-advised expatriates structure their affairs to:

- Remain compliant,

- Minimize tax friction,

- Preserve long-term wealth.

Common strategies include:

- Choosing between FEIE and FTC annually,

- Timing income recognition,

- Structuring foreign businesses to avoid punitive regimes (e.g., GILTI),

- Managing investment location and character,

- Coordinating U.S. and foreign estate planning.

Tax planning is not evasion. It is anticipation.

9. The 2026 Filing Season: What to Do Now

As we approach the 2026 tax declaration period, U.S. citizens abroad should:

- Inventory worldwide income sources

- Review foreign accounts and entities

- Confirm filing thresholds and deadlines

- Coordinate U.S. and foreign advisors

- File early — not late

For wealthy individuals, reactive filing is expensive. Proactive planning is not.

10. Final Thoughts from a Tax Expert

Living abroad offers lifestyle freedom, global opportunity, and professional expansion. But it does not sever your legal relationship with the IRS.

The U.S. tax system is complex, but it is also predictable — if you understand it.

After 20 years advising Americans across continents, my conclusion is simple:

Most expatriate tax problems are not caused by high taxes — they are caused by misunderstandings of tax regime.

Clarity, compliance, and intelligent planning remain the most reliable tools for protecting wealth abroad.

Our community already has nearly 205,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 2014