By John Meyer, consultant in business – Eurasia Business News, February 11, 2026. Article no. 2024

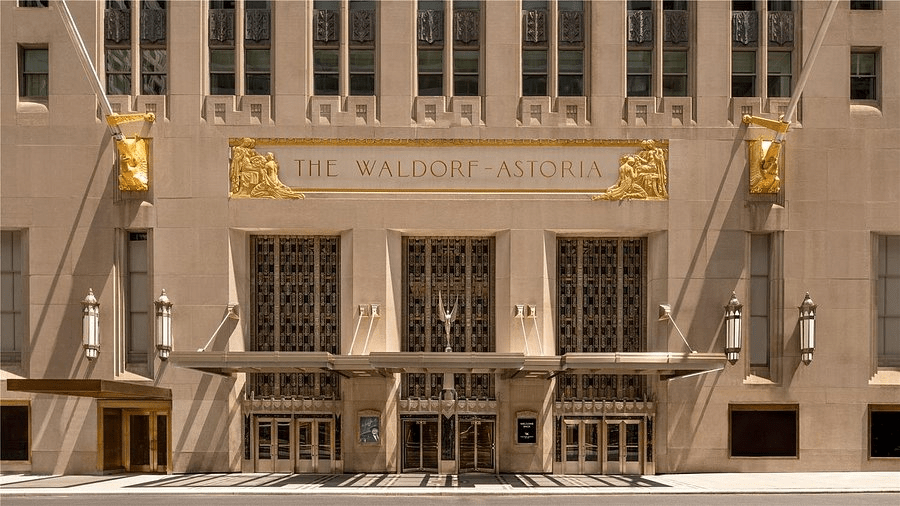

Waldorf Astoria New York is owned by China’s state‑linked Dajia Insurance Group, which took over the asset after the collapse of Anbang Insurance. On February 11, the Wall Street Journal reported that the Chinese owners are preparing to put the hotel up for sale only months after its long‑delayed, multibillion‑dollar renovation and reopening.

Hilton continues to manage the property under a long‑term agreement; what is being marketed is the ownership of the real estate, not the Waldorf Astoria brand or Hilton’s management contract.

The renovation reportedly ran far over its initial budget (by roughly an extra billion dollars), and Dajia/the Chinese authorities have examined options including selling all or part of the asset or partnering with another investor, which set the stage for the current sale plan.

Dajia’s reported decision to sell the Waldorf Astoria New York now reflects a mix of China‑level policy pressures, balance‑sheet realities at Dajia Insurance Group, and market timing.

Hilton sold the Waldorf Astoria New York to China‑based Anbang Insurance (now under Dajia Insurance Group) in 2014 for about 1.95 billion USD. This is the last clearly reported change‑of‑ownership price; the current planned sale by Dajia does not yet have a disclosed transaction price publicly available.

Chinese policy and deleveraging

Chinese regulators have been pushing state‑linked groups like Dajia (which inherited Anbang’s assets) to simplify and shrink their overseas real‑estate holdings, especially trophy U.S. hotels and offices that were bought during the 2014–2017 “go‑out” binge.

Read also : Tax Management strategies for Digital Nomads

Selling the Waldorf fits this longer‑running effort to reduce exposure to foreign property, clean up Anbang’s legacy, and recycle capital back into more tightly regulated, on‑shore financial activities.

Overbudget, complex redevelopment

The Waldorf conversion into a mix of ultra‑luxury condos and a rebuilt hotel went badly over budget—by roughly an extra billion dollars—and fell years behind schedule, turning it into a capital‑intensive, low‑yield project on Dajia’s books.

Offloading the asset now lets Dajia crystallize value after the heavy construction risk is largely behind it, rather than tying up more equity in a single high‑profile but slow‑payback building.

Our community already has 210,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2026 – Eurasia Business News. Article no. 2024