By Anthony Marcus for Eurasia Business News, February 16, 2026. Article n°2028

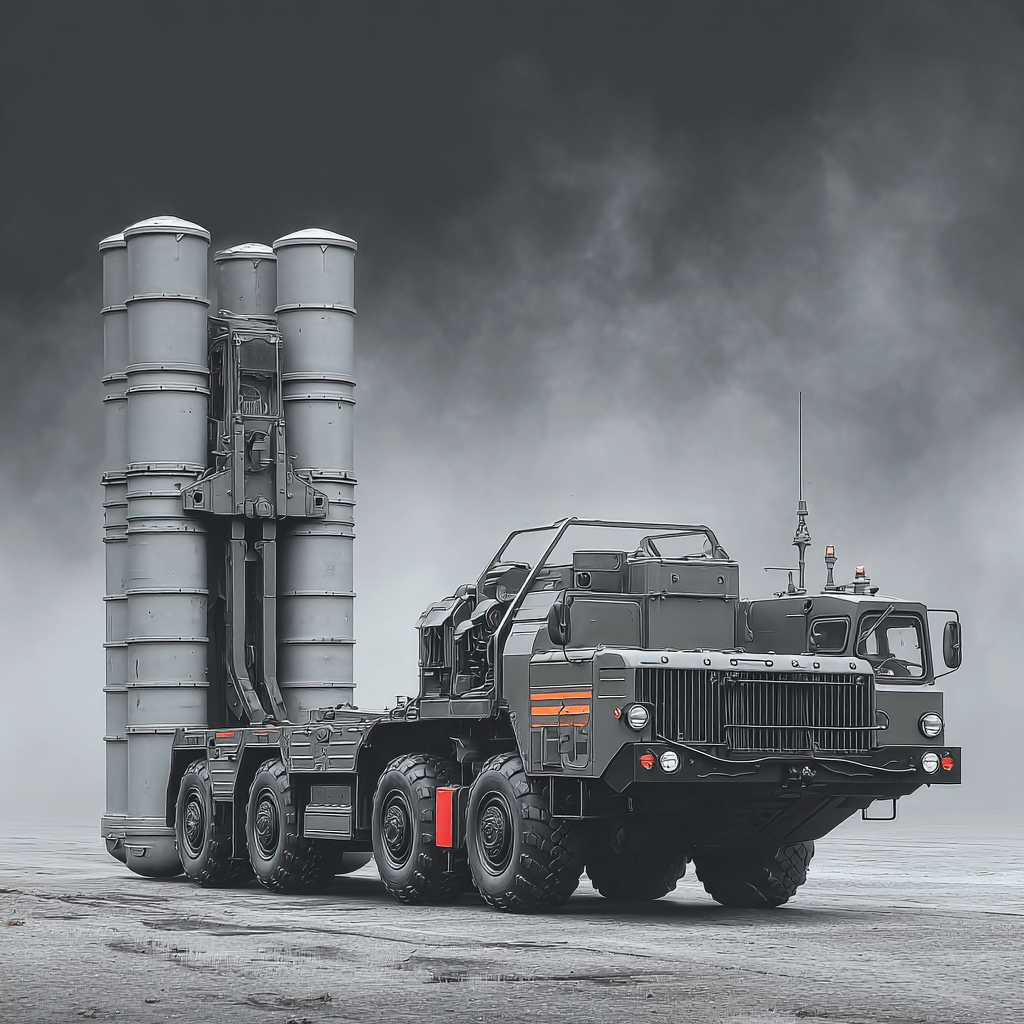

India has just fast‑tracked a new purchase of S‑400 missiles from Russia, clearing the way for an additional batch of interceptors to reinforce its air‑defence network after the 2025 conflict with Pakistan.

What has India approved?

India’s Defence Acquisition Council (DAC) has granted “Acceptance of Necessity” (AoN) for buying 288 more S‑400 surface‑to‑air missiles from Russia.

The package is valued at about ₹10,000 crore (roughly 1.1 billion USD) and is being processed under a fast‑track procurement route to speed up delivery.

These are interceptor missiles (not new launchers) to be used with the S‑400 systems India already operates or is still receiving.

Why is India accelerating this deal?

Stocks of Russian S‑400 missiles were significantly drawn down during “Operation Sindoor” in May 2025, a short but intense clash with Pakistan in which S‑400 units reportedly played a major role in air defence.

The new order is meant to replenish those expended missiles and reinforce India’s layered air‑defence posture against Pakistan and China, especially at long ranges out to about 400 km.

The decision is part of a much larger defence modernisation push that also includes more Rafale fighter jets and other big‑ticket acquisitions for the Air Force, Army, and Navy.

What exactly is being bought?

Reports indicate the mix includes both short‑range and long‑range interceptors; one breakdown cites around 120 short‑range and 168 long‑range S‑400 missiles.

At the high end, India is fast‑tracking 40N6‑type ultra‑long‑range missiles, which can engage aircraft, AWACS, tankers, cruise missiles, and some UAVs at up to roughly 400 km.

The missiles will plug into the five‑system S‑400 package that India contracted from Russia in 2018, of which two batteries are still due for delivery in June and November 2026.

How does this change the regional picture?

For India, the move strengthens deterrence by improving its ability to defend critical cities, airbases, and command nodes against enemy aircraft, drones, and some missile threats.

For Pakistan, the replenished S‑400 inventory complicates offensive air planning, since high‑value assets like fighter packages and ISR aircraft face greater risk at long range.

For China, it reinforces India’s air‑defence belt along the northern and eastern sectors, although China already fields its own long‑range systems, so the change is more about balancing than dominance.

What happens next?

“Acceptance of Necessity” (AoN) is an approval in principle; the deal still has to move through price negotiations, financial clearances, and a formal contract before deliveries start.

To speed induction, some of the initial missiles are expected to come from existing Russian stocks rather than new‑production slots, shortening lead times once the contract is signed.

Alongside this, India is examining complementary systems such as Pantsir‑S1 for closer‑range defence of S‑400 sites against low‑flying drones and cruise missiles, tightening the overall air‑defence “bubble.

Our community already has nearly 215,000 readers!

Subscribe to our Telegram channel

Follow us on Telegram, Facebook and Twitter

© Copyright 2025 – Eurasia Business News. Article no. 2028