By John Meyer, consultant in financial affairs – Eurasia Business News, October 4, 2023

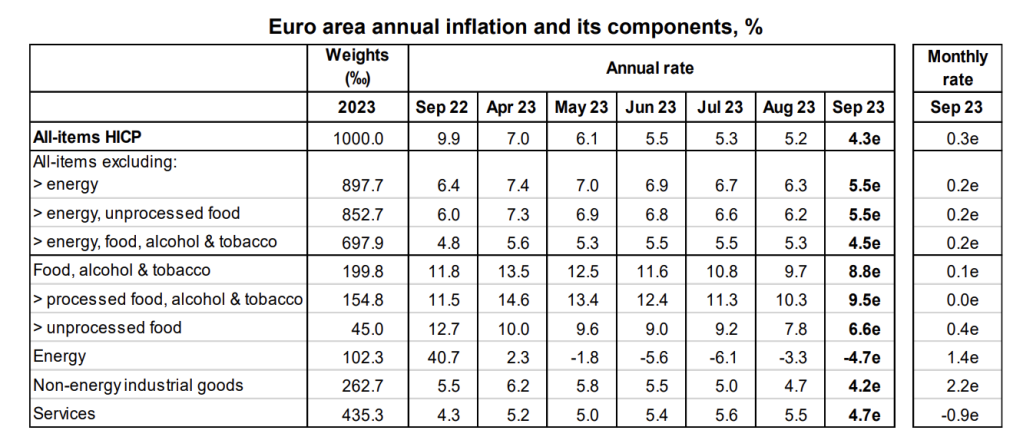

The euro area annual inflation rate was 4.3% in September, down from 5.2% in August and 5.3% in July, reported Eurostat, the statistical office of the European Union. This is the lowest level since October 2021. The fall of consumption amid high prices and decreasing purchasing power of European drives down inflation figures for September in the euro area.

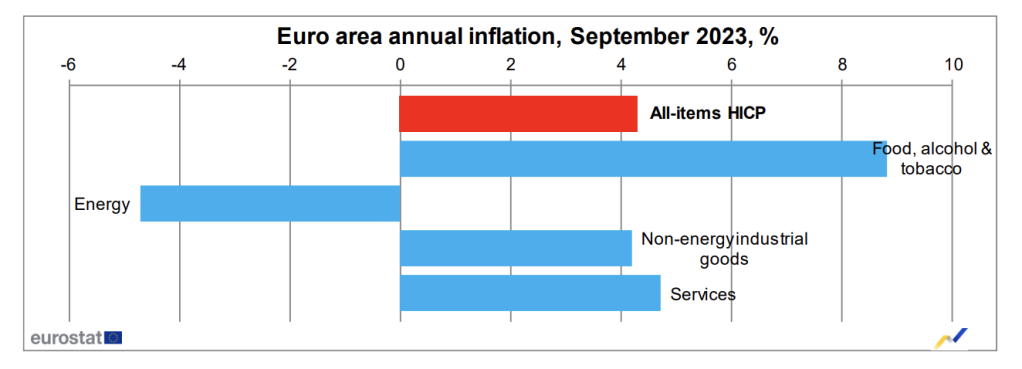

Looking at the main components of euro area inflation, food, alcohol & tobacco is expected to have the highest annual rate in September (8.8%, compared with 9.7% in August), followed by services (4.7%, compared with 5.5% in August), non-energy industrial goods (4.2%, compared with 4.7% in August) and energy (-4.7%, compared with -3.3% in August).

According to the European Central Bank’s (ECB) macroeconomic projections, Euro area inflation is expected to fall from 5.6% in 2023 to 3.2% in 2024 and to 2.1% in 2025.

However, underlying price pressures remain strong, and staff has revised up their projections for inflation excluding energy and food, owing to past upward surprises and the implications of a robust labor market for the speed of disinflation.

The IMF also suggests that the inflation outlook depends on how corporate profits absorb wage gains. The ECB Survey of Professional Forecasters (SPF) predicts similar inflation rates for the EU, with respondents revising their inflation expectations to 5.9% in 2023 and 2.7% in 2024. The European Commission forecasted Eurozone consumer inflation of 5.6% in 2023 and 2.9% in 2024, both well above the ECB’s target of 2.0%.

Inflation and democracy

The social pact of European democracies is disintegrating before our eyes. More and more citizens are questioning the legal authority and legitimacy of governments, their policies and financial capitalism. The middle class in France as in Germany is less and less willing to work more to earn less. Weak GDP growth in the Eurozone is maintaining the unemployment rate. The high public debt of the Eurozone States is now leading, with interest rates of nearly 5%, to debt trap situations. This leads to a mechanical impoverishment of national economies and their stakeholders, businesses and citizens.

Amid lasting inflation since summer 2021, many investors and middle class workers turn to gold, as a safe heaven to protect their purchasing power. On October 4 morning, gold prices hit $ 1,825 per troy ounce, floating around $ 1,822 per troy ounce, stable over the last day. This is a +5,55% growth over the past 12 months.

Read also : How to invest in gold

The European real estate market will be the next victim of rising interest rates and the fall in purchasing power of the middle classes.

Thank you for being one of our readers.

Our community already has nearly 120,000 members!

Notify me when a new article is published:

Follow us on Telegram, Facebook and Twitter

© Copyright 2023 – Eurasia Business News