By Swann Collins, investor, writer and consultant in international affairs – Eurasia Business News, May 31, 2022

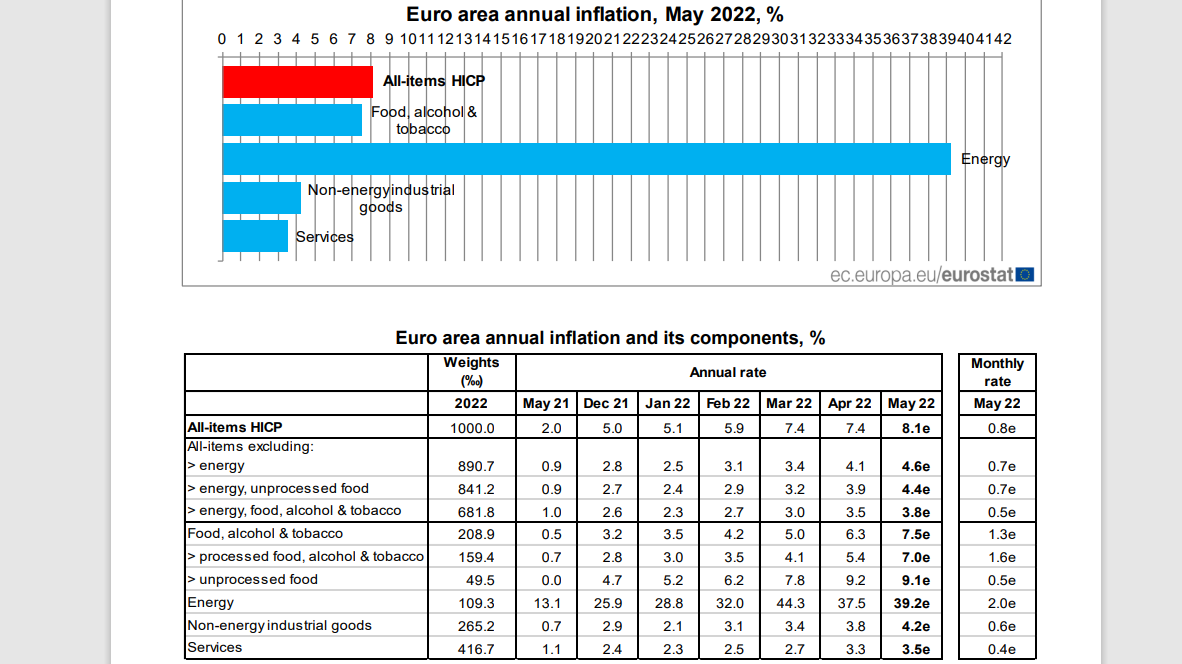

The euro area annual inflation is expected to hit 8.1% in May 2022, up from 7.4% in April according to a flash estimate released today by Eurostat, the statistical office of the European Union.

Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in May (39.2%, compared with 37.5% in April), followed by food, alcohol & tobacco (7.5%, compared with 6.3% in April), non-energy industrial goods (4.2%, compared with 3.8% in April) and services (3.5%, compared with 3.3% in April).

The euro area annual inflation rate stood at 7.4% in April, stable compared to March, when it hit record high 7.5%. In February, inflation hit 5.4%. A year earlier, registered annual inflation was only 1.6% in the euro zone.

The annual inflation rate in the European Union stood at 8.1% in April 2022, compared to 7.8% in March. A year earlier, it was 2.0%. These figures were published today by Eurostat, the statistical office of the European Union.

Over the month of May, prices rose by 0.8%, including core inflation by 0.5%. The acceleration of inflation in the euro area is driven by the increase in energy and food prices. At the same time, oil and gas prices are likely to continue to grow further against the background of a partial EU embargo on russian oil supplies.

Yesterday the EU countries agreed to stop Russian oil supplies by sea by the end of this year while maintaining part of the supplies through the Druzhba oil pipeline. Oil supplies through this pipeline account for about 35% of oil imports from Russia, but for individual countries they are very important: Hungary receives 86% of all oil, the Czech Republic – 97%, Slovakia – almost 100%. Taking into account the plans of Germany and Poland to completely abandon Russian oil, the embargo by the end of 2022 can cover up to 90% of supplies.This could generate a reduction in Russian oil exports from 5 million bpd to 3.5-4 million barrel per day. By the end of 2022, an increase in production by other producers with a slowdown in demand may lead the global market to a moderate surplus, which will cause a decrease in the price of Brent to $ 100 per barrel from the current $ 118.

Among the countries of the euro area, the most significant price increases were recorded in Estonia – plus 20.1%, Lithuania – 18.5% and Latvia – 16.4%. Double-digit inflation is also observed in Greece (10.7%), the Netherlands (10.2%) and Slovakia (11.8%). In Germany, inflation accelerated to 8.7%, in Italy – to 7.3% (this is a record since 1986). The lowest price increases are in France (5.8%), Malta (5.6%) and Finland (7.1%). In Poland, which is not part of the currency bloc, inflation accelerated to 13.9% in May.

This enduring wave of inflation in Europe since August 2021 adds pressure on the quantitative easing and purchases assets program of the European central bank (ECB), accused of reducing the purchasing power of the euro currency and provoking inflation as a consequence. In addition, the monetary policy of the ECB has failed to support a strong economic growth. Inflation in the euro zone is currently nearly four times the ECB’s target and will not fall back below 2% for years.

The dynamics of GDP in the eurozone in the first quarter of 2022 showed no change in growth rates – 0.3% quarter-on-quarter, as in October-December. In annual terms, the pace even accelerated – from 4.7% to 5.1%. Including in Germany – from 1.8% to 3.7%, but in the second quarter there is expected to slow down growth. In France and Italy, the figure has already decreased from 5.5% to 5.3% and from 6.2% to 5.8%, respectively.

Read also : How to invest in gold

The situation is also critical in the United States, where annual inflation hit record 7.9% in February and 8.5% in March. This is the highest level of inflation never seen in the United States since February 1982 and the dynamic has been here for months. U.S. inflation already reached 7.5% in January after hitting 7% in December 2021, 6.8% in November and 6.2% in October.

Amid this high inflation in the Euro area and in the U.S., gold prices have been stable today, hiting $1,858 per troy ounce, before stabilizing at $1,838.60 per troy ounce at closure on May 31, 2022 at 06:21 PM NY Time.

To contact the author, write at : swann.collins.consulting@gmail.com

Thank you for being among our readers.

Our community already has nearly 60,000 followers !

Sign up to receive our latest articles, it’s free !

Support us by sharing our posts !

Follow us on Facebook and Twitter

© Copyright 2022 – Swann Collins, investor and consultant in international affairs.